Comcast: A Severely Mispriced Stock With Strong Upside

Comcast Corp. (NASDAQ:CMCSA) has severely underperformed the S&P 500 in the last two years, disappointing shareholders. I do own the shares in my portfolio, as I see an attractive upside potential. As a matter of fact, I initiated my position last month. In this analysis, I will discuss the reasons for the severe underperformance and why I still bought it at the start of the year. My investment thesis is that the conglomerate nature of the company is its moat; the multiple revenue streams across a wide range of telecom and media segments make it a stable and growing one, with upside potential at the current price level.

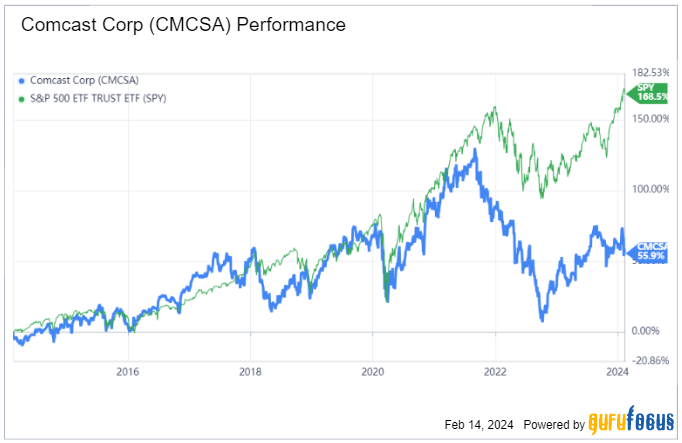

The stock performed in line with the broader stock market from 2014 to 2021, but lost momentum in 2021 and has accumulated over 100% underperformance in three years. The S&P 500's 10-year performance stands at over 160%, while shares of Comcast declined to below 60% performance in 10 years.

We will go through the issues and struggles the company has been facing over the last three years, particularly the tough competition (lagging behind in the 5G rollout of the last few years, hitting the main revenue source of the company) and the lack of mergers and acquisitions, reflecting an exhausted management. And yet, I do see arguments in favor of a turnaround after an irrational overreaction by investors. A catch-up on the broader stock market is possible given the attractive valuation and the sustained business growth.

Overview of a multidimensional and resilient business

Comcast is comprised of two product lines.

The first is Connectivity & Platforms, generating two-thirds of the revenue but 80% of the Ebitda, meaning it is the most profitable. It includes three businesses. The first one is Xfinity, which is the largest internet provider in the U.S. Then there is Comcast, which is focused on business technology. ^he last one is Sky, composed of Sky Broadband, an internet provider in the U.K., and Sky Mobile, a fast-growing wireless provider. Connectivity & Platforms is the largest of the two product lines in both revenue and profitability. Indeed, Comcast's residential broadband segment has a wide reach with 32 million subscribers, but the numbers are falling. This is compensated by the company's wireless business, with approximately 6 million lines and a revenue growth of around 16% year over year, representing a growth opportunity through the 5G business. But it also faces tremendous competition from well-established 5G providers such as Verizon (NYSE:VZ).

The second is Content & Experience. This product line comprises the media, studios and theme park segments. The main revenue segments are Peacock, a streaming service that has been growing quickly, NBCUniversal's film and television studios, including the famous Universal Pictures, one of the five major U.S. film production studios and the theme parks with Universal Theme Parks. Overall, Content & Experience represents only one-third of the revenue and one-fifth of the Ebitda, meaning it is less profitable. Content & Experience has, however, the highest growth potential thanks to its edge over competitors, in sharp contrast with the Connectivity & Platforms line that is losing momentum vis-a-vis the competition.

A severely mispriced and attractive stock based on hard evidence

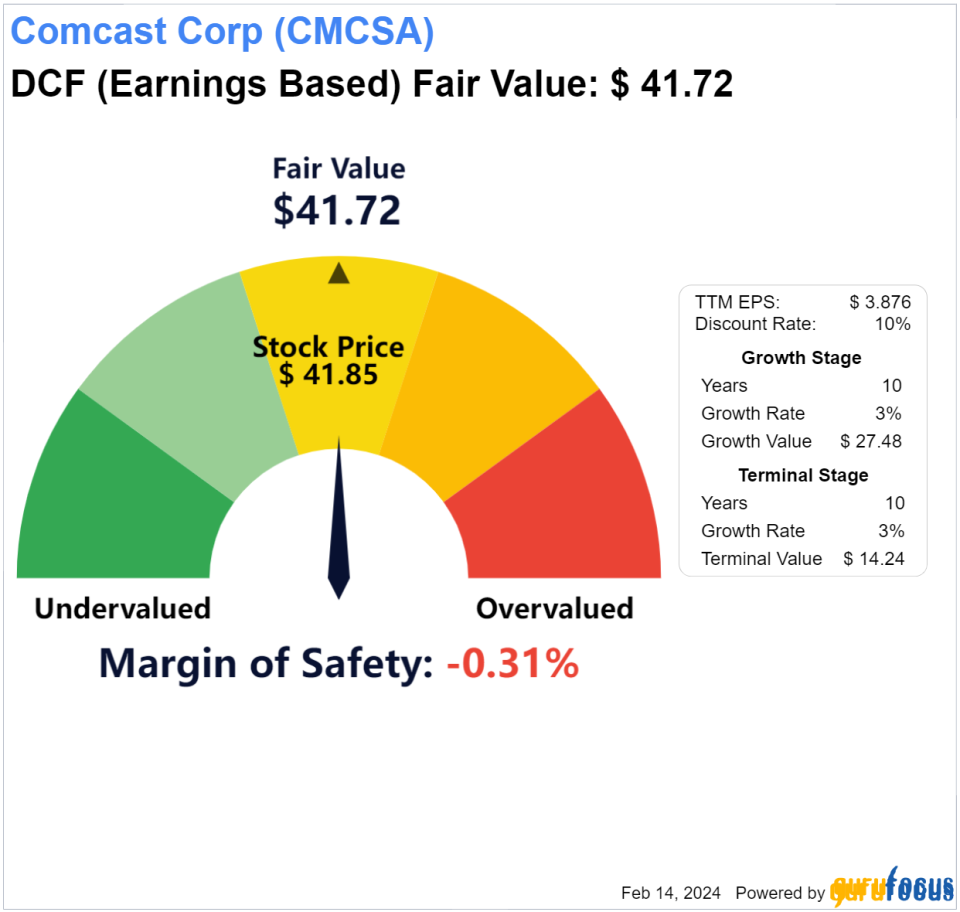

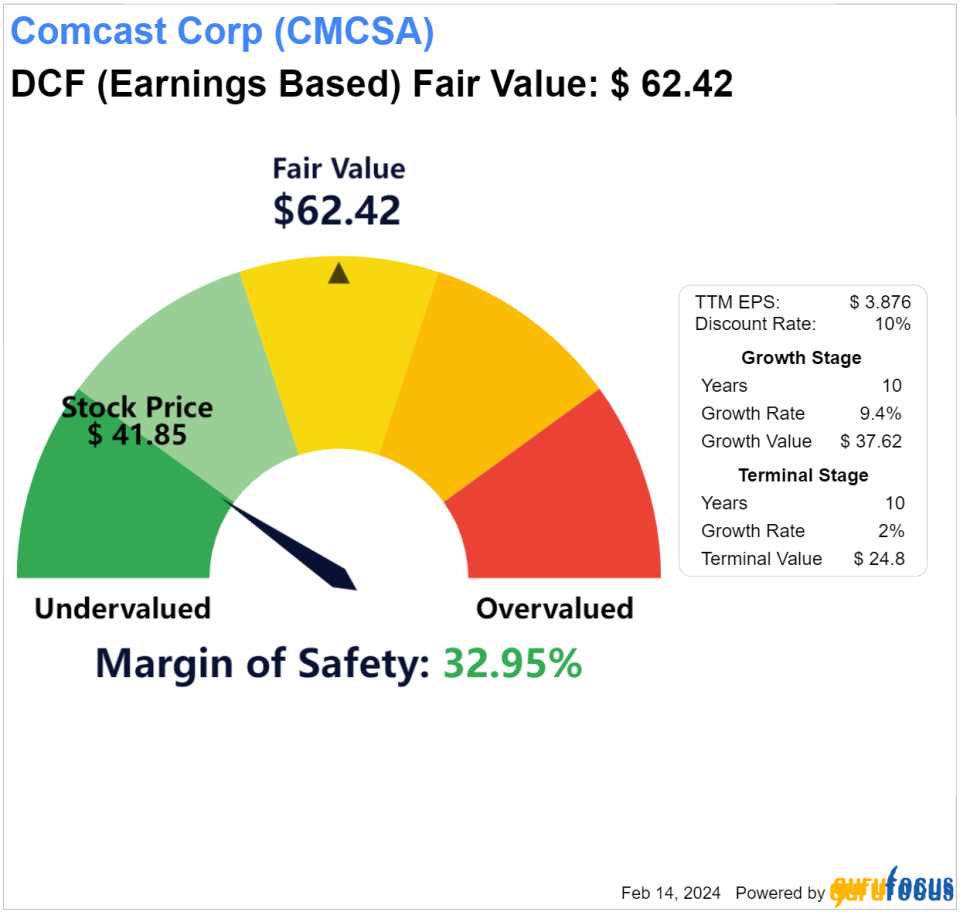

Let's take a look at the discounted cash flow calculations that pension funds and investment firms love to use in their analysis process. DCF models are easy to construct. However, if you don't have any at hand, there is a user-friendly model available on GuruFocus. Interestingly, I found the markets are currently pricing the stock as if it were to grow by 3%.

As you can see above, the DCF modelling available on GuruFocus based on the current stock price indicates the markets are assuming a modest 3% growth despite the company having grown at an average earnings per share growth rate of 9.40% in the last 10 years. If we remove the fear factor from the equation and stick to the historical earnings per share growth rate of the company of 9.40%, the fair value is approximately 50% above the current stock price, indicating an attractive risk-reward ratio given the fear factor in the equation is an overreaction, as I will explain later.

The fair value of the stock is likely to be closer to $60 than the current $40 level.

The Jan. 25 earnings announcement for the fourth quarter of 2023 further provides investors with additional comfort and good news. Net income per share stood at 81 cents, a 15.70% increase year over year. The dividend has increased by 6.90% to $1.24 per share and, given the stock sell-off of the last two years, the dividend yield has turned quite attractive at 3%. Comcast did continue to lose broadband subscribers (down 34,000 users, primarily due to cord-cutting) but compensated by adding 310,000 wireless subscribers, showing a shift in consumer preference. Peacock continued to be the fastest-growing U.S. streamer, adding 3 million subscribers as revenue increased 57% to a record of $1.03 billion.

The earnings per share acceleration of the last year is expected to continue to outperform in relation to the trendline in the next two years, reconfirming the 2022 stock price slump was fueled by exaggerated fears of competition. This leads to an overly attractive valuation that has yet to be corrected. This further confirms the 50% upside derived from the DCF model is not unreasonable.

The stock just reached a highly attractive valuation

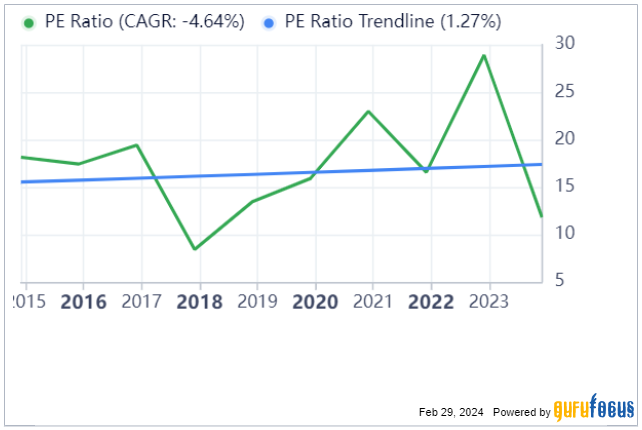

I initiated a long position last month because Comcast hit a highly attractive valuation point. Indeed, one of the most favored metrics of investors is the price-earnings ratio. As you can see in the below chart, it broke under the rising trendline for the first time since 2017, after which it reverted to the mean two years later.

Looking from the figures side, the stock is trading, as of end of December 2023, below a multiple of 12 - the lowest multiple since December 2017.

To put this in perspective, the weighted average price-earnings ratio for the sector is around 16. The average ratio of the stock for the last 10 years is slightly above 17, as calculated from the above table. Both metrics indicate the current multiple under 12 times is significantly discounted. The fact the company is in capable hands of a management that already navigated tremendous challenges convinced me to initiate a long position last month.

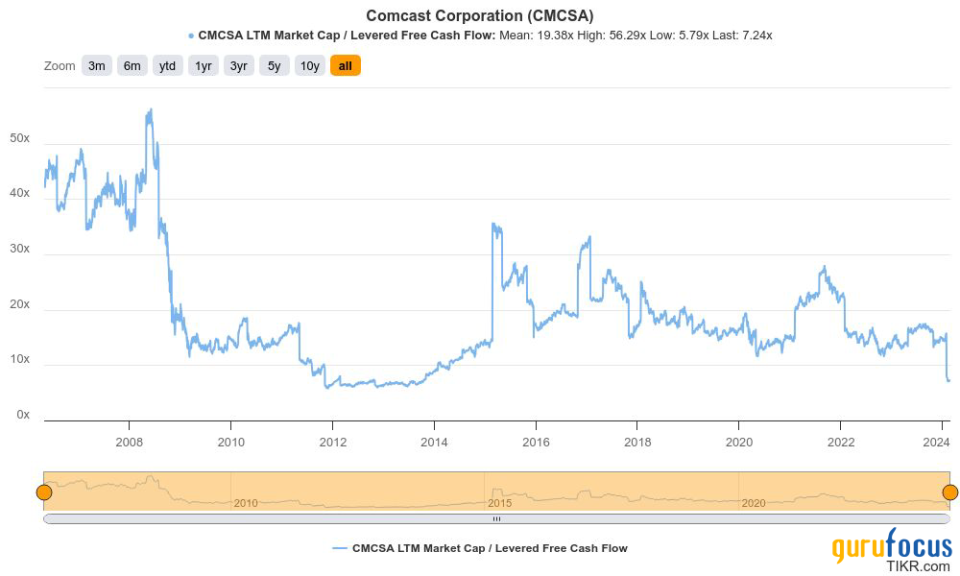

Additionally, my favorite metric that flashed at the end of last year and triggered my buy is the market cap as a multiple of levered free cash flow.

Levered free cash flow its the amount of cash a company has after paying its financial obligations. It is the cash that is available for the company to invest: management can raise dividends (which it just announced), is more likely to acquire new businesses or reinvest in its own assets.

The current returns on assets of 5.60%, on capital of 10.90% and equity of 18.30% demonstrate management knows how to efficiently run the business and the cash it has at hand.

Finally, Comcast has a comfortable margin of free cash flow currently standing at 13.30% (4.30% year-over-year growth), which could turn to be an excellent edge in relation to its competition. Indeed, Comcast does not need to increase its external debt as it generates its own cash, and that could prove to be vital in a high interest rate environment.

Outlook for the coming years and where growth lies

Indeed, Comcast is in good hands. Brian Roberts is chairman and CEO of Comcast. He was named president in 1990 at 31 years of age when the company had $657 million in annual revenue. Its annual revenue has since grown to $94.50 billion. Management is stable and plays the long run. Its acquisition strategy supporting inorganic growth in difficult times has proven more than once that management knows how to turn around the business. After the dotcom bubble burst and the stock market crashed, Roberts acquired in 2000 AT&T's Broadband for $53.2 billion in stock and assumed debt. The deal allowed Comcast to become the largest cable operator in the world. And again, right after the global financial crisis hit the world and valuations, Comcast acquired NBCUniversal in 2009, which is yet another success story of the company.

With likely cuts in the interest rate by the Fed, I believe Comcast will benefit more than other stocks from an eased environment where mergers and acquisitions, which Comcast excels at, would become cheaper thanks to a reduced cost of debt and where expensive infrastructure projects would also be easier to finance again. It is no coincidence the stock underperformed the broader index in 2022-23. That is when the Fed raised the rate by over 500 bais points. Given the overall valuations have softened in relation to the Covid years (the valuations were powered by Fed's zero rate), I do think it is likely Roberts will announce in the next few quarters an acquisition that would boost the stock and fuel investors' optimism. There is one key risk to seriously consider though: competition.

What could invalidate my case: Competition as a key risk to Comcast's main source of revenue

Competition has fueled the fears of the markets on Comcast, particularly its Connectivity & Platforms business, leading to the stock's underperformance in the last three years. Long-established copper-dependent fixed line communication service providers such as Verizon and AT&T (NYSE:T) have been modernizing their networks by installing extensive fiber infrastructure that reaches into buildings, both residential and commercial. Government subsidies have also given them a boost to promote digital transformation, particularly in certain remote areas where these corporations would otherwise be reluctant to provide high-speed internet.

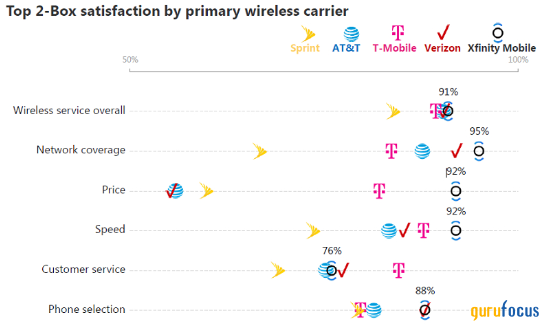

The rise of these substitute technologies has led to an increasing number of consumers terminating their 10-year cable contracts. In order to solve this issue, Comcast now provides 4G and 5G broadband plans in addition to other mobile phone services. The perceived problem is that Comcast provides it via a partnership with its competition. Comcast has a mobile virtual network operator agreement with Verizon for using its wireless infrastructure. And the users are actually happier with Comcast's Xfinity Mobile.

Source: fiercewireless.com

Despite the positive feedback, Comcast's issue is that the 1.3 million wireless accounts it added in the previous year pale in comparison to the 2.50 million added by Charter (a competitor that also relies on an MVNO with Verizon). Even though Comcast has surpassed the $1 billion quarterly revenue mark and the 1.30 million addition is a high number, the fact the number is much lower than Charter's raises questions about how quickly Comcast can develop its wireless services into a multibillion-dollar business. As mentioned, Verizon continues to be a competitor in the mobile market and Comcast's plan to provide 5G with its infrastructure fuels fears that the partnership established in 2011 could be unsustainable.

However, due to non-disclosure agreements, little is known about the arrangement. It is likely that the MVNO is perpetual or at least spans over several decades as infrastructure-related contracts tend to be established for a long period of time. Therefore, I do believe this key risk fueled an overreaction in the markets and that we will continue to see assurances from both Comcast and Verizon. Verizon CEO Hans Vestberg declared recently that Verizon is making money on this, but that he could not go into details due to the complexity and the non-disclosure agreements in place. This came as the Verizon CEO sought to calm stockholders' fear on Comcast's competition, which led to a stock sell-off in 2022 (the stock continued its sell-off in 2023, led by aging lead cable fears). Vestberg confirmed not being prone to try and alter the MVNO, as it drives some of the revenue growth of Verizon. Given the likely long-term nature of the MVNO and that the new users of Xfinity Mobile primarily come from Verizon, as you can see below, it does look like Comcast will ultimately preserve the sustained growth of Xfinity Mobile, further tapping into the competitors' user bases.

Souce: fiercewireless.com

Bottom line

Comcast is an attractive opportunity currently with the market having yet to readjust the discounted valuation after 2022 fears that the competition would harm its growth prospects. The stock has recently suffered from the high rate environment and a market overreaction fueled by fear, leading to a cheap valuation. The business being in the hands of a long-term thinking management, and its edge over competitors with an overall more satisfied and growing user base are both solid arguments for a bullish case. Market tailwinds, in particular with Fed rate cuts in sight and cheaper valuations of potential target business, could further boost the stock to achieve a new turn around and catch up with the broader index.

This article first appeared on GuruFocus.