Comerica Inc (CMA) Reports Mixed Results Amid Strategic Shifts and Economic Uncertainty

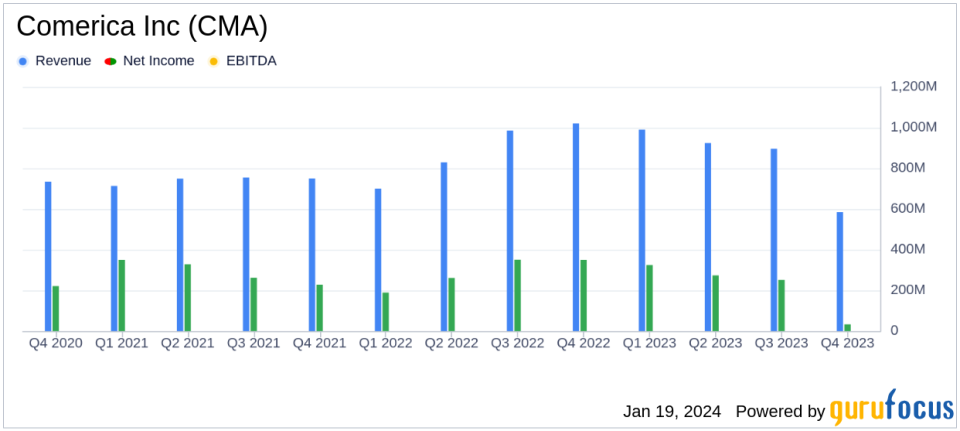

Net Income: Full-year net income of $881 million, or $6.44 per share, compared to $1,151 million, or $8.47 per share in the previous year.

Q4 Performance: Fourth quarter net income of $33 million, or $0.20 per share, influenced by notable items and strategic balance sheet management.

Net Interest Income: Record annual net interest income of $2,514 million, up from $2,466 million in the prior year.

Credit Quality: Continued strong credit quality with net charge-offs of 4 basis points and a robust capital position.

Efficiency Ratio: Increased to 91.86% in Q4 from 61.86% in Q3, reflecting higher noninterest expenses.

Capital Ratios: Common equity Tier 1 capital ratio estimated at 11.09% and Tier 1 capital ratio at 11.61% as of December 31, 2023.

On January 19, 2024, Comerica Inc (NYSE:CMA) released its 8-K filing, detailing its financial performance for the fourth quarter and full-year 2023. Despite facing industry disruptions, the company achieved record full-year average loans and annual net interest income. However, the fourth quarter results were affected by several notable items, including a special FDIC assessment and hedging losses due to the cessation of the Bloomberg Short-Term Bank Yield Index (BSBY).

Comerica, a Dallas-based financial services company, is known for its relationship-based commercial banking and operates primarily in Texas, California, and Michigan, with additional locations in Arizona, Florida, and other states, as well as Canada.

The company's full-year net income stood at $881 million, or $6.44 per diluted share, a decrease from the previous year's $1,151 million, or $8.47 per diluted share. The fourth quarter saw a significant drop in net income to $33 million, or $0.20 per diluted share, compared to $251 million, or $1.84 per diluted share in the third quarter. This decline was attributed to several factors, including a special FDIC assessment and hedging losses related to BSBY cessation.

Despite these challenges, Comerica's credit quality remained strong, with net charge-offs at just 4 basis points. The company also maintained a solid capital position, with capital ratios well above the strategic target of 10%.

Comerica's financial achievements, particularly the record net interest income, underscore the company's ability to generate earnings through its core lending activities, which is crucial for banks in managing interest rate environments and economic cycles.

Financial Highlights

Key financial metrics from the income statement, balance sheet, and cash flow statement include:

Financial Metric | Q4 2023 | Q3 2023 | Full-Year 2023 | Full-Year 2022 |

|---|---|---|---|---|

Net Interest Income ($ in millions) | 584 | 601 | 2,514 | 2,466 |

Provision for Credit Losses ($ in millions) | 12 | 14 | 89 | 60 |

Noninterest Expenses ($ in millions) | 718 | 555 | 2,359 | 1,998 |

Net Income ($ in millions) | 33 | 251 | 881 | 1,151 |

Efficiency Ratio (%) | 91.86 | 61.86 | 65.56 | 56.32 |

Comerica's Chairman and CEO, Curtis C. Farmer, commented on the results, stating,

In 2023, we demonstrated the strength and resilience of our model as we navigated disruptive industry events,"

and highlighted the record average loans and highest year of net interest income in the company's history.

However, the fourth quarter was marked by several notable items that impacted the results, including an additional FDIC insurance expense due to the FDIC Board of Directors' approval of a special assessment following the failures of Silicon Valley Bank and Signature Bank, and hedging losses related to the planned cessation of BSBY.

Comerica's efficiency ratio, a measure of noninterest expenses as a percentage of net interest income and noninterest income, increased significantly in the fourth quarter, indicating higher costs relative to revenue. This metric is important as it reflects the bank's operational efficiency and cost management capabilities.

The company's strategic focus on managing its balance sheet, calibrating expenses, and prioritizing investments is aimed at enhancing customer support and improving returns over time. Despite the challenges faced in the fourth quarter, Comerica's full-year performance and strong credit quality position it to navigate future economic uncertainties.

For a more detailed analysis and commentary on Comerica Inc (NYSE:CMA)'s financial performance, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Comerica Inc for further details.

This article first appeared on GuruFocus.