Comfort Systems (FIX) to Acquire Summit, Expand Business

Comfort Systems USA, Inc. FIX inked a deal with The Stephens Group, LLC, to acquire Houston, TX-based Summit Industrial Construction, LLC, a specialty industrial mechanical contractor. The deal is expected to close in the first quarter of 2024.

Post completion, Summit is expected to contribute approximately $360-$400 million in annual revenues and $30-$45 million in earnings before interest, taxes, depreciation and amortization or EBITDA. It is also expected to make a neutral to slightly accretive contribution to earnings per share in 2024 and 2025 owing to amortization expenses.

Brian Lane, FIX’s chief executive officer, stated, “Summit is a 100% industrial contractor with the capacity to execute large-scale modular programs for its customers and we are optimistic that this investment will expand and diversify our modular construction offering, which is experiencing significant demand and growth. We believe that Summit will be a key platform to further expand our off-site solutions, especially for advanced technology and heavy industrial customers.”

With this buyout, Summit is expected to have extraordinary capabilities and a stellar reputation as a modular technology leader in growing end markets, with multiple ongoing and large semiconductor projects.

However, shares of the company fell 1.8% on Jan 2.

A Look at FIX’s Growth Expectation

Based in Houston, TX, Comfort Systems is a national provider of comprehensive heating, ventilation and air conditioning installation, along with maintenance, repair and replacement services. A solid backlog level and substantial ongoing investments in training, productivity and technology are expected to drive growth.

Overall positive trends, primarily in industrial, technology and manufacturing markets served by the company, as well as accretive buyouts, are encouraging. The acquisitions have expanded its scale, increased recurring service revenues and enhanced expertise in complex markets, including industrial, technology and life sciences.

In the third quarter, earnings grew 64% to $2.74 per share from the previous year on 23% higher revenues. Revenues were higher across the operations, with notable increases in the modular business, where execution was solid. Service also continued to grow and improve, thanks to its past and ongoing investments.

Backlog as of Sep 30, 2023, was $4.29 billion compared with $4.19 billion as of Jun 30, 2023 and $3.25 billion a year ago. On a same-store basis, the backlog increased to $4.12 billion at the end of the third quarter from $3.25 billion a year ago.

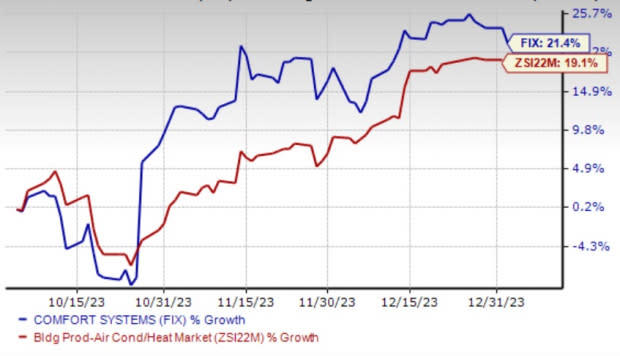

Image Source: Zacks Investment Research

Comfort Systems has gained 21.4% over the past three months compared with the Zacks Building Products - Air Conditioner and Heating industry’s 19.1% growth. The company is expected to witness 13.5% earnings growth in 2024. FIX’s earnings topped the consensus mark in the trailing four quarters with an average of 23.9%.

Zacks Rank & Key Picks

It currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks that warrant a look in the Zacks Construction sector are Knife River Corporation KNF, Watsco, Inc. WSO and AAON, Inc. AAON.

Knife River: Headquartered in Bismarck, ND, this firm offers construction materials and contracting services throughout the United States, specializing in aggregates-based solutions. Knife River has effectively implemented its EDGE plan to enhance adjusted EBITDA margins and achieve strategic objectives.

A crucial component of this strategy involves optimizing pricing to fully capture the value of core products, including aggregates, ready-mix concrete, asphalt and contracting services. The company has adopted a more reasonable approach in selecting higher-margin projects within its contracting services division. Despite challenges, Knife River maintains a positive outlook on the long-term market strength, anticipating favorable impacts from local, state and federal funding.

Knife River, a Zacks Rank #1 (Strong Buy) company, has seen a downward estimate revision for 2024 earnings to $3.30 per share from $3.48 over the past 30 days. The company’s earnings surpassed the Zacks Consensus Estimate in the last reported quarter by 41%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Watsco: Based in Miami, FL, Watsco is the largest distributor of heating, ventilation and air conditioning equipment, as well as related parts and supplies (“HVAC/R”) in North America. The company has been gaining strength from its continuous investment in industry-leading technologies, accretive acquisitions and a consistent focus on rewarding customers. The solid performance of HVAC equipment and commercial refrigeration product segments added to its uptrend.

WSO has a Zacks rank #2 (Buy). Its 2024 earnings estimates have increased to $15.21 per share from $15.15 over the past 30 days. WSO surpassed earnings estimates in three of the trailing four quarters and missed on one occasion, the average surprise being 5.7%.

AAON: Based in Tulsa, OK, AAON engineers, manufactures and markets air conditioning, as well as heating equipment. The company maintains a balance between new construction and replacement applications and is making the most of robust replacement demand, broadly across the non-residential building market. Moderating cost inflation and solid pricing have been aiding the company in delivering solid results.

AAON currently carries a Zacks Rank #2. The company’s earnings for 2024 moved up to $2.29 per share from $2.26 over the past 60 days. AAON surpassed earnings estimates in each of the trailing four quarters, the average surprise being 24.9%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Watsco, Inc. (WSO) : Free Stock Analysis Report

AAON, Inc. (AAON) : Free Stock Analysis Report

Comfort Systems USA, Inc. (FIX) : Free Stock Analysis Report

Knife River Corporation (KNF) : Free Stock Analysis Report