Comfort Systems USA Inc (FIX) Reports Strong Growth in Q4 and Full Year 2023 Results

Q4 Net Income: Increased to $91.6 million, or $2.55 per diluted share, from $55.4 million, or $1.54 per diluted share in Q4 2022.

Annual Net Income: Rose to $323.4 million, or $9.01 per diluted share, up from $245.9 million, or $6.82 per diluted share in 2022.

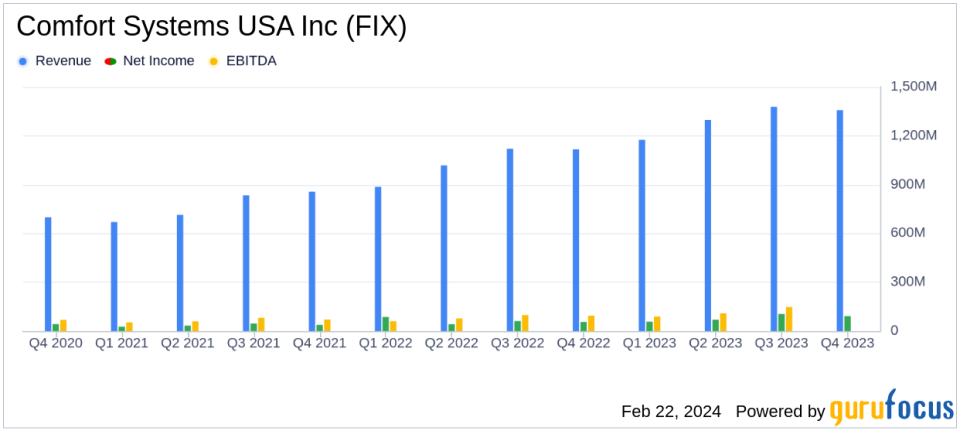

Q4 Revenue: Jumped to $1.36 billion, a significant rise from $1.12 billion in the same quarter last year.

Annual Revenue: Increased to $5.21 billion from $4.14 billion in 2022.

Operating Cash Flow: Grew to $173.0 million in Q4 and $639.6 million for the full year, compared to $132.0 million and $301.5 million in the respective periods of 2022.

Backlog: Reached a record $5.16 billion as of December 31, 2023, a 27% increase year-over-year.

Free Cash Flow: Ended the year with over $550 million, a substantial improvement from the previous year.

On February 22, 2024, Comfort Systems USA Inc (NYSE:FIX) released its 8-K filing, detailing a robust performance for both the fourth quarter and the full year of 2023. The company, a leading provider of mechanical contracting services, including HVAC, plumbing, and electrical services, has reported significant growth in revenue and net income, alongside a record-high backlog.

Financial Performance Highlights

Comfort Systems USA Inc (NYSE:FIX) has demonstrated a strong financial performance in the fourth quarter, with net income soaring to $91.6 million, or $2.55 per diluted share, compared to $55.4 million, or $1.54 per diluted share in the same quarter of the previous year. This impressive growth is mirrored in the company's annual figures, with net income reaching $323.4 million, or $9.01 per diluted share, up from $245.9 million, or $6.82 per diluted share in 2022.

The company's revenue also saw a substantial increase, with fourth-quarter revenue climbing to $1.36 billion from $1.12 billion in the prior year's quarter. The annual revenue followed suit, escalating to $5.21 billion from $4.14 billion in 2022. Operating cash flow for the quarter was reported at $173.0 million, compared to $132.0 million in the same quarter of 2022, while the full-year operating cash flow nearly doubled to $639.6 million from $301.5 million.

Operational Achievements and Future Outlook

President and CEO Brian Lane attributed the year's success to excellent execution by the company's team, highlighting growth, earnings, and cash flow as unprecedented achievements. Lane noted, "During the fourth quarter both our mechanical and electrical businesses grew and increased margins to drive our annual results to new heights." He also emphasized the company's strong cash flow for the quarter and the significant increase in free cash flow over the year.

"Our backlog is up 27% from last year, with a year over year increase of roughly $1.1 billion, and most of that growth resulted from a same-store backlog surge in the just completed quarter. Underlying demand remains very supportive, and we are excited about the two new companies that joined us at the beginning of this month. As a result, we are optimistic that we will continue to grow and maintain our strong operational results in 2024," said Mr. Lane.

The company's backlog, an indicator of future revenue potential, has reached a new high of $5.16 billion as of December 31, 2023, compared to $4.06 billion at the end of 2022. This represents a 27% increase year-over-year, with the majority of the growth coming from a same-store backlog surge in the fourth quarter.

Balance Sheet and Cash Flow Statement

Comfort Systems USA's balance sheet reflects a solid financial position, with cash and cash equivalents of $205.15 million as of December 31, 2023, a significant increase from $57.21 million at the end of 2022. The company's total assets have grown to $3.31 billion from $2.60 billion in the previous year.

The cash flow statement further underscores the company's financial strength, with free cash flow concluding the year at over $550 million. This is a notable improvement from the $256.03 million reported in 2022, demonstrating the company's ability to generate cash efficiently.

Conclusion

Comfort Systems USA Inc (NYSE:FIX) has reported a year of strong growth and financial performance, with significant increases in revenue, net income, and backlog. The company's focus on operational excellence and strategic expansion has positioned it well for continued success in the construction industry. With a robust backlog and a positive outlook for 2024, Comfort Systems USA Inc (NYSE:FIX) remains a company to watch for value investors and industry stakeholders alike.

For a deeper dive into Comfort Systems USA Inc (NYSE:FIX)'s financial details and to stay updated on the latest investment opportunities, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Comfort Systems USA Inc for further details.

This article first appeared on GuruFocus.