Commerce Bancshares (CBSH) Stock Up 5.26% on Q2 Earnings Beat (Revised)

Commerce Bancshares Inc.’s CBSH second-quarter 2023 earnings per share of $1.02 surpassed the Zacks Consensus Estimate of 93 cents. The bottom line increased 10.9% from the prior-year quarter.

Results benefited from an increase in net interest income (NII) driven by a rise in loan balance and higher interest rates. Also, non-interest income grew during the quarter. The investors turned bullish on the stock, as the share price rose 5.26% following the release of the quarterly results.

Net income attributable to common shareholders was $127.8 million, up 10.4% year over year. Our estimate for the metric was $112 million.

Revenues & Expenses Rise

Total revenues were $397.1 million, up 6.8% year over year. The top line beat the Zacks Consensus Estimate of $387.2 million.

NII was $249.5 million, up 7.4% year over year. Net yield on interest-earning assets expanded 33 basis points (bps) to 3.12%. Our estimate for NII was $248.5 million.

Non-interest income came in at $147.6 million, increasing 5.9%. The upswing was largely driven by an increase in bank card transaction fees and other fees. Our estimate for non-interest income was $139.4 million.

Non-interest expenses increased 6.6% to $227.6 million. The rise was mainly due to higher salaries and employee benefit expenses, data processing and software expense, and other expenses. We had projected expenses to be $226.6 million.

The efficiency ratio decreased to 57.22% from 57.29% in the year-ago quarter. A decrease in the efficiency ratio indicates an improvement in profitability.

As of Jun 30, 2023, total loans were $16.96 billion, up 2.5% from the prior quarter. Total deposits as of the same date were $25.87 billion, up 4.8%.

Credit Quality: A Mixed Bag

Provision for credit losses was $6.5 million, which decreased 9.6% from the prior-year quarter.

Non-accrual loans to total loans were 0.04%, which decreased 1 bp from the prior-year number.

The ratio of annualized net loan charge-offs to total average loans was 0.16%, up from 0.10% in the year-earlier quarter. Allowance for credit losses on loans to total loans was 0.94%, increasing 6 bps.

Capital & Profitability Ratios Solid

As of Jun 30, 2023, the Tier I leverage ratio was 10.46%, up from 9.45% in the year-ago quarter. Tangible common equity to tangible assets ratio increased to 7.70% from the prior-year quarter’s 7.56%.

At the end of the second quarter of 2023, the return on total average assets was 1.56%, up from the year-ago period’s 1.36%. Return on average common equity was 18.81%, up from 16.29% in the prior-year quarter.

Share Repurchase Update

During the reported quarter, the company did not repurchase any shares.

Our Take

Commerce Bancshares’ revenues are expected to be driven by decent loan demand, higher interest rates and its initiatives to strengthen fee income sources. However, rising expenses and provisions remain major near-term headwinds.

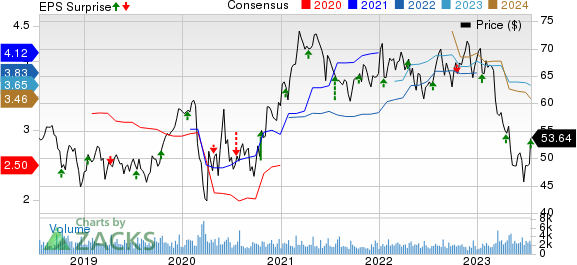

Commerce Bancshares, Inc. Price, Consensus and EPS Surprise

Commerce Bancshares, Inc. price-consensus-eps-surprise-chart | Commerce Bancshares, Inc. Quote

Currently, Commerce Bancshares carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Major Banks

Wells Fargo & Company’s WFC second-quarter 2023 earnings per share of $1.25 outpaced the Zacks Consensus Estimate of $1.15. The figure improved 66.7% year over year.

Results of WFC have benefited from higher NII and non-interest income. Improvements in capital and profitability ratios were other positives. However, higher provisions for credit losses and a rise in expenses were the undermining factors.

Citigroup Inc.’s C second-quarter 2023 earnings per share (excluding divestiture-related impacts) of $1.37 outpaced the Zacks Consensus Estimate of $1.31.

In the second quarter, C witnessed a decline in the top line due to lower revenues in the Institutional Clients Group. Also, the higher cost of credit was a spoilsport. Nonetheless, higher revenues in Personal Banking and Wealth Management segments were bright spots.

(We are reissuing this article to correct a mistake. The original article, issued on July 20, 2023, should no longer be relied upon.)

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Wells Fargo & Company (WFC) : Free Stock Analysis Report

Citigroup Inc. (C) : Free Stock Analysis Report

Commerce Bancshares, Inc. (CBSH) : Free Stock Analysis Report