Commerce Bancshares (CBSH) Stock Gains on Q4 Earnings Beat

Shares of Commerce Bancshares Inc. CBSH gained 2.1% following the release of its fourth-quarter and 2023 results. Quarterly earnings per share of 84 cents surpassed the Zacks Consensus Estimate of 82 cents. However, the bottom line decreased 16% from the prior-year quarter.

Results benefited from a rise in non-interest income and lower provisions. Also, the company recorded a sequential improvement in loan balances in the quarter. However, a decline in net interest income (NII) and higher expenses were the major headwinds.

Net income attributable to common shareholders was $109.2 million, down 17% year over year. Our estimate for the metric was pegged at $98 million.

For 2023, earnings were $3.64 per share, surpassing the Zacks Consensus Estimate of $3.62. The bottom line declined marginally from the previous year. Net income attributable to common shareholders was $477.1 million, down 2.3% year over year. Our estimate for the metric was $465.8 million.

Revenues Improve Marginally, Expenses Rise

Total quarterly revenues were $393.3 million, up marginally year over year. The top line also beat the Zacks Consensus Estimate of $384.4 million.

Revenues were $1.57 billion for 2023, up 5.5% year over year. The top line beat the Zacks Consensus Estimate of $1.56 billion.

Quarterly NII was $248.4 million, down 2.4% year over year. Our estimate for NII was $243.7 million.

Net yield on interest-earning assets contracted 1 basis point (bp) from the prior-year quarter to 3.17%.

Non-interest income was $144.9 million, growing 5.9% year over year. The rise was driven by an increase in almost all fee income components, except for consumer brokerage services fees and other income. Our estimate for non-interest income was $137.1 million.

Non-interest expenses increased 15.9% to $251.3 million. The rise was due to an increase in all cost components. We had projected expenses of $238.5 million.

The efficiency ratio increased to 63.80% from 55.26% in the year-ago quarter. A rise in the efficiency ratio indicates a deterioration in profitability.

As of Dec 31, 2023, total loans were $17.21 billion, up marginally from the prior quarter. Total deposits as of the same date were $25.36 billion, up 1.1% sequentially.

Asset Quality: Mixed Bag

Provision for credit losses was $5.9 million, which decreased 62% from the prior-year quarter. Our estimate for the metric was $18.6 million.

Non-accrual loans to total loans were 0.04%, down 1 bp from the prior-year quarter.

The ratio of annualized net loan charge-offs to total average loans was 0.19%, up from 0.14% in the year-earlier quarter. Allowance for credit losses on loans to total loans was 0.94%, increasing 2 bps.

Capital Ratios Improve, Profitability Ratios Deteriorate

As of Dec 31, 2023, the Tier I leverage ratio was 11.25%, up from 10.34% in the year-ago quarter. Tangible common equity to tangible assets ratio increased to 8.85% from the prior-year quarter’s 7.32%.

At the end of the fourth quarter of 2023, the return on total average assets was 1.38%, down from the year-ago period’s 1.65%. Return on average equity was 16.48% compared with 21.88% in the prior-year quarter.

Share Repurchase Update

During the reported quarter, the company repurchased 0.4 million shares at an average price of $48.84.

Our Take

Commerce Bancshares’ revenues are expected to be driven by decent loan demand and its initiatives to strengthen fee income sources. However, rising expenses act as a major near-term headwind.

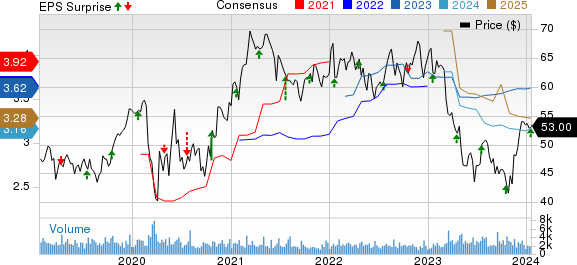

Commerce Bancshares, Inc. Price, Consensus and EPS Surprise

Commerce Bancshares, Inc. price-consensus-eps-surprise-chart | Commerce Bancshares, Inc. Quote

Currently, Commerce Bancshares carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Banks

Citigroup Inc.’s C fourth-quarter 2023 earnings per share (excluding the impacts of notable items) of 84 cents surpassed the Zacks Consensus Estimate of 73 cents. The company registered earnings of $1.16 a year ago.

Including the impacts of notable items in the quarter, C recorded a loss per share of $1.16.

Citigroup witnessed growth in total loans and deposits in the quarter. However, a decline in revenues and deteriorating credit quality were the major headwinds.

KeyCorp’s KEY fourth-quarter 2023 adjusted earnings from continuing operations of 25 cents per share surpassed the Zacks Consensus Estimate of 22 cents. This excludes an FDIC special assessment charge, efficiency-related expenses and a pension settlement charge.

KEY’s results benefited from a decline in provisions. However, lower NII and non-interest income, along with higher expenses, were the undermining factors.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Citigroup Inc. (C) : Free Stock Analysis Report

KeyCorp (KEY) : Free Stock Analysis Report

Commerce Bancshares, Inc. (CBSH) : Free Stock Analysis Report