Commercial Metals Co (CMC) Reports Q2 Fiscal 2024 Earnings: A Mixed Performance Amidst ...

Net Earnings: Reported at $85.8 million, or $0.73 per diluted share.

Adjusted Earnings: $103.1 million, or $0.88 per diluted share, excluding specific charges.

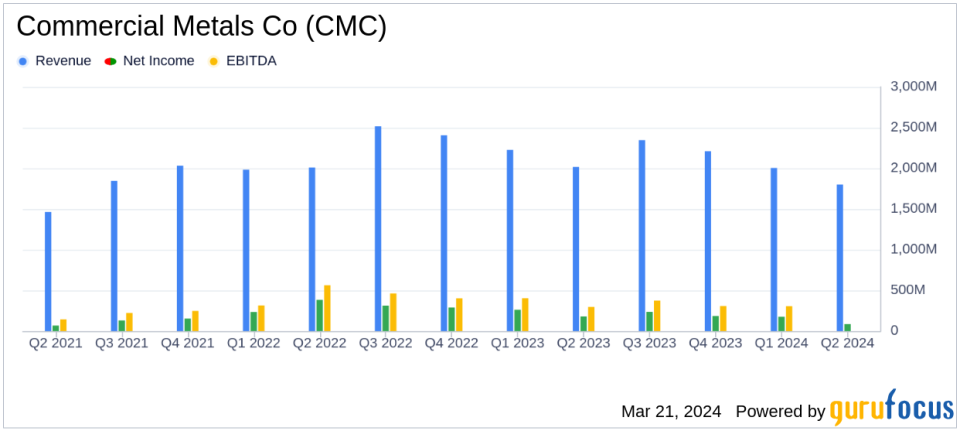

Net Sales: Decreased to $1.8 billion from $2.0 billion in the prior year period.

Core EBITDA: $224.4 million with a core EBITDA margin of 12.1%.

Dividend: Quarterly dividend declared at $0.18 per share, up approximately 13%.

Liquidity: Strong with cash and cash equivalents totaling $638.3 million.

Stock Repurchase: CMC repurchased 945,205 shares valued at $47.9 million.

On March 21, 2024, Commercial Metals Co (NYSE:CMC) released its 8-K filing, announcing the financial results for its fiscal second quarter ended February 29, 2024. The company, which operates steel mills, steel fabrication plants, and metal recycling facilities primarily in the United States and Central Europe, reported net earnings of $85.8 million, or $0.73 per diluted share, on net sales of $1.8 billion. This performance marks a decrease from the prior year period's net earnings of $179.8 million, or $1.51 per diluted share, on net sales of $2.0 billion.

Commercial Metals Co's core EBITDA stood at $224.4 million, reflecting a core EBITDA margin of 12.1%. The company highlighted that downstream contract awards rebounded to the highest quarterly level in nearly two years, indicating a strong pipeline ahead of the construction season. Both the North America and Europe Steel Groups reported significant year-over-year improvements in controllable costs per ton of finished steel shipped, positively impacting financial performance.

Despite facing challenging weather conditions and seasonal weakness, CMC's strategic growth initiatives continued to progress. Notably, the Arizona 2 micro mill successfully produced and sold merchant bar product, a global first for a micro mill steelmaking operation. The company's liquidity remained robust, with cash and cash equivalents totaling $638.3 million and available liquidity nearing $1.5 billion.

Financial Performance Analysis

CMC's financial achievements this quarter are significant, given the cyclical nature of the steel industry. The company's ability to control costs and improve margins in a challenging environment demonstrates operational efficiency and resilience. The strategic growth initiatives, such as the Arizona 2 micro mill, signal CMC's commitment to innovation and long-term growth, which is crucial for maintaining a competitive edge in the steel industry.

However, the decrease in net sales compared to the previous year highlights the impact of external market conditions on the company's top-line performance. The company's management remains optimistic, citing strong fundamentals in the North American markets and improved market conditions for the Europe Steel Group.

CMC's balance sheet strength, as evidenced by its cash position and share repurchase activity, reflects confidence in its financial health and commitment to delivering shareholder value. The increase in the quarterly dividend further underscores this commitment.

The company's outlook remains positive, with expectations of robust construction activity in the coming months. CMC's North America Steel Group anticipates stable adjusted EBITDA margins, while the Europe Steel Group expects to approach breakeven levels in the third quarter. The Emerging Businesses Group is projected to see improved financial results due to seasonal demand increases and a healthy order book.

In conclusion, Commercial Metals Co's second quarter fiscal 2024 results present a mixed picture, with strategic growth and cost control measures balancing the revenue decline. The company's focus on operational efficiency and strategic investments positions it well to capitalize on favorable market trends and drive future growth.

For a detailed analysis of CMC's financials and future outlook, investors and interested parties are encouraged to review the full earnings release and financial statements.

Explore the complete 8-K earnings release (here) from Commercial Metals Co for further details.

This article first appeared on GuruFocus.