Commodity Check: Time to Buy Stock in These High Inflationary Winners?

High inflation led to peaks in commodity prices over the last few years with Cal-Maine Foods CALM, Lamb Weston LW, and Nucor NUE being prime examples of companies that were able to capitalize.

Slowly but surely Inflation has begun to ease taking away from their inflationary boost but August’s 0.6% spike in CPI data for all items has investors anxiously awaiting September numbers next Thursday. This is also why now may be a good time to check the current prospects of some of these inflationary winners.

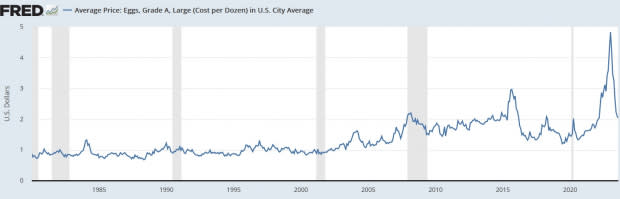

Cal-Maine & Egg Prices

The cost per dozen of eggs has fallen sharply from a peak of $4.82 in early January to around $2 at the moment. Correlating with such, Cal-Maine’s stock has dropped near 52-week lows at $46 a share and 29% from its 52-week high of $65.32 last December.

Image Source: FRED

However, as the largest producer and distributer of fresh shell eggs in the United States Cal-Maine's stock currently lands a Zacks Rank #3 (Hold).

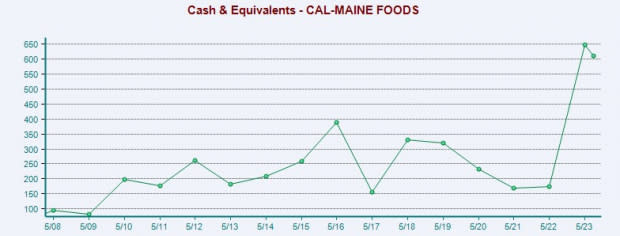

There could still be better buying opportunities but Cal-Maine’s ability to stack cash over the last year during high probability is promising. To that point, the company’s sustainability and market dominance should continue with Cal-Maine's cash & equivalents soaring to $648 million at the end of its fiscal 2023 compared to $175 million in 2022.

Image Source: Zacks Investment Research

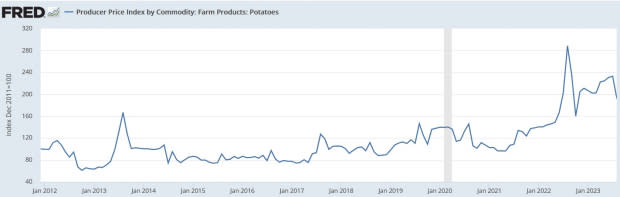

Lamb Weston & Potato Prices

After falling sharply from multi-year highs of $288 last August, the price index for potatoes had begun to ascend again this year before recently cooling off to around $192. With Lamb Weston being the largest potato producer in North America, its stock has mirrored the commodity price soaring +60% over the last two years and up roughly +5% for the year.

Image Source: FRED

Still, Lamb Weston’s stock is 19% from its 52-week high of $116 a share in July and the recent dip is starting to look like a buying opportunity. Notably, Lamb Weston’s earnings are forecasted to jump 12% in its current fiscal 2024 and rise another 9% in FY25 to $5.76 per share. More importantly, FY24 and FY25 earnings estimates are modestly higher over the last 60 days which largely attributes to Lamb Weston’s stock sporting a Zacks Rank #2 (Buy) at the moment.

Image Source: Zacks Investment Research

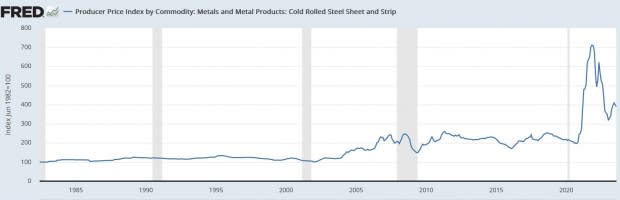

Nucor & Steel Prices

Steel prices had started to rise at the beginning of the year before falling of late with the price per sheet of cold-rolled steel at $389 and well-off multi-year highs of over $700 at the end of 2021. Investing in leading steel producer Nucor has been very lucrative but it may be time to take some profits with NUE shares landing a Zacks Rank #4 (Sell).

Image Source: FRED

Nucor's stock has soared +59% over the last two years and is up +19% YTD but earnings estimate revisions have started to decline again over the last 30 days. Many steel producers are expected to see their bottom lines contract after stellar profits over the last few years but one company seeing positive EPS revisions for the year ahead is Commercial Metals CMC which could be a better alternative for investors right now.

Commercial Metals’ stock currently sports a Zacks Rank #1 (Strong Buy) and looks poised for a rally with its price performance being virtually flat this year and rising earnings estimates for FY24 offering support to its attractive 7.2X forward earnings multiple.

Image Source: Zacks Investment Research

Bottom Line

A high inflationary environment looks here to stay which makes monitoring commodity prices and stocks that can benefit accordingly very important to investors. September’s CPI data will give a better grasp on this as well and help flush out the commodities that may lead to opportunity going forward.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Nucor Corporation (NUE) : Free Stock Analysis Report

Cal-Maine Foods, Inc. (CALM) : Free Stock Analysis Report

Commercial Metals Company (CMC) : Free Stock Analysis Report

Lamb Weston (LW) : Free Stock Analysis Report