CommScope (COMM) Partners Orange Belgium to Offer Set Top

CommScope Holding Company, Inc. COMM has partnered with Orange Belgium to provide its subscribers with set tops powered by the Android TV operating system that offers live television and streaming services.

Orange Belgium is a leading telecommunication operator in the Belgian market, with more than 3 million customers. It provides connectivity services to residential and business customers through multigigabit mobile, cable and fiber-optic networks.

Orange Belgium is the second affiliate CommScope has provided with Android TV devices. The first being Orange Slovensko in August 2021.

CommScope provides solutions to simplify and accelerate the deployment of Android-based TV services. It integrates high-quality set-top hardware with the latest version of Android TV Operator Tier, additional software components and a customized user interface.

The latest set top is the result of the integration of Orange ecosystem partners with CommScope’s software. It will provide Orange Belgium subscribers with a connected 4K UHD digital video decoder providing OTT streaming services and broadcast TV services.

Subscribers will have access to a variety of premium streaming apps and a new multiscreen cloud recording service. With a microphone built into the remote control, they can talk to Google to search for movies and shows.

CommScope removed all single-use plastics in the packaging, which aligns with both CommScope and Orange Belgium’s commitment to reducing environmental impact. CommScope and Orange plan to launch similar platforms to more affiliates in 2022.

CommScope is likely to benefit from industry tailwinds such as 5G and mobile network densification, indoor coverage and expansion of optical fiber networks.

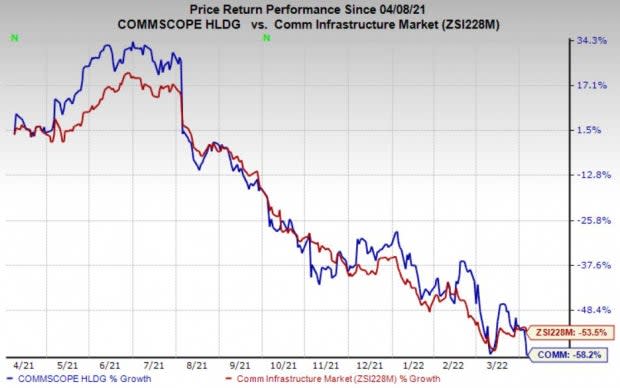

The stock has lost 58.2% in the past year compared with the industry’s decline of 53.5%.

Image Source: Zacks Investment Research

COMM currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Clearfield, Inc. CLFD is a better-ranked stock in the broader Zacks Computer and Technology sector, sporting a Zacks Rank #1. The Zacks Consensus Estimate for its current-year earnings has been revised upward by 20.5% over the past 60 days.

Clearfield delivered a trailing four-quarter earnings surprise of 50.7%, on average. It has soared 95% in the past year.

Qualcomm, Inc. QCOM, carrying a Zacks Rank #2 (Buy), is another solid pick for investors. The consensus estimate for current-year earnings has been revised upward by 12.2% over the past 60 days.

Qualcomm has a trailing four-quarter earnings surprise of 12.2%, on average. It has inched up 0.7% in the past year.

Sierra Wireless, Inc. SWIR carries a Zacks Rank #2. The consensus mark for current-year earnings has been revised upward by 237.5% over the past 60 days.

Sierra Wireless pulled off a trailing four-quarter earnings surprise of 58%, on average. The stock has returned 9.3% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

QUALCOMM Incorporated (QCOM) : Free Stock Analysis Report

Sierra Wireless, Inc. (SWIR) : Free Stock Analysis Report

CommScope Holding Company, Inc. (COMM) : Free Stock Analysis Report

Clearfield, Inc. (CLFD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research