CommScope (COMM) Q2 Earnings and Revenues Lag Estimates

CommScope Holding Company, Inc. COMM reported soft second-quarter 2023 results, with the bottom line and top line missing the respective Zacks Consensus Estimate.

Lower capital spending from customers, inventory adjustments, macroeconomic challenges and weak demand in several verticals led to top-line contraction year over year.

Net Income

On a GAAP basis, net loss in the second quarter was $115.7 million or a loss of 55 cents per share compared with a net loss of $75.7 million or a loss of 36 cents per share in the year-ago quarter. Top-line contraction led to a greater net loss during the quarter.

Non-GAAP net income came in at $47.3 million or 19 cents per share compared with $100.5 million or 41 cents per share in the prior-year quarter. The bottom line fell short of the Zacks Consensus Estimate by 20 cents.

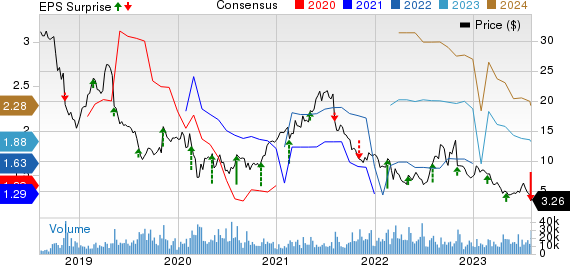

CommScope Holding Company, Inc. Price, Consensus and EPS Surprise

CommScope Holding Company, Inc. price-consensus-eps-surprise-chart | CommScope Holding Company, Inc. Quote

Revenues

Net sales in the reported quarter were $1,918.4 million, down 16.6% year over year. The decline was primarily due to weak demand trends in Connectivity and Cable Solutions (CCS), Home Networks and Outdoor Wireless Networks (OWN) segments. The top line missed the consensus estimate by $124 million.

Revenues from CCS were down 29.2% to $698.9 million from $986.7 million in the year-ago quarter. The downside was induced by sluggish demand for network cable and connectivity, as well as building and data center connectivity. The top line fell short of our estimate of $998.5 million.

Sales from the OWN segment were $228.8 million, down 41.5% year over year due to the sales drop of Base Station Antennas and Heliax products. Net sales missed our estimate of $337 million.

Sales in NICS rose 59.5% to $327.6 million, backed by strength in Ruckus and Intelligent Cellular Networks. Segment revenues surpassed our estimate of $300.2 million.

Sales in ANS totaled $333.5 million, up 13.7% year over year. Healthy traction in Access Technologies and Converged Network drove the top line in this vertical. Net sales fell short of our estimate of $364.2 million.

Sales from the Home Networks business declined to $329.6 million from $423.9 million in the year-ago quarter, owing to weak demand for Broadband Home solutions.

Region-wise, revenues from the United States declined 22.4% to $1,105.4 million. Europe, the Middle East and Africa reported a 2.3% top-line contraction year over year to $369.8 million. Asia Pacific revenues were $195 million, down 12.6% year over year. Caribbean and Latin American revenues fell 14.8% to $128.2 million and revenues from Canada were $120 million, down 3.2%.

Other Details

Gross profit decreased to $617.2 million from $683.2 million in the prior-year quarter, due to lower net sales. Total operating expenses declined to $545 million from $620.1 million in the year-ago quarter. Operating income totaled $72.2 million, up from $63.1 million a year ago. Non-GAAP adjusted EBITDA was $259.5 million, down 13.4% year over year.

Cash Flow & Liquidity

In the second quarter of 2023, CommScope generated $136.8 million in cash from operating activities against a cash utilization of $94.6 million in the prior-year period. As of Jun 30, 2023, the company had $418.1 million in cash and cash equivalents, with $9,380.9 million in long-term debts.

Outlook

For 2023, management lowered its guidance for core adjusted EBITDA to $1.15-$1.25 billion from the previous estimation of $1.35-$1.5 billion, owing to demand softness. Adjusted free cash flow is expected in the range of $250-$350 million. Weak demand trends, owing to near-term business uncertainties, are likely to impact the company’s margins. However, CommScope’s cost optimization initiatives and investments in broadband and wireless infrastructure are likely to have a positive impact in the long run.

Zacks Rank & Stocks to Consider

CommScope currently carries a Zacks Rank #5 (Strong Sell).

Akamai Technologies, Inc. AKAM, currently carrying a Zacks Rank #2 (Buy), delivered an earnings surprise of 4.9%, on average, in the trailing four quarters. It delivered an earnings surprise of 6.06% in the last reported quarter. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Akamai is a global provider of content delivery networks and cloud infrastructure services. The company’s solutions accelerate and improve content delivery over the Internet, enabling faster response to requests for web pages, streaming of video & audio, business applications, etc. Akamai’s offerings are intended to reduce the impact of traffic congestion, bandwidth constraints and capacity limitations on customers.

Workday Inc. WDAY, sporting a Zacks Rank #1 at present, delivered an earnings surprise of 13.05%, on average, in the trailing four quarters.

Workday is a provider of enterprise-level software solutions for financial management and human resource domains. The company’s cloud-based platform combines finance and HR in a single system, which makes it easier for organizations to provide analytical insights and decision support.

Motorola Solutions, Inc. MSI, currently carrying a Zacks Rank #2, delivered an earnings surprise of 5.62%, on average, in the trailing four quarters.

The leading communications equipment manufacturer has strong market positions in bar code scanning, wireless infrastructure gear, and government communications. Motorola Solutions generally provides services and solutions to government segments and public safety programs, along with large enterprises and wireless infrastructure service providers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Akamai Technologies, Inc. (AKAM) : Free Stock Analysis Report

Motorola Solutions, Inc. (MSI) : Free Stock Analysis Report

Workday, Inc. (WDAY) : Free Stock Analysis Report

CommScope Holding Company, Inc. (COMM) : Free Stock Analysis Report