CommScope Holding Co Inc (COMM) Faces Headwinds: A Dive into the 2023 Earnings Report

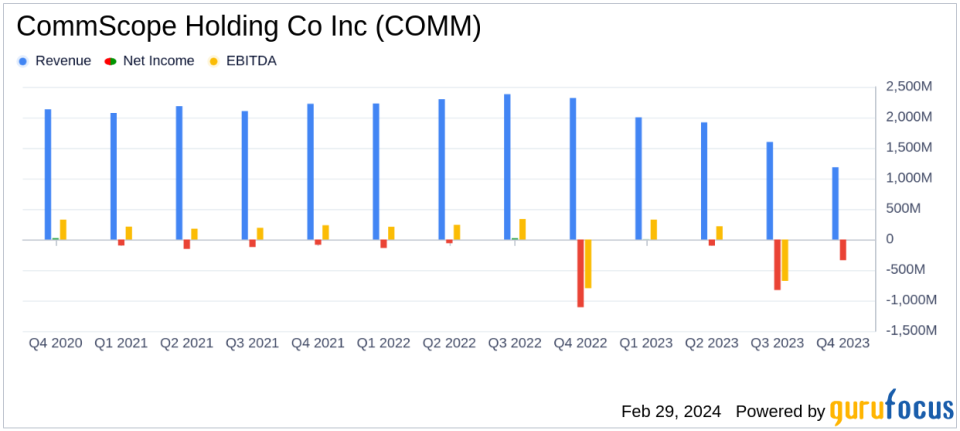

Net Sales: $5.789 billion in 2023, a decrease of 23.1% year-over-year.

GAAP Loss from Continuing Operations: $851.3 million in 2023, including significant asset impairments.

Non-GAAP Adjusted EBITDA: $999.0 million for the full year, down 18.3% from the previous year.

Adjusted Free Cash Flow: Non-GAAP adjusted free cash flow of $382.3 million in 2023.

Core Segment Performance: Core segment adjusted EBITDA of $1.022 billion, reflecting a decrease of 18.3%.

On February 29, 2024, CommScope Holding Co Inc (NASDAQ:COMM), a global leader in network connectivity solutions, released its 8-K filing, detailing the financial outcomes for the fourth quarter and full year of 2023. The company, known for its infrastructure solutions for communication and entertainment networks, faced a challenging year with net sales declining by 23% to $5.79 billion and adjusted EBITDA falling by 18% to $1.02 billion.

CommScope's performance in 2023 was significantly impacted by macroeconomic factors, including higher interest rates, inflation concerns, and a global economic slowdown. These conditions led to softened demand for the company's products, with customers adjusting inventories and pausing capital spending. This trend was particularly evident in the Connectivity and Cable Solutions (CCS), Outdoor Wireless Networks (OWN), and Access Network Solutions (ANS) segments, while the Networking, Intelligent Cellular and Security Solutions (NICS) segment experienced higher demand and favorable pricing impacts for the full year, despite a decline in the fourth quarter.

Financial Achievements and Challenges

Despite the overall decline in sales and profitability, CommScope generated a non-GAAP adjusted free cash flow of $382.3 million in 2023. The company also ended the year with $543.8 million in cash and cash equivalents, and total liquidity of approximately $1.231.8 million. These figures underscore CommScope's ability to maintain financial stability and generate cash during a challenging economic period.

However, the company's GAAP loss from continuing operations was significant, totaling $851.3 million for the year, which included asset impairments of $571.4 million. This loss reflects the challenges faced by the company, including the impact of macroeconomic conditions on its business segments.

Key Financial Metrics and Commentary

CommScope's financial performance is further elucidated by examining key metrics from its income statement and balance sheet:

The company's net sales for the fourth quarter were $1.186 billion, a 38.4% decrease from the previous year.

GAAP loss from continuing operations per share was $(1.67) in the fourth quarter, improving from $(5.16) in the same period last year.

Non-GAAP adjusted net income per diluted share for the full year was $0.64, down from $1.63 in the previous year.

"As we closed a challenging year, CommScope net sales declined 23% from the prior year to $5.79 billion and delivered adjusted EBITDA at the midpoint of our range at $1.02 billion down 18% from the prior year. As previously discussed, all of our businesses had significant pressure by year end. In addition to the challenges we have been experiencing in CCS, OWN and ANS, we have started to see similar adjustments in the NICS business as customers continued to digest inventory. Although we believe there will be a market recovery in the second half of 2024, visibility continues to be limited on the timing and extent of that recovery. As stated, we are targeting an additional $100 million of cost savings in early 2024. Our cost actions as well as our investments in capacity that we have implemented will better position us when demand returns to more normalized levels," said Chuck Treadway, President and Chief Executive Officer.

CommScope's management has taken proactive steps to address the downturn, including cost savings initiatives and investments in capacity. These measures are expected to position the company favorably for a potential market recovery in the latter half of 2024.

Analysis and Outlook

While CommScope's 2023 performance reflects the impact of a challenging economic environment, the company's efforts to streamline operations and manage costs have allowed it to maintain a solid liquidity position. The strategic divestiture of its Home business and the focus on core segments are part of CommScope's broader strategy to navigate through the current market conditions and emerge stronger as demand recovers.

However, the company's cautious outlook for 2024, with limited visibility on market recovery, suggests that investors and stakeholders should prepare for continued volatility in the short term. CommScope's ability to achieve additional cost savings and capitalize on market opportunities as they arise will be critical in determining its financial trajectory in the coming year.

For a more detailed analysis and to stay updated on CommScope's financial journey, visit GuruFocus.com for comprehensive reports and expert insights.

Explore the complete 8-K earnings release (here) from CommScope Holding Co Inc for further details.

This article first appeared on GuruFocus.