CommScope's (COMM) Q4 Earnings Lag Estimates on Lower Revenues

CommScope Holding Company, Inc. COMM reported soft fourth-quarter 2023 results, with the bottom line and top line missing the respective Zacks Consensus Estimate. Lower capital spending from customers, inventory adjustments, macroeconomic challenges and decrease in net sales in major business verticals led to top-line contraction year over year.

Net Income

On a GAAP basis, the net loss in the December quarter was $540.9 million or a loss of $2.55 per share compared to a net loss of $1.12 billion or a loss of $5.39 per share in the year-ago quarter. The significant improvement despite top-line contraction was primarily attributable to lower operating expenses.

Non-GAAP net loss was $3.9 million or a loss of 2 cents per share against net income of $138.1 million or 55 cents per share in the prior-year quarter. The bottom line lagged the Zacks Consensus Estimate of 6 cents.

For 2023, CommScope reported a GAAP net loss of $1.51 billion or a loss of $7.17 per share compared with a net loss of $1.35 billion or a loss of $6.49 per share in 2022. Non-GAAP adjusted net income declined to $161.8 million or 64 cents per share from $407.3 million or $1.63 per share.

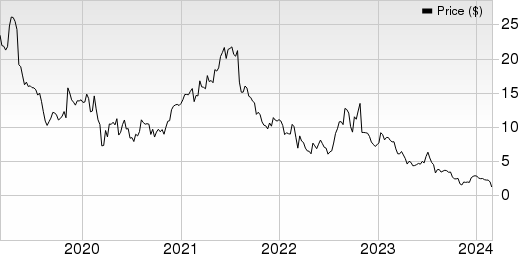

CommScope Holding Company, Inc. Price, Consensus and EPS Surprise

CommScope Holding Company, Inc. price-consensus-eps-surprise-chart | CommScope Holding Company, Inc. Quote

Revenues

Revenues for the reported quarter were $1.19 billion, down 38.4% from $1.93 million in the prior-year quarter. Net sales declined in major business verticals due to higher interest rates and global economic slowdown along with cautious customer spending. Revenues missed the Zacks Consensus Estimate of $1.53 billion.

Sales in Connectivity and Cable Solutions were down 41.9% to $555.8 million compared with $957.1 million in the prior-year quarter, primarily due to a decline in Network Cable and Connectivity and Building and Data Center Connectivity.

Sales in Outdoor Wireless Networks came in at $182.5 million, down 40.1% year over year, owing to lower product sales in Base Station Antennas and HELIAX.

Sales in Networking, Intelligent Cellular and Security Solutions decreased 24.9% to $216.7 million from $288.5 million in the prior-year quarter, primarily on a decline in Ruckus and Intelligent Cellular Networks.

Sales in Access Network Solutions totaled $230.9 million, down 38.4% year over year due to a decline in Access Technologies and Converged Network Solutions.

For 2023, net sales totaled $5.79 billion, down from the prior-year level of $7.52 billion.

Other Details

Gross profit decreased to $448.3 million from $725.4 million in the year-ago quarter due to lower revenue generation. Due to a significant decline in asset impairment charges, total operating expenses fell to $510.4 million from $1,628.2 million in the year-ago quarter. Operating loss totaled $62.1 million compared with a loss of $902.8 million in the year-ago quarter. Non-GAAP adjusted EBITDA was $190.7 million compared with $375.2 million a year ago.

Cash Flow & Liquidity

For 2023, CommScope generated $289.9 million in cash from operating activities compared with an operating cash flow of $190 million in 2022. As of Dec 31, 2023, the company had $543.8 million in cash and cash equivalents with $9,246.6 million long-term debt compared with respective tallies of $373 million and $9,469.6 million a year ago.

Outlook

The company expects lower market demand to persist, at least till the second half of 2024. Core adjusted EBITDA is estimated to be in the range of $100-$125 million.

Zacks Rank & Stocks to Consider

CommScope currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

NVIDIA Corporation NVDA, currently sporting a Zacks Rank #1, delivered a trailing four-quarter average earnings surprise of 20.18%. In the last reported quarter, it delivered an earnings surprise of 13.41%.

NVIDIA is the worldwide leader in visual computing technologies and the inventor of the graphic processing unit. Over the years, the company’s focus evolved from PC graphics to AI-based solutions that support high-performance computing, gaming and virtual reality platforms.

InterDigital, Inc. IDCC, carrying a Zacks Rank #2 (Buy) at present, delivered a trailing four-quarter average earnings surprise of 170.50%. In the last reported quarter, it delivered an earnings surprise of 16.53%.

IDCC is a pioneer in advanced mobile technologies that enable wireless communications and capabilities. The company engages in designing and developing a wide range of advanced technology solutions, which are used in digital cellular as well as wireless 3G, 4G and IEEE 802-related products and networks.

Arista Networks, Inc. ANET, carrying a Zacks Rank #2 at present, is likely to benefit from strong momentum and diversification across its top verticals and product lines. The company has a software-driven, data-centric approach to help customers build their cloud architecture and enhance their cloud experience. Arista has delivered an earnings surprise of 13.28%, on average, in the trailing four quarters.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

InterDigital, Inc. (IDCC) : Free Stock Analysis Report

CommScope Holding Company, Inc. (COMM) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report