Community Bank System Inc. Reports Mixed Results Amidst Challenging Environment

Net Income: Q4 net income of $38.3 million, full year net income of $136.5 million.

Earnings Per Share (EPS): Q4 EPS at $0.71, down from Q4 2022; full year EPS at $2.53.

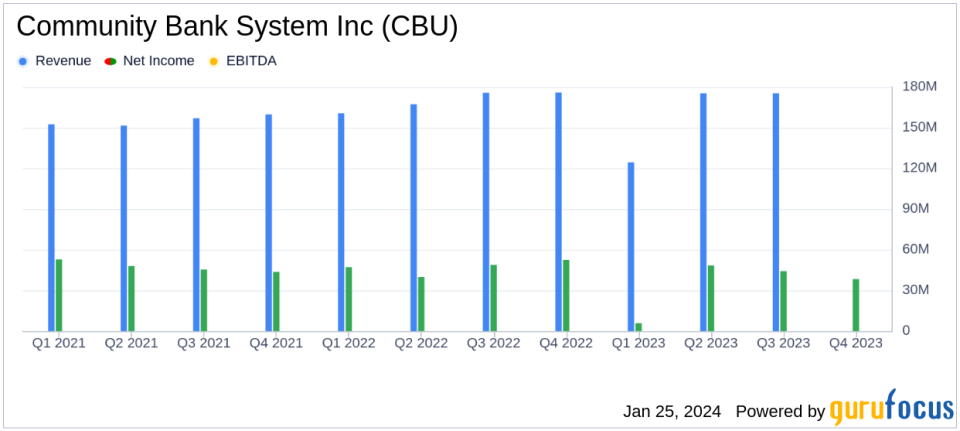

Revenue: Q4 total revenues increased slightly to $177.0 million; full year revenues faced a 4.0% decline.

Net Interest Margin: Q4 net interest margin decreased to 3.05%; full year margin increased to 3.11%.

Loan Growth: Total ending loans reached $9.70 billion, marking a 10.2% increase from the previous year.

Dividend: The quarterly dividend increased, marking the 31st consecutive year of dividend growth.

Capital Ratios: All regulatory capital ratios significantly exceeded well-capitalized standards.

On January 23, 2024, Community Bank System Inc (NYSE:CBU) released its 8-K filing, disclosing its financial results for the fourth quarter and full year of 2023. The company, a diversified financial services entity, operates through banking, benefits administration, insurance services, and wealth management. Despite a challenging environment, CBU achieved its highest level of quarterly revenues in Q4 2023 but faced a decline in net income due to non-operating expenses and notable noninterest expense items.

Financial Performance Overview

CBU reported a Q4 net income of $38.3 million, or $0.71 per fully diluted share, and a full year net income of $136.5 million, or $2.53 per fully diluted share. The company's President and CEO, Dimitar A. Karaivanov, noted that the bottom-line results were impacted by various non-operating expenses, including FDIC insurance special assessment, increased retirement expense, fraud expenses, and restructuring costs. Despite these challenges, all four business segments recorded year-over-year increases in revenues.

Revenue and Net Interest Margin

For Q4, total revenues edged up to $177.0 million, a 0.6% increase from the same quarter in 2022. Full year revenues, however, saw a 4.0% decrease to $652.1 million. The net interest margin for Q4 decreased slightly to 3.05%, while the full year margin increased to 3.11%, indicating a more profitable use of assets throughout the year.

Loan and Deposit Portfolios

CBU experienced robust loan growth, with total ending loans reaching $9.70 billion, a 10.2% increase from the previous year. However, total ending deposits slightly decreased by 0.6% to $12.93 billion. The company's loan-to-deposit ratio stood at 75.1%, reflecting a strong liquidity position.

Capital Strength and Shareholder Returns

The company's capital ratios remained well above the regulatory standards for being well-capitalized, with a Tier 1 Leverage Ratio of 9.37%. CBU's commitment to shareholder returns was evident in the increase of its quarterly dividend, marking the 31st consecutive year of dividend growth.

Segment Performance

CBU's banking segment faced a decrease in revenues due to higher funding costs, while its employee benefit services, insurance services, and wealth management services segments showed revenue growth. The insurance services segment, in particular, saw a significant increase of 39.9% from the fourth quarter of 2022.

Outlook and Management Commentary

Looking ahead to 2024, CBU's focus is on maintaining revenue growth, moderating operating expenses, and maximizing returns on investments made across all business segments. The management remains confident in achieving positive operating leverage despite the volatile market environment.

Community Bank System Inc's diversified business model and strategic focus on revenue growth and cost management position it to navigate the complexities of the financial landscape. Value investors may find CBU's consistent dividend growth and robust capital position to be compelling reasons to consider the stock as a potential addition to their portfolios.

For a detailed analysis of Community Bank System Inc's financial results, investors can access the full earnings release and supplemental financial tables on the company's investor relations website.

Disclaimer: This content is intended for informational purposes only and should not be construed as financial advice. Investors are encouraged to conduct their own due diligence before making investment decisions.

Explore the complete 8-K earnings release (here) from Community Bank System Inc for further details.

This article first appeared on GuruFocus.