Community Health (CYH) Sells Three Florida Facilities for $294M

Community Health Systems, Inc. CYH recently divested three of its Florida-based facilities to Tampa General Hospital and some of its affiliates for a cash consideration of around $294 million. The cash consideration takes into account the estimated working capital and other purchase price adjustments.

The agreement to sell the facilities was inked this July and as expected, closed in late 2023. Equipped with 120, 124 and 128 licensed beds, respectively, Bravera Health Brooksville, Bravera Health Spring Hill and Bravera Health Seven Rivers, together with their associated assets, physician clinic operations and outpatient services, formed a part of the divestiture deal.

Community Health sincerely follows a strategy of divesting healthcare facilities, which are not under any of its strategically beneficial service areas or grapple with a low level of operating profit. With deep roots routed across Florida and a well-diversified services suite, CYH’s divested facilities seem to be in very able hands.

The divestiture spree that Community Health has embarked on this year is quite active in nature. The initiatives are a means to get rid of non-core assets and free up capital, which can be subsequently diverted and spent on business operations that promise higher returns to the healthcare company.

CYH has divested a total of four facilities during the first nine months of 2023, which include the Greenbrier Valley Medical Center, Plateau Medical Center, Medical Center of South Arkansas and Lutheran Rehabilitation Hospital.

Community Health also inked a deal in February 2023 to divest two of its healthcare facilities in North Carolina and their respective assets to Novant Health, which is likely to close in late 2023, subject to customary regulatory nod. This August, it entered into an agreement to sell two of its Oklahoma-based hospitals to INTEGRIS Health. CYH divested a total of one, five and 13 hospitals during 2022, 2021 and 2020, respectively.

The funds that Community Health derive from such divestitures are leveraged to make debt repayments and pursue capital expenditures. Paying off debts has successfully brought down the interest expenses of the healthcare company and the metric declined 4.8% year over year in the first nine months of 2023. While divestiture proceeds can take care of debt repayments, CYH can use its cash balance and operating cash flows to make uninterrupted growth-related investments.

It takes the help of acquisitions and partnerships to enhance medical service offerings, boost business scale and expand nationwide presence. In September 2023, Community Health partnered with the population health management company, Mindoula, to provide seamless access to mental health care and ensure better whole-person health outcomes for patients.

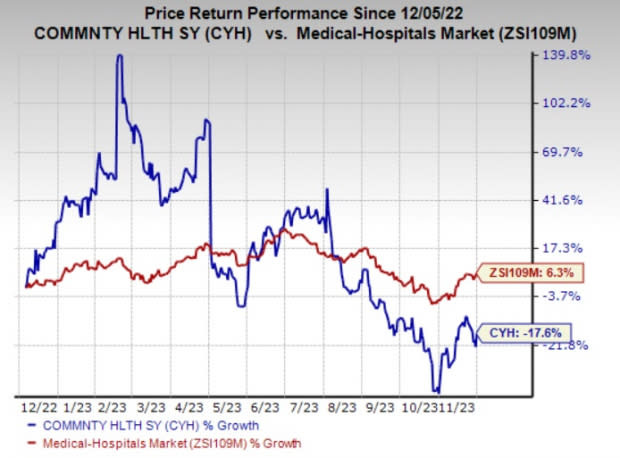

Shares of Community Health have declined 17.6% in the past year against the industry’s 6.3% growth. CYH currently carries a Zacks Rank #3 (Hold).

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the Medical space are Integer Holdings Corporation ITGR, DexCom, Inc. DXCM and Medpace Holdings, Inc. MEDP. While Integer sports a Zacks Rank #1 (Strong Buy), DexCom and Medpace carry a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Integer’s earnings surpassed the Zacks Consensus Estimate in each of the last four quarters, the average beat being 11.98%. The Zacks Consensus Estimate for ITGR’s 2023 earnings and revenues suggests an improvement of 18.6% and 14.9% from the respective year-ago reported figures.

The consensus estimate for Integer’s 2023 earnings has moved 2% north in the past 30 days. Shares of ITGR have gained 22.6% in the past year.

DexCom’s earnings outpaced the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 36.43%. The consensus estimate for DXCM’s 2023 earnings and revenues suggests an improvement of 64.4% and 23.5% from the respective year-ago reported figures.

The consensus estimate for DexCom’s 2023 earnings has moved 1.4% north in the past 30 days. Shares of DXCM have inched up 0.1% in the past year.

Medpace’s earnings outpaced the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 14.62%. The Zacks Consensus Estimate for MEDP’s 2023 earnings and revenues suggests an improvement of 18.8% and 29.4% from the respective year-ago reported figures.

The consensus estimate for Medpace’s 2023 earnings has moved 3.1% north in the past 60 days. Shares of MEDP have gained 34% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DexCom, Inc. (DXCM) : Free Stock Analysis Report

Community Health Systems, Inc. (CYH) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report

Medpace Holdings, Inc. (MEDP) : Free Stock Analysis Report