Community West Bancshares Reports Full Year Earnings Amid Merger Developments

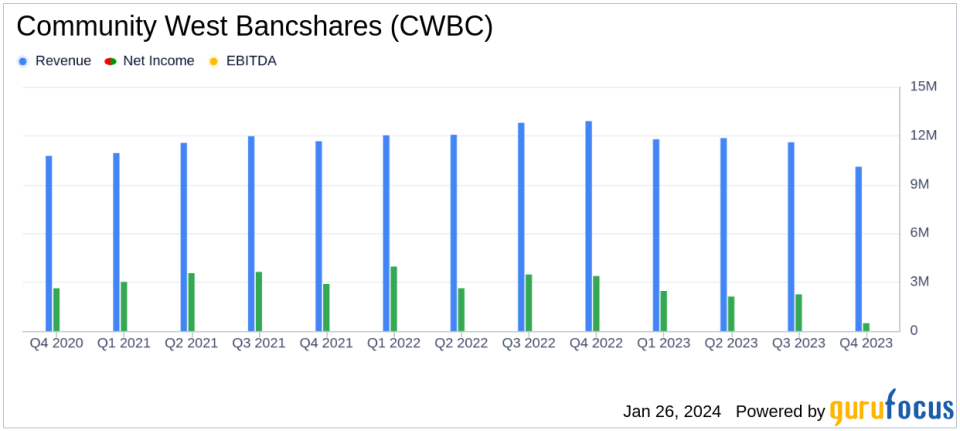

Net Income: Reported $7.3 million for the full year 2023, a decrease from $13.4 million in 2022.

Earnings Per Share: Dropped to $0.81 per diluted share for the year, down from $1.51 in the previous year.

Quarterly Performance: Q4 net income was $479,000, or $0.05 per diluted share, compared to $3.4 million, or $0.38 per diluted share in Q4 2022.

Net Interest Margin: Decreased to 3.87% in Q4 2023 from 4.58% in Q4 2022.

Dividend: Declared a quarterly cash dividend of $0.08 per common share, payable on February 29, 2024.

Merger Update: Received all regulatory approvals for the merger with Central Valley Community Bancorp, expected to close in Q2.

Asset Quality: The Allowance for Credit Losses was 1.31% of total loans held for investment at the end of 2023.

On January 26, 2024, Community West Bancshares (NASDAQ:CWBC) released its 8-K filing, detailing its financial results for the year ended December 31, 2023. The company, a prominent financial services provider in the United States, operates through its subsidiary Community West Bank, offering a variety of financial products and services to businesses and individuals.

Despite a challenging year for the industry, CWBC's President & CEO, Martin E. Plourd, expressed satisfaction with the company's operational results, attributing them to the team's efforts. However, the company faced headwinds, including lower net interest income influenced by higher deposit costs and expenses related to the pending merger with Central Valley Community Bancorp.

Financial Performance and Challenges

Community West Bancshares reported a significant decrease in net income for both the fourth quarter and the full year of 2023. The full-year net income of $7.3 million represented a substantial decline from the $13.4 million reported in 2022. The fourth quarter saw net income fall to $479,000 from $3.4 million in the same quarter of the previous year. This performance reflects the impact of higher deposit costs and merger-related expenses, which could pose challenges to profitability if they persist.

Merger Developments and Financial Health

The merger with Central Valley Community Bancorp is a strategic move that has received all necessary regulatory approvals. This development is poised to create shareholder value and expand the company's market presence in California. CWBC's capital position remains strong, with a well-capitalized Tier 1 leverage ratio of 10.88% as of December 31, 2023.

Key Financial Metrics

Community West Bancshares' financial achievements in the context of a merger and industry challenges are noteworthy. The company's net interest margin, a critical metric for banks, stood at 3.87% for the fourth quarter of 2023. While this represents a decrease from the previous year, it is an important indicator of the bank's lending profitability. The company's efficiency ratio, which measures non-interest expenses as a percentage of revenue, was 87.98% for the fourth quarter, indicating higher costs relative to income.

"While 2023 proved to be a challenging year for our industry, we are pleased with our 2023 operating results as we continue benefiting from the tremendous efforts our team has put into this organization," stated Martin E. Plourd, President & Chief Executive Officer.

Analysis of Company's Performance

The earnings report indicates that Community West Bancshares is navigating a period of transition and consolidation. The decline in net income and earnings per share is a concern, but the company's proactive steps towards a merger and maintaining a strong capital position demonstrate a strategic approach to long-term growth. The declared dividend also signals a commitment to shareholder returns despite the earnings dip.

As Community West Bancshares prepares for its merger with Central Valley Community Bancorp, investors will be watching closely to see how the combined entity can leverage its strengths to overcome the challenges faced in 2023 and capitalize on new opportunities for growth and profitability.

For more detailed financial analysis and up-to-date information on Community West Bancshares, visit GuruFocus.com.

Contact: Richard Pimentel, EVP & CFO805.692.4410www.communitywestbank.com

Explore the complete 8-K earnings release (here) from Community West Bancshares for further details.

This article first appeared on GuruFocus.