Companhia Brasileira (CBD) Up More Than 40% YTD: Here's Why

Companhia Brasileira De Distribuicao CBD is on track to fuel growth through its strategic priorities. A focus on digital transformation and store expansions have been working well for this Brazilian departmental store chain amid escalated costs.

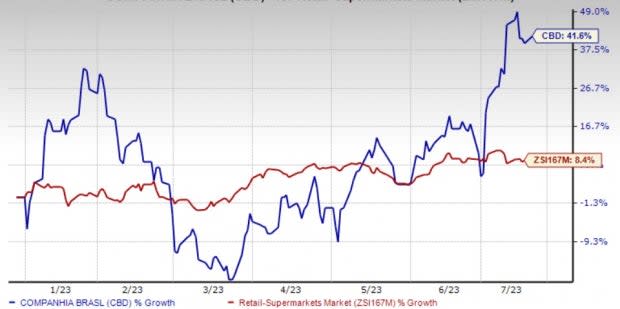

This Zacks Rank #3 (Hold) stock has rallied 41.6% year to date compared with the industry’s growth of 8.4%.

Factors Working Well

Companhia Brasileira is focused on its six strategies, which include the top line, digital expansion and store conversions, profitability, NPS (Net Promoter Score), and ESG & culture. The company’s first-quarter 2023 results reflect the progress of the company’s turnaround project. During the quarter, the segregation of the Grupo Exito and GPA businesses reached significant milestones.

In the first quarter, consolidated gross revenues increased 15.4% in local currency. The company saw improved customer traffic, especially in the Pao de Acucar and Proximity stores. Same-store sales grew 6.3%, excluding gas stations. Companhia Brasileira saw an increased market share of perishables.

Image Source: Zacks Investment Research

CBD has been expanding its stores and market share. As of the first-quarter 2023 earnings release, the company has opened 78 new stores since 2022. The company has been putting a greater emphasis on the Minuto Pao de Acucar banner, which has a mature format and strong growth potential.

In the first quarter of 2023, Companhia Brasileira opened three new Minuto Pao de Acucar stores, two new Pao de Acucar stores and one new Mini Extra store. Further, it renovated 13 Pao de Acucar stores and stated that it has 70 expansions in the pipeline.

Moreover, Companhia Brasileira is on track with its digital transformation endeavors in the face of consumers’ increased preference for online shopping. In the first quarter of 2023, GPA Brazil continued to benefit from digital strength. During the quarter, the company’s GMV increased 7% year over year in e-commerce, backed by increased orders through same-day delivery and the expansion of alliances with external platforms, among other factors.

Food e-commerce has been playing a significant role for the company. CBD has been benefiting from its delivery models, including same-day delivery, Click & Collect, Traditional or next-day delivery and Last Mile or next-hour delivery — James Delivery.

Cost Woes Persist

Companhia Brasileira has been seeing soft margins for the past few quarters now. In the first quarter of 2023, the consolidated adjusted gross margin contracted 253 basis points (bps) to 24.4%, with the adjusted EBITDA margin decreasing 75 bps to 5%.

The gross margin at new GPA Brazil contracted 253 bps due to the impact of inflation on labor, goods and logistic costs. Also, adjustments related to repositioning banners and formats dented the gross margin. Consolidated net income from continued activities also declined year over year due to elevated financial expenses.

However, the abovementioned upsides keep Companhia Brasileira well-placed for growth.

Promising Retail Stocks

Abercrombie & Fitch ANF, which operates as a specialty retailer, currently sports a Zacks Rank #1 (Strong Buy). ANF has a trailing four-quarter earnings surprise of 480.6%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Abercrombie & Fitch’s current fiscal-year EPS suggests a considerable increase from the year-ago reported number.

Urban Outfitters URBN, which engages in the retail and wholesale of general consumer products, currently sports a Zacks Rank #1. URBN has a trailing four-quarter earnings surprise of 12.2%, on average.

The Zacks Consensus Estimate for Urban Outfitters’ current fiscal-year earnings suggests growth of 57.1% from the year-ago reported number.

The supermarket giant, Walmart Inc. WMT, currently carries a Zacks Rank #2 (Buy). WMT has a trailing four-quarter earnings surprise of around 12%, on average.

The Zacks Consensus Estimate for Walmart’s current fiscal-year sales suggests growth of 4.2% from the year-ago reported number.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Walmart Inc. (WMT) : Free Stock Analysis Report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

Urban Outfitters, Inc. (URBN) : Free Stock Analysis Report

Companhia Brasileira de Distribuicao (CBD) : Free Stock Analysis Report