Companhia De Saneamento Basico Do Estado De Sao Paulo: A Good Outperformance Potential with a ...

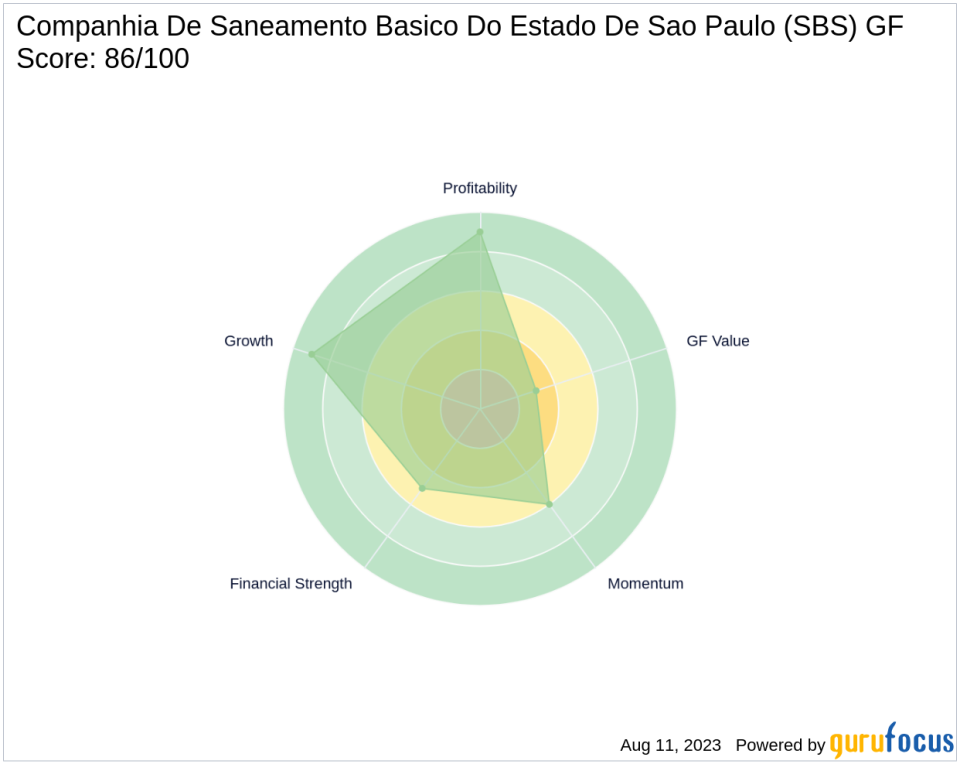

Companhia De Saneamento Basico Do Estado De Sao Paulo (NYSE:SBS), a leading player in the Utilities - Regulated industry, has been making waves in the stock market. As of August 11, 2023, the company's stock price stands at $11.42, reflecting a gain of 4.77% today and a 1.46% increase over the past four weeks. With a market cap of $7.81 billion, SBS has a GF Score of 86 out of 100, indicating good outperformance potential.

Financial Strength Analysis

The Financial Strength of SBS is ranked at 5/10. This rank is determined by several factors including the interest coverage of 3.75, a debt to revenue ratio of 0.80, and an Altman Z score of 1.48. These figures suggest that the company has a moderate level of financial strength.

Profitability Rank Analysis

SBS's Profitability Rank is impressive at 9/10. This high rank is supported by an operating margin of 21.32%, a Piotroski F-Score of 7, and a consistent profitability record over the past 10 years. However, the 5-year average trend of the operating margin is -7.70%, indicating a need for improvement.

Growth Rank Analysis

The company's Growth Rank is also strong at 9/10, reflecting a 5-year revenue growth rate of 7.80% and a 3-year revenue growth rate of 7.00%. The 5-year EBITDA growth rate is 5.10%, indicating a steady growth in the company's business operations.

GF Value Rank Analysis

The GF Value Rank of SBS is 3/10, suggesting that the stock is currently fairly valued. This rank is determined by the price-to-GF-Value ratio, a proprietary metric calculated based on historical multiples and an adjustment factor based on the company's past returns and growth.

Momentum Rank Analysis

SBS's Momentum Rank stands at 6/10, indicating a moderate momentum in the stock price. This rank is determined using the standardized momentum ratio and other momentum indicators.

Competitor Analysis

When compared to its competitors in the Utilities - Regulated industry, SBS holds a competitive position. Compania de Saneamento de Minas Gerais - COPASA MG has a GF Score of 81, CIA Saneamento Do Parana-SANEPAR has a GF Score of 92, and American Water Works Co Inc has a GF Score of 83. This comparison suggests that SBS is well-positioned in the industry with a strong GF Score.

Conclusion

In conclusion, Companhia De Saneamento Basico Do Estado De Sao Paulo presents a good outperformance potential with a GF Score of 86. The company's strong profitability and growth ranks, moderate financial strength, and momentum, coupled with a fair GF Value Rank, make it an attractive investment option. However, investors should keep an eye on the company's operating margin trend and GF Value Rank for future investment decisions.

This article first appeared on GuruFocus.