Companies Like Lyell Immunopharma (NASDAQ:LYEL) Are In A Position To Invest In Growth

There's no doubt that money can be made by owning shares of unprofitable businesses. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

Given this risk, we thought we'd take a look at whether Lyell Immunopharma (NASDAQ:LYEL) shareholders should be worried about its cash burn. For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). Let's start with an examination of the business' cash, relative to its cash burn.

Check out our latest analysis for Lyell Immunopharma

Does Lyell Immunopharma Have A Long Cash Runway?

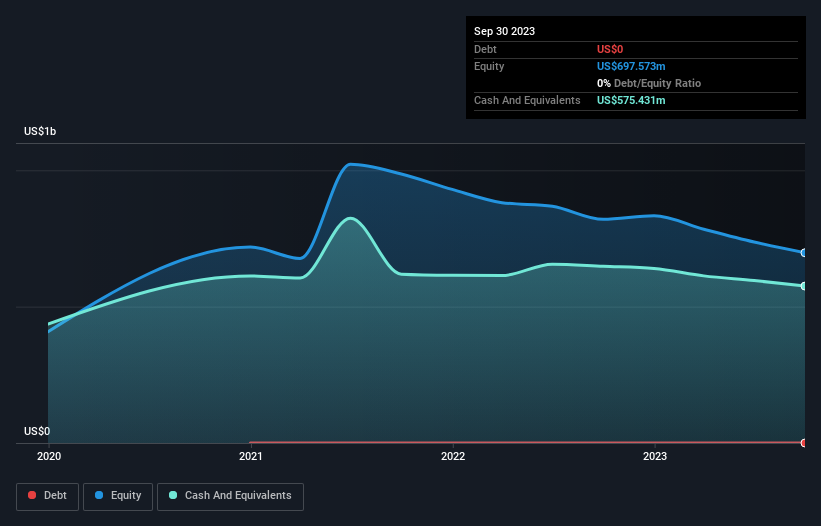

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. As at September 2023, Lyell Immunopharma had cash of US$575m and no debt. In the last year, its cash burn was US$171m. Therefore, from September 2023 it had 3.4 years of cash runway. A runway of this length affords the company the time and space it needs to develop the business. You can see how its cash balance has changed over time in the image below.

How Well Is Lyell Immunopharma Growing?

On balance, we think it's mildly positive that Lyell Immunopharma trimmed its cash burn by 11% over the last twelve months. And considering that its operating revenue gained 24% during that period, that's great to see. Considering the factors above, the company doesn’t fare badly when it comes to assessing how it is changing over time. Clearly, however, the crucial factor is whether the company will grow its business going forward. So you might want to take a peek at how much the company is expected to grow in the next few years.

How Hard Would It Be For Lyell Immunopharma To Raise More Cash For Growth?

There's no doubt Lyell Immunopharma seems to be in a fairly good position, when it comes to managing its cash burn, but even if it's only hypothetical, it's always worth asking how easily it could raise more money to fund growth. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Commonly, a business will sell new shares in itself to raise cash and drive growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Lyell Immunopharma's cash burn of US$171m is about 35% of its US$484m market capitalisation. That's fairly notable cash burn, so if the company had to sell shares to cover the cost of another year's operations, shareholders would suffer some costly dilution.

How Risky Is Lyell Immunopharma's Cash Burn Situation?

On this analysis of Lyell Immunopharma's cash burn, we think its cash runway was reassuring, while its cash burn relative to its market cap has us a bit worried. Cash burning companies are always on the riskier side of things, but after considering all of the factors discussed in this short piece, we're not too worried about its rate of cash burn. Separately, we looked at different risks affecting the company and spotted 3 warning signs for Lyell Immunopharma (of which 1 doesn't sit too well with us!) you should know about.

Of course Lyell Immunopharma may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.