Compass Diversified Holdings Reports Notable Gains from Asset Sales in Q4 and Full Year 2023 Results

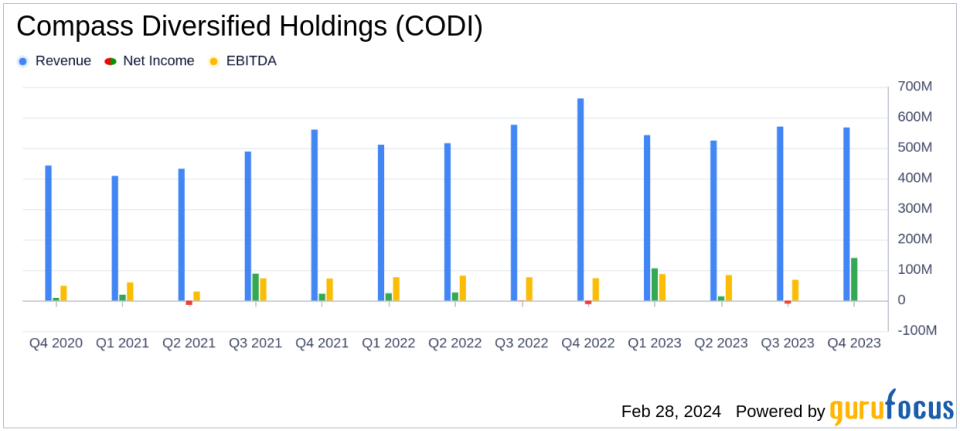

Net Sales: Q4 net sales increased by 7% to $567.0 million, full-year net sales up 2% to $2.1 billion.

Net Income: Q4 net income soared to $139.4 million from $8.7 million, full-year net income rose to $262.4 million from $51.4 million.

Adjusted EBITDA: Q4 Adjusted EBITDA up 35% to $94.8 million, full-year Adjusted EBITDA increased by 11% to $340.9 million.

Divestitures: Gains from the sale of Marucci Sports and Advanced Circuits significantly impacted earnings.

Acquisitions: The acquisition of The Honey Pot Company expected to contribute to above-trend growth in 2024.

Distributions: Paid a Q4 2023 cash distribution of $0.25 per share on CODI's common shares.

2024 Outlook: CODI provides guidance for consolidated Subsidiary Adjusted EBITDA between $480 million and $520 million for the full year 2024.

On February 28, 2024, Compass Diversified Holdings (NYSE:CODI), an owner of leading middle-market branded consumer and industrial businesses, released its consolidated operating results for the fourth quarter and full year of 2023 through an 8-K filing. CODI's portfolio includes branded consumer businesses like 5.11, Ergobaby, Liberty Safe, and Velocity Outdoor, as well as niche industrial businesses such as Advanced Circuits, Arnold, Foam Fabricators, and Sterno.

Financial Performance and Strategic Moves

CODI's fourth quarter results exceeded expectations, with CEO Elias Sabo attributing the strong financial performance to the company's premium businesses and defensible competitive moats. The company's diversified business model has proven resilient amidst economic uncertainty, with optimism for strong shareholder returns in the coming year.

The company's financial achievements are particularly noteworthy given the challenges faced by many businesses during the period. The significant gains from the sale of Marucci Sports and Advanced Circuits underscore CODI's strategic prowess in asset disposition, contributing to a substantial increase in net income. These divestitures, along with the acquisition of The Honey Pot Company, highlight CODI's active management of its portfolio and its ability to capitalize on market opportunities.

Key Financial Metrics

Compass Diversified Holdings reported a 7% increase in net sales for the fourth quarter, reaching $567.0 million, and a 2% increase for the full year, totaling $2.1 billion. The branded consumer segment saw a 13% increase in Q4 net sales, while the industrial segment experienced a slight decline. Notably, the company's net income for the fourth quarter was $139.4 million, compared to $8.7 million in the same period last year, largely due to gains from asset sales. The full-year net income also saw a significant rise to $262.4 million from $51.4 million in the previous year.

Adjusted EBITDA, a key metric for evaluating a company's operating performance, increased by 35% in the fourth quarter to $94.8 million and by 11% for the full year to $340.9 million. These figures reflect the strong results from CODI's subsidiaries, particularly Lugano Diamonds.

"Our differentiated competitive advantage of a permanent capital structure and a lower cost of capital enabled our opportunistic sale of Marucci Sports in November and our acquisition of The Honey Pot Company in early 2024," said Elias Sabo, CEO of Compass Diversified.

As of December 31, 2023, CODI had approximately $450.5 million in cash and cash equivalents, with a net borrowing availability of approximately $598 million under its revolving credit facility, indicating a strong liquidity position.

Looking Ahead

For the full year 2024, CODI expects consolidated Subsidiary Adjusted EBITDA to be between $480 million and $520 million, reflecting the addition of The Honey Pot Company and the company's confidence in its current subsidiaries. This guidance excludes corporate expenses such as interest expense, management fees paid by CODI, and corporate overhead.

The company's strategy of owning and managing a diverse set of highly defensible, middle-market businesses has consistently generated strong returns. CODI's approach to providing both debt and equity capital for its subsidiaries contributes to their financial and operating flexibility, fostering long-term growth and value creation.

Investors and stakeholders can look forward to a conference call hosted by management to discuss these results and corporate developments, providing further insights into CODI's performance and strategic direction.

For a more detailed analysis of Compass Diversified Holdings' financial results and strategic initiatives, readers are encouraged to visit GuruFocus.com for comprehensive coverage and expert commentary.

Explore the complete 8-K earnings release (here) from Compass Diversified Holdings for further details.

This article first appeared on GuruFocus.