Compass Minerals (CMP) Earnings and Sales Lag Estimates in Q4

Compass Minerals International, Inc. CMP recorded a loss of 6 cents per share in fourth-quarter fiscal 2023 (ended Sep 30, 2023), compared with a loss of 22 cents per share in the year-ago quarter. It missed the Zacks Consensus Estimate of earnings of 14 cents.

Sales fell around 6% year over year to $233.6 million in the quarter. The figure lagged the Zacks Consensus Estimate of $234.8 million. The results mainly reflect weaker Plant Nutrition segment sales offset by improved profitability in the salt business.

Compass Minerals International, Inc. Price, Consensus and EPS Surprise

Compass Minerals International, Inc. price-consensus-eps-surprise-chart | Compass Minerals International, Inc. Quote

Segment Highlights

Sales from the Salt segment fell 1% year over year to $186.7 million in the reported quarter. The figure was above the consensus estimate of $183 million. Higher prices were offset by lower total sales volumes. Volumes fell across the highway deicing and consumer and industrial salt businesses.

The Plant Nutrition segment raked in revenues of $35.3 million in the quarter, down 39% year over year. It was above the consensus estimate of $30.7 million. Sales were hurt by lower prices and sales volumes. Prices fell due to the decline in global fertilizer prices.

FY23 Results

Earnings for fiscal 2023 were 37 cents per share, compared with a loss of 74 cents a year ago. Revenues were $1.2 billion for the full year, down around 3% year over year.

Financials

At the end of fiscal 2023, the company had cash and cash equivalents of $38.7 million, down around 16% year over year. Long-term debt was $800.3 million, down roughly 15% year over year.

Net cash provided by operating activities was $101.1 million for fiscal 2023 compared with net cash provided by operating activities of $120.5 million in fiscal 2022.

Outlook

For fiscal 2024, the company sees salt sales volumes to increase 3-5% factoring in average winter weather despite lower committed volumes. It expects lower profitability in the Plant Nutrition unit on a year-over-year basis due to reduced sulfate of potash pricing notwithstanding a strong rebound in sales volumes. CMP envisions Plant Nutrition sales volumes to rise meaningfully in fiscal 2024 as demand in California reverts to normal levels.

Total capital expenditures for fiscal 2024 are projected to be in the range of $125-$140 million.

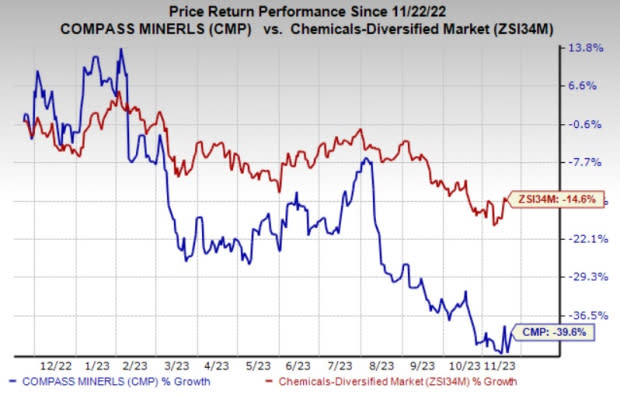

Price Performance

Shares of Compass Minerals are down 39.6% in the past year compared with the 14.6% decline of the industry.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

CMP currently has a Zacks Rank #4 (Sell).

Better-ranked stocks worth a look in the basic materials space include Denison Mines Corp. DNN, Axalta Coating Systems Ltd. AXTA and The Andersons Inc. ANDE.

Denison Mines has a projected earnings growth rate of 100% for the current year. DNN has a trailing four-quarter earnings surprise of roughly 225%, on average. The stock is up around 51% in a year. It currently carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, the Zacks Consensus Estimate for Axalta Coating Systems’ current year has been revised upward by 8.2%. AXTA, carrying a Zacks Rank #1, beat the Zacks Consensus Estimate in three of the last four quarters while missing in one quarter, with the average earnings surprise being 6.7%. The company’s shares have gained 18% in the past year.

Andersons currently carries a Zacks Rank #2 (Buy). The Zacks Consensus Estimate for ANDE's current-year earnings has been revised 8.6% upward over the past 60 days. Andersons beat the Zacks Consensus Estimate in three of the last four quarters. It delivered a trailing four-quarter earnings surprise of 32.8%, on average. ANDE shares have rallied around 35% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Andersons, Inc. (ANDE) : Free Stock Analysis Report

Denison Mine Corp (DNN) : Free Stock Analysis Report

Compass Minerals International, Inc. (CMP) : Free Stock Analysis Report

Axalta Coating Systems Ltd. (AXTA) : Free Stock Analysis Report