CompoSecure Inc (CMPO) Reports Strong Q4 and Full Year 2023 Results; Announces Share Repurchase ...

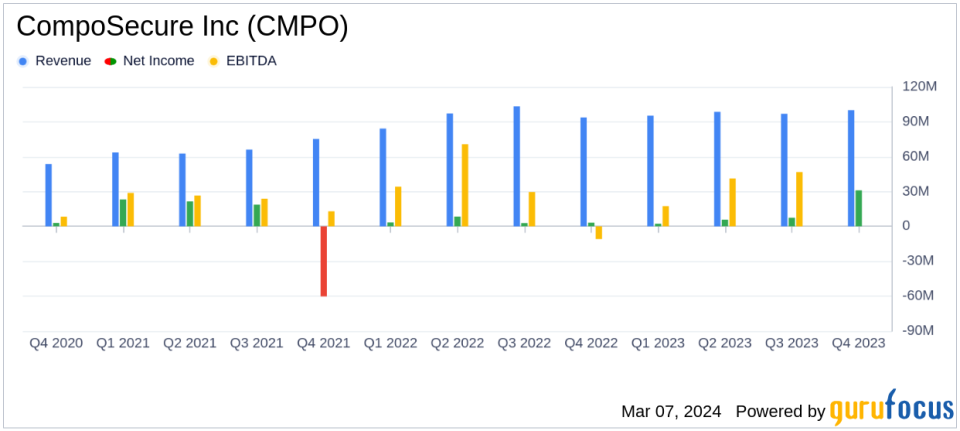

Q4 Net Sales: Increased by 7% to $100 million.

Q4 Net Income: Grew by 39% to $31 million.

Q4 Adjusted EBITDA: Rose by 22% to $37 million.

2024 Guidance: Net Sales projected between $408-$428 million; Adjusted EBITDA forecasted between $147-$157 million.

Share Repurchase Program: Up to $40 million approved, effective March 7, 2024, through March 7, 2027.

On March 6, 2024, CompoSecure Inc (NASDAQ:CMPO), a leader in premium financial cards and security solutions, released its 8-K filing, announcing robust financial results for the fourth quarter and the full year of 2023. The company reported a 7% increase in Q4 net sales, amounting to $100 million, and a significant 39% rise in Q4 net income, reaching $31 million. Adjusted EBITDA for the quarter also saw a 22% increase to $37 million.

CompoSecure Inc is renowned for its innovative metal payment card technology and Arculus security platform, which provide secure and premium branded experiences for financial transactions. The company's strong Q4 performance was driven by sustained demand for its products in the U.S. market, leading to a record quarter with a 9% increase in annual domestic net sales.

Financial Performance and Strategic Initiatives

President and CEO Jon Wilk expressed satisfaction with the company's performance, which aligned with the original guidance from March 2023. He highlighted the company's consistent delivery of profitable growth and maintained leadership in the global metal payment card market. To further enhance shareholder value, the board has approved a repurchase program for up to $40 million of the company's securities, reflecting confidence in the company's financial strength and market valuation.

Looking forward to 2024, CompoSecure anticipates another record year, with net sales expected to range between $408-$428 million and adjusted EBITDA projected between $147-$157 million. The company's strategic approach to capital allocation focuses on driving organic growth, reducing debt, and now includes the flexibility to repurchase securities, among other opportunities to deliver shareholder value.

Financial Statements Highlights

The company's balance sheet shows a healthy liquidity position with cash and cash equivalents of $41.2 million as of December 31, 2023, a significant increase from $13.6 million the previous year. Total assets stood at $201 million, while the company managed to reduce its total stockholders' deficit from $(292) million to $(206) million year-over-year.

CompoSecure's income statement reflects the strong sales performance, with a total net income of $31 million for Q4 and $112.5 million for the full year. The company's operational efficiency is evident in the increase in income from operations, which rose to $30.5 million in Q4 and $119.1 million for the full year.

The cash flow statement further underscores the company's solid financial management, with net cash provided by operating activities totaling $104.3 million for the year, an increase from $92.8 million in the previous year.

In summary, CompoSecure Inc (NASDAQ:CMPO) has demonstrated a robust financial performance in Q4 and throughout 2023, with significant growth in net sales and net income. The company's strategic initiatives, including the newly announced share repurchase program, are set to enhance shareholder value and position the company for continued success in the coming year.

For a more detailed analysis and to stay updated on CompoSecure Inc's financial journey, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from CompoSecure Inc for further details.

This article first appeared on GuruFocus.