A Comprehensive GF Score Analysis of Avery Dennison Corp (AVY)

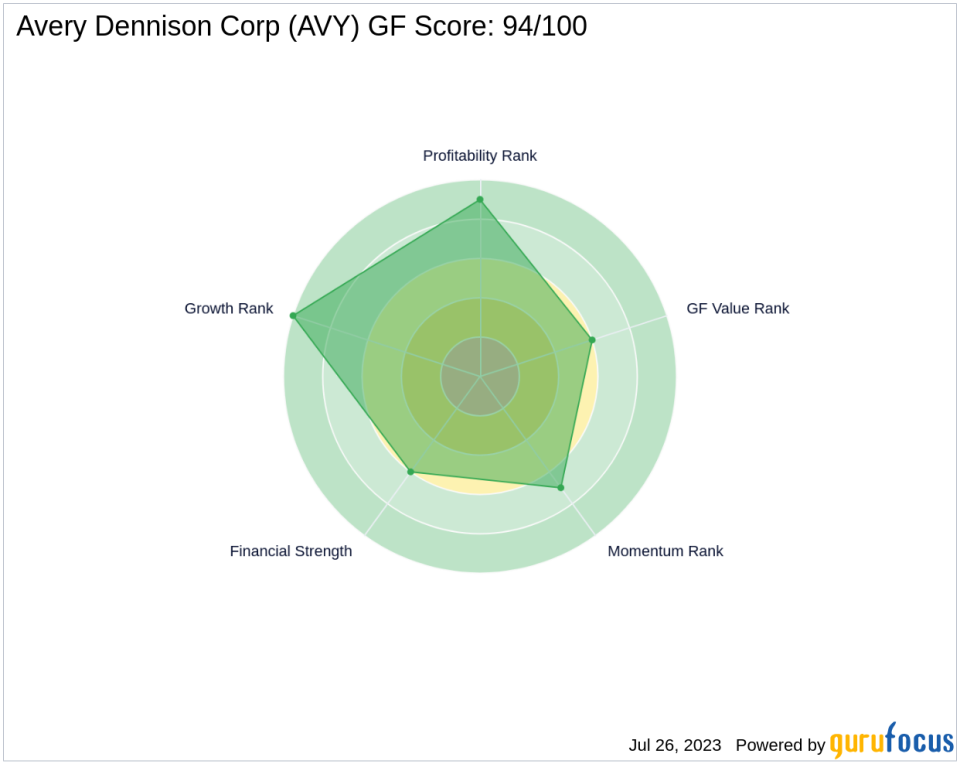

Avery Dennison Corp (NYSE:AVY), a prominent player in the Packaging & Containers industry, is currently trading at $180.2 with a market capitalization of $14.55 billion. The stock has seen a gain of 3.17% today and a 5.92% increase over the past four weeks. In this article, we will delve into the company's GF Score of 94/100, a comprehensive stock performance ranking system developed by GuruFocus. The GF Score evaluates a company's valuation across five key aspects, with a higher score indicating a higher potential for returns.

Financial Strength Analysis

The Financial Strength rank of Avery Dennison Corp stands at 6/10. This metric evaluates the robustness of a company's financial situation, considering factors such as its debt burden, debt to revenue ratio, and Altman Z-Score. Avery Dennison Corp's interest coverage is 9.00, indicating a manageable debt burden. The company's debt to revenue ratio is 0.41, suggesting a healthy financial structure. Furthermore, its Altman Z score of 3.65 indicates a low risk of bankruptcy.

Profitability Rank Analysis

Avery Dennison Corp's Profitability Rank is an impressive 9/10. This rank assesses a company's profitability and its likelihood of maintaining it. The company's Operating Margin is 11.36%, and its Piotroski F-Score is 6, indicating a healthy financial situation. The company has also demonstrated consistent profitability over the past 10 years.

Growth Rank Analysis

The company's Growth Rank is a perfect 10/10, reflecting strong revenue and profitability growth. The 5-year revenue growth rate is 7.90, and the 3-year revenue growth rate is 9.80, indicating a consistent upward trend. The 5-year EBITDA growth rate is an impressive 16.50, further demonstrating the company's robust growth.

GF Value Rank Analysis

The GF Value Rank of Avery Dennison Corp is 6/10. This rank is determined by the price-to-GF-Value ratio, a proprietary metric calculated based on historical multiples and an adjustment factor based on a company's past returns and growth and future estimates of the business' performance.

Momentum Rank Analysis

The company's Momentum Rank is 7/10, indicating a positive momentum in its stock price. This rank is determined using the standardized momentum ratio and other momentum indicators.

Competitor Analysis

When compared to its main competitors, Avery Dennison Corp holds a strong position. Amcor PLC (NYSE:AMCR) has a GF Score of 78, Packaging Corp of America (NYSE:PKG) has a GF Score of 86, and International Paper Co (NYSE:IP) has a GF Score of 75. Avery Dennison Corp's GF Score of 94 outperforms all these competitors, indicating its strong potential for returns.

Conclusion

In conclusion, Avery Dennison Corp's overall GF Score of 94/100 suggests a high potential for outperformance. With strong financial strength, impressive profitability, robust growth, fair value, and positive momentum, the company presents an attractive investment opportunity. However, as with any investment, potential investors should conduct their own due diligence before making a decision.

This article first appeared on GuruFocus.