A Comprehensive Look at Sarepta's Growth and Innovation

Sarepta Therapeutics, Inc. (NASDAQ:SRPT) is an American pharmaceutical company leading the global Duchenne muscular dystrophy, or DMD, treatment market.

The company has an extensive portfolio of commercial products that remain leaders in the Duchenne muscular dystrophy market and is also developing best-in-class drugs for the treatment of a variety of neuromuscular disorders.

As a result, this allows Sarepta not to depend on sales from a single medicine, thereby more flexibly using its free cash flow for research and development expenses, and also reduces the financial risks associated with possible changes in the regulation of the pharmaceutical industry.

On Feb. 28, the company published financial results for 2023, demonstrating to financial market participants that business strategies and financial resources spent on business development are beginning to bear fruit.

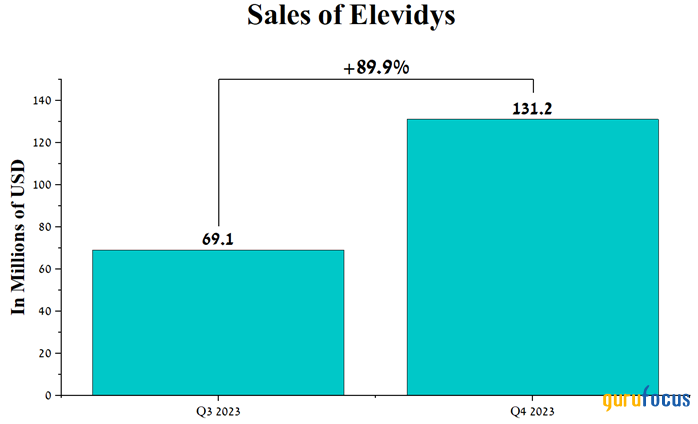

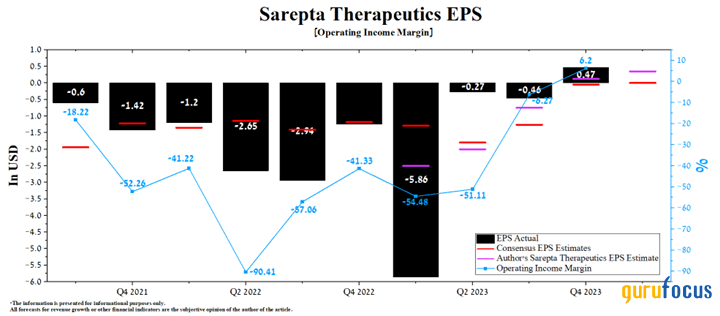

Its earnings per share for the fourth quarter were 47 cents, an increase of $1.71 year over year, mainly due to Elevidys. Elevidys (delandistrogene moxeparvovec-rokl) is the first gene therapy approved by regulatory authorities for the treatment of patients with Duchenne muscular dystrophy.

Its sales were $131.20 million for the three months ended Dec. 31, up 89.90% quarter over quarter due to geographic expansion, new patient growth in the United States and continued extremely strong demand from physicians and organizations.

Source: Author's elaboration, based on quarterly securities reports.

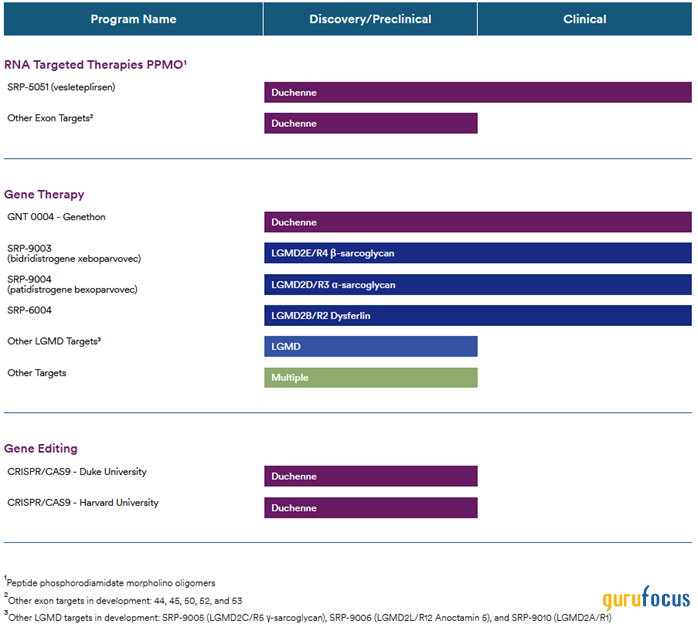

Another investment thesis we highlight is Sarepta Therapeutics' pipeline of product candidates, the effectiveness and safety profile of which has been assessed in numerous clinical studies. The company is focused on bringing to market genetic therapies to combat diseases for which there are no effective treatments.

Source: Sarepta Therapeutics

An additional investment thesis is that since the launch of Elevidys, the company has begun to generate a positive operating profit income margin for the first time, which amounted to 6.20% for the fourth quarter of 2023, outperforming its key health care competitors, such as PTC Therapeutics (NASDAQ:PTCT), REGENXBIO (RGNX) and Dyne Therapeutics (DYN).

Source: Author's elaboration, based on GuruFocus data.

As such, we initiate our coverage of Sarepta Therapeutics with an outperform rating for the next 12 months.

Financial position and outlook

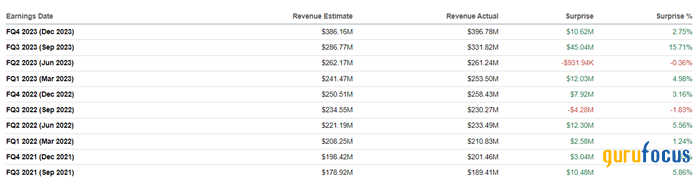

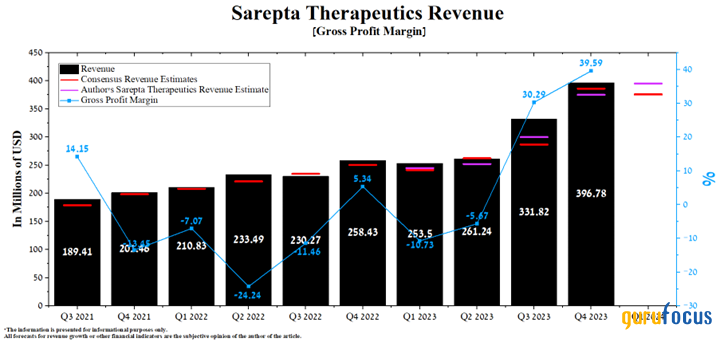

Sarepta's revenue for the fourth quarter of 2023 was $396.80 million, exceeding our expectations by about $21.80 million and, just as importantly, up 53.50% year over year.

Moreover, the company's actual revenue beat analysts' consensus estimates in nine of the last 10 quarters, indicating that investors and traders continue to underestimate the growth prospects of a leader in the global DMD therapeutics market.

Source: Author's elaboration, based on analyst projections.

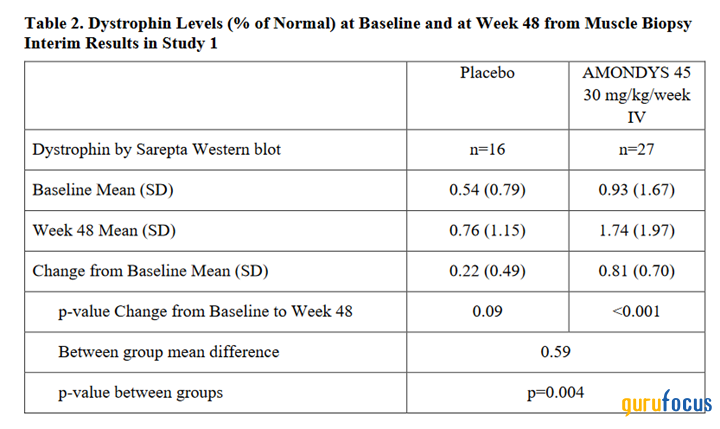

Besides Elevidys, another key contributor to Sarepta's improved financial position is Amondys 45 (casimersen), which has been approved by regulators to treat patients with DMD who have the genetic mutation amenable to exon 45 skipping.

Amondys 45's mechanism of action is based on its binding to exon 45 of the DMD gene pre-mRNA, which helps prevent its inclusion in mature mRNA before translation. Ultimately, this leads to a slowdown in the progression of Duchenne muscular dystrophy due to the beginning of the production of significantly more functional dystrophin protein, which is also responsible for maintaining the structural integrity of muscle fibers.

Source: U.S. Food and Drug Administration

Sales of Amondys 45 totaled $69.90 million for the three months ended Dec. 31, an increase of 13.80% compared to the fourth quarter of 2022, driven by new patients and expansion of the geography of its use.

Source: Author's elaboration, based on quarterly securities reports.

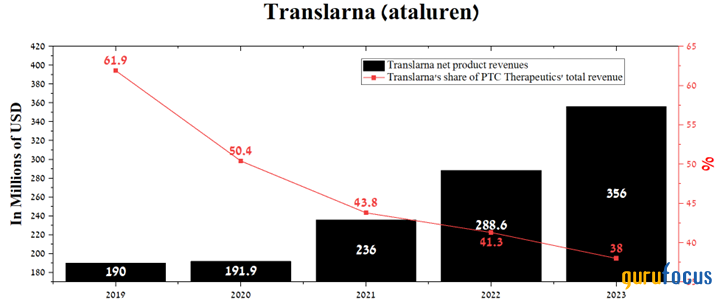

From the second quarter of 2024, we expect the growth rate of sales of this medicine to increase following the decision by the European Medicines Agency's CHMP in September 2023 not to convert Translarna's conditional marketing authorization to the marketing authorization, which ultimately led to the withdrawal of PTC Therapeutics' flagship product from the European market at the end of January.

Source: Author's elaboration, based on quarterly securities reports.

Sarepta Therapeutics is expected to release financial results for the first quarter of 2024 on May 3. According to analysts, its revenue is anticipated to be in the range of $299.50 million to $403.85 million, up 48.20% year over year.

Source: Author's elaboration, based on GuruFocus data.

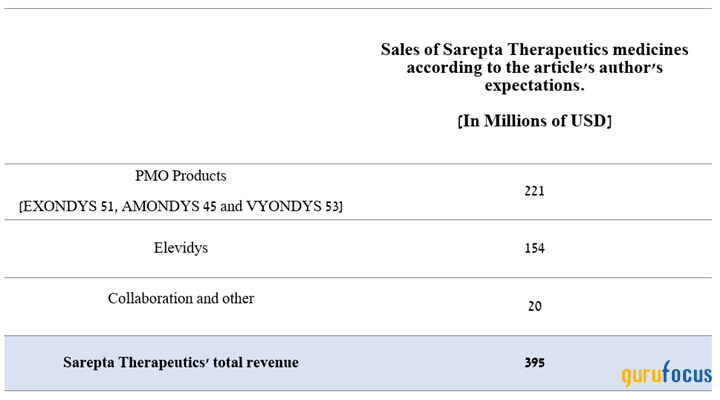

Our model projects Sarepta's total revenue to reach $395 million in the first three months of 2024, about $19.30 million above the median of the above range, primarily due to higher Elevidys sales as well as stabilizing demand for Exondys 51.

Source: Created by author.

The company's operating income margin was 6.20% for the fourth quarter, a sharp increase from previous quarters.

According to our assessment, the positive trend toward improving this financial metric will continue in the next two years, mainly due to the emergence of Elevidys as the "gold standard" in the treatment of DMD, an increase in total sales of PMO products, optimization of administrative expenses as well as the expected reduction in the cost of raw materials necessary for the production of its medications. As a result, we expect Sarepta's operating income margin to reach 12.10% in 2024 and increase to 18.50% by 2025.

Analysts project the company's earnings per share in the first quarter to be between a loss of 64 cents and 63 cents, a significant increase compared to the previous year.

However, we expect this key figure to be 36 cents higher than the median of this range and reach 35 cents due to the withdrawal of PTC Therapeutics' Translarna from the European market, as well as more optimistic expectations regarding the commercial potential of Sarepta's FDA-approved drugs to treat Duchenne muscular dystrophy.

Source: Author's elaboration, based on GuruFocus data.

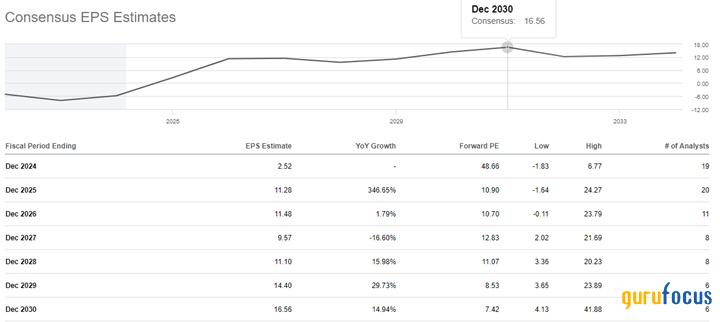

The trailing 12-month non-GAAP price-earnings ratio remains negative because the company has only posted positive net income since the fourth quarter of 2023. This could discourage conservative investors from considering the company as a long-term investment.

However, Sarepta Therapeutics is a growth stock, posting extremely strong operating profit and revenue growth rates, and has an extensive pipeline of experimental drugs that have the potential to become the best treatments for Limb-girdle muscular dystrophy, Charcot-Marie-Tooth disease and other central nervous system diseases.

On a more global scale, Sarepta's price-earnings ratio is expected to fall from a high of 48.66 to around 10 by 2025, which will ultimately be reflected in an increase in GF Value. The GF Value is a highly effective and helpful development by GuruFocus and demonstrates the intrinsic value of a stock.

Source: GuruFocus data

The expected growth rate of the company's net income is impressive, which, in our opinion, is one of the key factors that will interest financial market participants in considering Sarepta as a long-term investment.

Source: Author's elaboration, based on analyst projections.

Conclusion

Crucial risks that could negatively impact Sarepta's investment attractiveness include its significant dependence on the commercial success of its PMO products and potential failures in the development of its product candidates targeting the treatment of limb-girdle muscular dystrophy.

However, despite these financial risks, after PTC Therapeutics' Translarna was withdrawn from the market, the company strengthened its position in the Duchenne muscular dystrophy treatment market, and also thanks to the launch of Elevidys in the second half of 2023, the growth rate of operating and gross profit margins accelerated, which allows it to increase investments in development of its preclinical candidates.

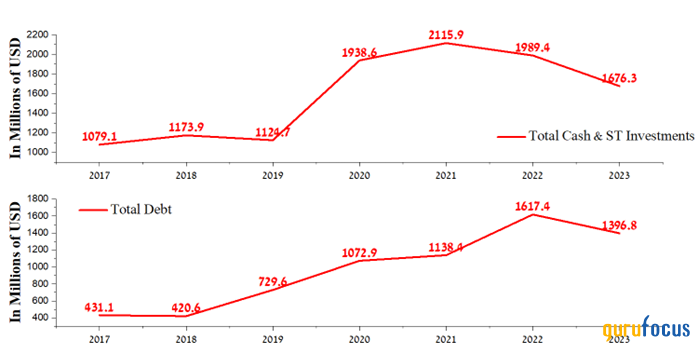

Sarepta also has total cash and short-term investments that exceed its total debt, thereby strengthening its financial position and resilience in the face of market fluctuations in the run-up to the U.S. presidential election.

Source: Author's elaboration, based on GuruFocus data.

We initiate our coverage of Sarepta Therapeutics with an outperform rating for the next 12 months.

This article first appeared on GuruFocus.