Comstock (LODE) Executes First Commercial Biorefinery Deal

Comstock Mining LODE announced the execution of agreements with RenFuel K2B AB to progress LODE's first commercial biorefinery, which includes an option to buy a RenFuel subsidiary ("JV").

The company has also committed to a $3 million strategic investment in RenFuel over the next three years. This move will aid in the further development and commercialization of advanced uses of complementary technology from RenFuel and Comstock.

The JV has previously completed extensive preliminary engineering for a new biorefinery in Europe. It refines lignin from byproducts of paper production into a biointermediate for refining into sustainable aviation fuel and renewable diesel using RenFuel's patented catalytic esterification process.

RenFuel develops solutions that help reduce carbon emissions and promote circularity by effectively converting underutilized biomass waste and leftovers into renewable fuels and materials. RenFuel provided Comstock the right to buy a majority stake in the JV as part of the consideration paid under its investment.

The JV biorefinery’s existing engineering work includes the integration of the RenFuel process into a pulp and paper mill in Sweden. LODE and RenFuel are now assessing the requirement for an additional 25,000 TPY of biorefining capacity based on Comstock's commercially available Cellulosic Ethanol and Bioleum-derived fuels technology.

The JV will enable both firms to capitalize on existing TRL 7 scale-up work and boost the development of an initial small-scale facility based on Comstock's technologies. The resulting integrated site would be the first Bioleum Hubs for LODE, as well as a catalyst in the rapidly increasing European renewable fuels market.

In the third quarter of 2023, LODE reported adjusted earnings of 11 cents per share, beating the Zacks Consensus Estimates of 2 cents. The company posted an adjusted loss of 7 cents in the third quarter of 2022. The company reported net sales of $1 million, in line with the Zacks Consensus Estimate.

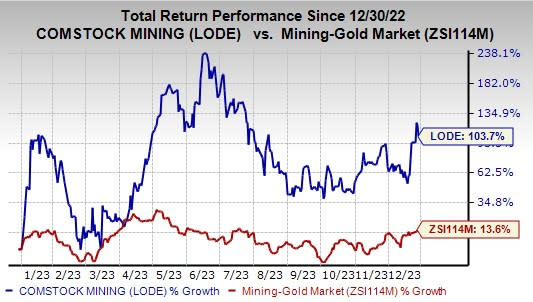

Price Performance

Shares of Comstock have rallied 103.7% in the past year compared with the industry’s growth of 13.6%.

Image Source: Zacks Investment Research

Zacks Rank & Other Stocks to Consider

Comstock currently sports a Zacks Rank #1 (Strong Buy).

Some other top-ranked stocks from the basic materials space are Axalta Coating Systems Ltd. AXTA, Universal Stainless & Alloy Products, Inc. USAP and Hawkins, Inc. HWKN. While AXTA sports a Zacks Rank #1, USAP and HWKN carry a Zacks Rank #2 (Buy) each at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Axalta Coating’s 2023 earnings is pegged at 44 cents per share. The consensus estimate for 2023 earnings has moved 23% north in the past 60 days. AXTA shares have gained 31% in a year.

Universal Stainless & Alloy Products has an average trailing four-quarter earnings surprise of 44.4%. The Zacks Consensus Estimate for USAP’s 2023 earnings is pegged at 27 cents per share. Earnings estimates have been unchanged in the past 60 days. USAP shares rallied 137% last year.

The consensus estimate for Hawkins’ current fiscal year’s earnings is pegged at $3.46 per share, indicating a year-over-year rise of 20.9%. HWKN has a trailing four-quarter average surprise of 27.4%. The company’s shares have surged 83.5% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Universal Stainless & Alloy Products, Inc. (USAP) : Free Stock Analysis Report

Axalta Coating Systems Ltd. (AXTA) : Free Stock Analysis Report

Comstock Inc. (LODE) : Free Stock Analysis Report

Hawkins, Inc. (HWKN) : Free Stock Analysis Report