Comstock Resources Inc (CRK) Navigates Challenging Market with Solid Drilling Results and ...

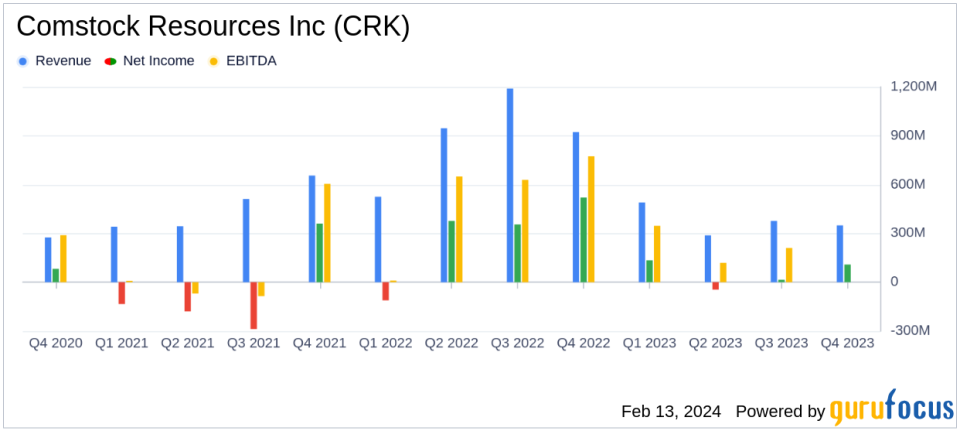

Revenue: Q4 natural gas and oil sales totaled $353.5 million, including realized hedging gains.

Net Income: Q4 net income available to common stockholders was $108.4 million, or $0.39 per share.

Adjusted EBITDAX: Q4 adjusted EBITDAX reached $244 million.

Production Costs: Q4 production cost per Mcfe averaged $0.81, with an unhedged operating margin of 67%.

Drilling Results: 22 operated wells turned to sales in Q4 with an average initial production rate of 24 MMcf per day.

Reserves: Year-end proved reserves estimated at 4.9 Tcfe, down from 6.7 Tcfe the previous year due to lower natural gas prices.

2024 Budget: Plans to reduce operating drilling rigs from seven to five and suspend quarterly dividend amid weak natural gas prices.

On February 13, 2024, Comstock Resources Inc (NYSE:CRK) released its 8-K filing, detailing the financial and operating results for the fourth quarter and full year ended December 31, 2023. The independent energy company, focused on the Haynesville shale, faced headwinds due to continued weak natural gas prices, which heavily influenced the fourth quarter's financial outcomes.

Despite the challenging market conditions, Comstock reported solid results from its Haynesville shale drilling program, turning 22 operated wells to sales with robust initial production rates. The company also expanded its footprint in the Western Haynesville, adding 23,000 net acres, bringing its total acreage in the play to over 250,000 net acres.

Financial Performance and Challenges

Comstock's fourth-quarter revenue from natural gas and oil sales, including realized hedging gains, amounted to $354 million. The adjusted EBITDAX for the quarter stood at $244 million, with operating cash flow reaching $207 million or $0.75 per share. However, the company's net income was significantly impacted by an unrealized gain of $107.3 million on hedging contracts, which, when excluded, resulted in an adjusted net income of $27.9 million or $0.10 per share.

The company's production cost per Mcfe for the quarter averaged $0.81, with unhedged and hedged operating margins of 67% and 68%, respectively. These metrics are crucial as they reflect the company's efficiency and ability to manage costs in a volatile price environment, which is particularly important for energy companies like Comstock that are subject to commodity price fluctuations.

Annual Overview and Reserve Estimates

For the year ended December 31, 2023, Comstock's natural gas and oil sales totaled $1.3 billion, with operating cash flow of $774.5 million and net income available to common stockholders of $211.9 million or $0.76 per share. The company's proved natural gas and oil reserves were estimated at 4.9 Tcfe, a decrease from the previous year's 6.7 Tcfe, primarily due to lower natural gas prices used in the determination.

The company's drilling activities in 2023 were robust, drilling 67 operated horizontal Haynesville/Bossier shale wells with an average lateral length of 10,796 feet and turning 74 operated wells to sales with an average initial production rate of 25 MMcf per day.

Strategic Adjustments for 2024

In response to the weak natural gas prices, Comstock plans to suspend its quarterly dividend and reduce the number of operating drilling rigs from seven to five. The company has outlined a budget of approximately $750 million to $850 million for 2024, focusing on drilling 46 operated horizontal wells and turning 44 operated wells to sales. Additionally, Comstock expects to invest $125 million to $150 million in its Western Haynesville midstream system, funded by its midstream partnership.

The company's strategic adjustments aim to maintain financial discipline while continuing to invest in high-return projects, even as it navigates the challenges posed by the current market dynamics.

Comstock Resources Inc's resilience in the face of market adversity and its strategic focus on cost management and operational efficiency are key takeaways for investors. The company's ability to adapt to changing market conditions while delivering solid drilling results is indicative of its commitment to creating value for its shareholders.

For more detailed information, investors are encouraged to review the full 8-K filing and participate in the upcoming conference call scheduled for February 14, 2024, to discuss the fourth quarter and full-year operational and financial results.

Explore the complete 8-K earnings release (here) from Comstock Resources Inc for further details.

This article first appeared on GuruFocus.