Comtech (CMTL) Secures Contract Worth $544M From U.S. Army

Comtech Telecommunications Corp CMTL recently secured a notable contract from the U.S. Army valued at up to $544 million. The contract involves providing professional engineering services and supporting Comtech's satellite and terrestrial networking communication technologies for the Project Manager Tactical Network within the Global Field Service Representative program.

The contract will ensure ongoing communication and IT infrastructure support for various military branches, which will help to enhance their connectivity for global operations across different environments.

The contract falls under Comtech's existing agreement with the U.S. Army, which utilizes the extensive Global Tactical Communications Systems II contract, emphasizing tactical satellite communications. Comtech's defense portfolio aims to enhance Combined Joint All Domain Command and Control operations to meet future mission needs.

Comtech Telecommunications Corp. Price and Consensus

Comtech Telecommunications Corp. price-consensus-chart | Comtech Telecommunications Corp. Quote

Comtech offers terrestrial and wireless network solutions, next-generation emergency services, satellite and space communications technologies and cloud-native solutions to commercial and government customers worldwide. The company continues to provide market-leading products for messaging, location and deployable wireless communications. It offers services to integrate networks, servers, gateways and intelligent peripherals and provides transmission responses to users.

In October, the company was awarded a contract worth $48.6 million to deliver Enterprise Digital Intermediate Frequency Multi-Carrier modems to support the U.S. Army satellite communications digitization and modernization programs.

The Federal government has been working tirelessly to increase its cyber workforce to protect national security in light of the exponential development of cyber breach occurrences. Hence, the latest contract renewal will reinforce Comtech and the Federal government’s longstanding relationship, delivering cybersecurity operation training needed by Federal government customers.

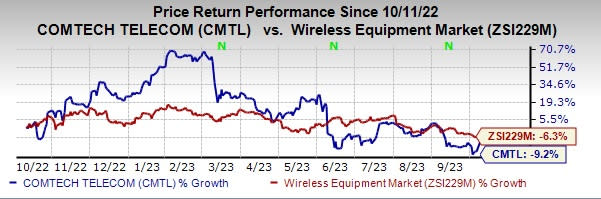

Comtech currently has a Zacks Rank #3 (Hold). The stock has lost 9.2% in the past year compared with the sub-industry’s decline of 6.3%.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks in the broader technology space are Asure Software ASUR, Woodward WWD and Watts Water Technologies WTS. Asure Software currently sports a Zacks Rank #1 (Strong Buy), whereas Woodward and Watts Water Technologies carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Asure Software’s 2023 earnings per share (EPS) has increased 35% in the past 60 days to 54 cents.

Asure Software’s earnings beat the Zacks Consensus Estimate in all the last four quarters, the average being 676.4%. Shares of ASUR have surged 68.4% in the past year.

The Zacks Consensus Estimate for Woodward’s fiscal 2023 EPS has increased 5.6% in the past 60 days to $4.15.

WWD’s long-term earnings growth rate is 18.8%. Shares of WWD have gained 42.1% in the past year.

The Zacks Consensus Estimate for Watts Water’s 2023 EPS has increased 4.8% in the past 60 days to $7.78. The company’s long-term earnings growth rate is 7.5%.

Watts Water’s earnings beat estimates in all the trailing four quarters, delivering an average surprise of 12.5%. Shares of WTS have rallied 30% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Comtech Telecommunications Corp. (CMTL) : Free Stock Analysis Report

Asure Software Inc (ASUR) : Free Stock Analysis Report

Watts Water Technologies, Inc. (WTS) : Free Stock Analysis Report

Woodward, Inc. (WWD) : Free Stock Analysis Report