Conagra Brands (CAG) Q2 Earnings Coming Up: Factors to Note

Conagra Brands, Inc. CAG is likely to register a top-line and bottom-line decline when it reports second-quarter fiscal 2024 earnings on Jan 4. The Zacks Consensus Estimate for revenues is pegged at $3.2 billion, suggesting a decrease of 2.2% from the prior-year quarter’s reported figure.

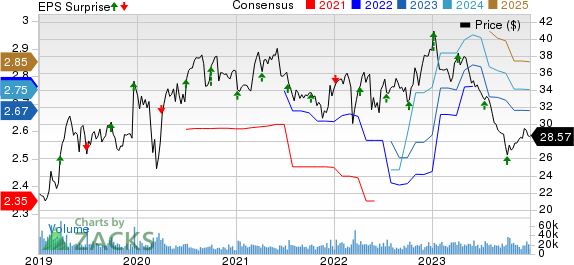

The consensus mark for quarterly earnings has remained unchanged in the past 30 days at 67 cents per share. This indicates a decline of 17.3% from the year-ago quarter’s reported figure. CAG has a trailing four-quarter earnings surprise of 13.7%, on average.

Factors to Consider

Conagra has been seeing soft volumes as a result of an industry-wide slowdown in consumption and the recent changes in consumer behavior. The inflationary landscape has been a drag on consumers’ pockets, leading them to look for budget-friendly alternatives and shift from big brands toward private-label companies. This trend has hampered the sales volume of several food manufacturers.

For the second quarter of fiscal 2024, Conagra’s organic net sales are anticipated to have declined in the low-single-digit range. Volumes are expected to have declined, though the trend is likely to have improved from the first quarter. Our model suggests volume declines of 3.6% for the second quarter of fiscal 2024.

Conagra Brands Price, Consensus and EPS Surprise

Conagra Brands price-consensus-eps-surprise-chart | Conagra Brands Quote

Conagra has been encountering cost inflation for a while now, though pressure has been easing of late. For the second quarter, management expects a sequential decline in the gross and operating margins resulting from escalated trade and A&P investments. Our model suggests an 8% rise in A&P expenses in the second quarter.

That being said, Conagra’s efficient pricing initiatives have been offering respite amid cost headwinds. We expect pricing to be up 3.2% in the second quarter. A focus on innovation, especially in the frozen and snacks categories, has been an upside. Growth in the frozen category reflects the strength of the company’s brands and the effective execution of the Conagra Way playbook.

Though the frozen business was hit by changing consumer behavior in the first quarter of fiscal 2024, it continued to see unit share gains in key categories like single-serve meals. Moving to snacks, the domain showed resilience in the first quarter despite macroeconomic headwinds. The continuation of these factors is likely to have aided in the quarter under review.

What the Zacks Model Unveils

Our proven model does not conclusively predict an earnings beat for Conagra Brands this time. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat, which is not the case here.

Conagra Brands has an Earnings ESP of +0.30%, but it carries a Zacks Rank #4 (Sell). You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks With the Favorable Combination

Here are three companies worth considering as our model shows that these have the correct combination to beat on earnings this time:

Colgate-Palmolive CL currently has an Earnings ESP of +2.12% and a Zacks Rank of 3. The company is likely to register top-line and bottom-line increases when it reports fourth-quarter 2023 numbers. The Zacks Consensus Estimate for Colgate’s quarterly revenues is pegged at $4.9 billion, indicating a rise of 5.3% from the figure reported in the prior-year quarter. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Colgate’s quarterly earnings of 85 cents suggests an increase of 10.4% from the year-ago quarter’s levels. CL has a trailing four-quarter earnings surprise of 3.6%, on average.

Mondelez International MDLZ currently has an Earnings ESP of +1.52% and a Zacks Rank #3. The company is likely to register top-and-bottom-line growth when it reports fourth-quarter 2023 numbers. The Zacks Consensus Estimate for Mondelez’s quarterly revenues is pegged at $9.2 billion, indicating a rise of roughly 6% from the figure reported in the prior-year quarter.

The Zacks Consensus Estimate for Mondelez’s quarterly earnings of 76 cents suggests an increase of 4.1% from the year-ago quarter’s levels. MDLZ has a trailing four-quarter earnings surprise of 7.3%, on average.

Philip Morris PM has an Earnings ESP of +9.88% and a Zacks Rank #3. The company is likely to witness top-and-bottom-line growth when it reports fourth-quarter 2023 results. The Zacks Consensus Estimate for Philip Morris’ quarterly revenues is pegged at $8.9 billion, which suggests a rise of 9.5% from the figure reported in the prior-year quarter.

The Zacks Consensus Estimate for Philip Morris’ quarterly EPS has remained unchanged in the past 30 days at $1.48, which suggests an increase of 6.5% from the year-ago quarter’s level. PM has a trailing four-quarter earnings surprise of 5.8%, on average.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Philip Morris International Inc. (PM) : Free Stock Analysis Report

Colgate-Palmolive Company (CL) : Free Stock Analysis Report

Conagra Brands (CAG) : Free Stock Analysis Report

Mondelez International, Inc. (MDLZ) : Free Stock Analysis Report