Conagra: Feeling Bullish Following Earnings and Dividend Boost

- By Nathan Parsh

Conagra Brands, Inc (NYSE:CAG) recently reported earnings results that easily topped what analysts had been looking for both on the top and bottom lines. The company also announced a dividend increase of almost 30%.

Better than expected earnings combined with an extremely high dividend yield make me very bullish on the company. Let's dig into the results to see why.

Warning! GuruFocus has detected 6 Warning Signs with CAG. Click here to check it out.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

Quarterly highlights

Conagra, which is the maker of brands such as Hunts, Birds Eye, Slim Jim and Vlasic pickles, announced earnings results for its first quarter of fiscal 2021 on Oct. 1 (the company's fiscal year ends May 31).

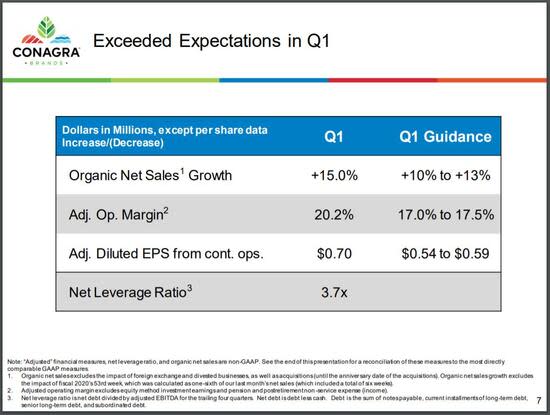

Source: Conagra's First Quarter Earnings Presentation, slide 7.

Revenue grew 12.1% year-over-year to $2.7 billion, which was $70 million more than Wall Street analysts had expected. Organic net sales were higher by 15%. Adjusted earnings per share improved 23 cents, or 49%, to 70 cents. This topped estimates by 13 cents.

EPS growth wasn't aided by share buybacks. In fact, the average share count ticked up 0.3% compared to the same quarter in the previous year.

Included in reported sales were several divestitures. Since the first quarter of the previous fiscal year, Conagra has divested its Direct Store Delivery snacks and Lender's Bagel businesses as well as exited a private label peanut butter business.

Each of Conagra's three retail division had at least double-digit increases in both sales and volumes. Consumers ate at home more often due to the pandemic. This trend has been seen in other consumer packaged foods companies. Organic growth consisted of a 10.9% increase in volumes and a 4.1% improvement in price and mix.

Grocery & Snacks grew 16% to $1.1 billion. While there was a slight headwind from divestitures, organic sales were up almost 21%. Volumes were up more than 17% and price and mix improved from the previous year. At-home eating and restocking from consumers greatly aided results, with Armour leading the pack at 18.8% growth. Wishbone sales improved 17% while Hunts climbed 14.7%.

Snacks as a group were up 14.6%. Meat snacks were extremely popular, growing more than 20%. This was mostly due to a top selling new meat snack, Slim Jim Savage Stick. Popcorn (up 19.5%) and Sweet Treats (up 15.4%) also were in high demand. Seeds were down 12%.

Refrigerated & Frozen sales were up 17.9%, with organic sales improving 19%. Volumes were higher by a low double-digit percentage and pricing added 6.2%. This segment has been a high growth machine for Conagra, as sales over the last three years have almost doubled.

Frozen single-serve meals grew almost 18% while frozen multi-serve meals were up more than 10%. Frozen vegetables were higher by less than 1%, a somewhat surprising occurrence given the popularity of frozen meals.

Frozen vegetables were up less than 1%, but demand was above what the company was able to produce due to a Birds Eye plant shutdown. Once resumed, shipments increased at a high rate. Birds Eye holds the top position in the frozen vegetables category and holds a staggering double the market share of its nearest competitor.

International was higher by 7.2% as currency exchange rates was a hefty headwind of 5.9% to revenue results. Organic volumes were up 10.5%. Each region saw an improvement in numbers.

The one segment of the company that was challenged was Foodservice, as investors should very much expect at this point. Sales fell almost 22%, the majority of which was due to a 24.2% decline in volumes. On the plus side, pricing and mix were a 3.9% tailwind to results.

Higher sales greatly benefited margins. Gross margins were up 245 basis points to 30.2% while the operating margin improved 800 basis points to 19%. Synergies from the Pinnacle Foods acquisition and improvements in supply chains were also a factor in the margin expansion. Selling, general and administrative expenses were down 25.1% to $300 million due to cost synergies with Pinnacle Foods and to elimination of business travel. Total cumulative synergies captured were $219 million through the end of the quarter. Conagra has a target for total synergies of $305 million by the end of next fiscal year.

Analysts expect Conagra to produce EPS of $2.39 in fiscal year 2021, which would be a 4.8% increase from fiscal year 2020.

The company did reaffirm its three-year guidance ending with fiscal 2022. Conagra expects to earn $2.66 to $2.76 next fiscal year.

Growth Prospects

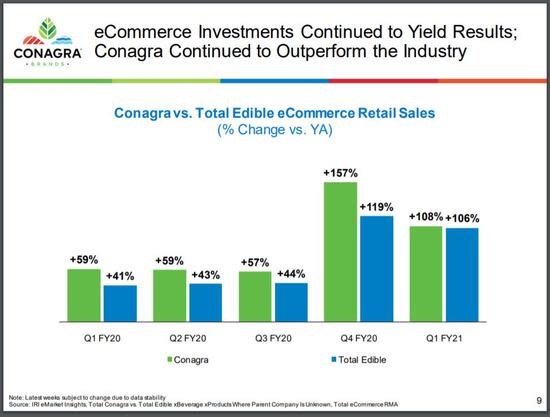

One area that Conagra has excelled at compared to the competition is the leveraging of e-commerce to boost revenue.

Source: Conagra's First Quarter Earnings Presentation, slide 9.

While the rest of the consumer-packaged food industry nearly caught the company in the most recent quarter, Conagra has outperformed its peers in the area of e-commerce. The company's two-year stacked growth rate for this channel is almost 170%.

Another area that Conagra has improved upon is the percentage of annual retail sales that come from new product launches. This percentage has increased from 9% in fiscal year 2015 to 17% in fiscal year 2020. Approximately 17% of sales in the most recent quarter were also from newly launched products, above Conagra's annual target of 15%. This speaks to the company's ability to bring new products to market and have them be in high demand with consumers.

This proved fruitful as Conagra saw an increase of new buyers across almost all age groups. The repeat customer rate of consumers whose first purchase was in either March or April was at least 53% in all rolling four-week periods during the quarter. Being able to match products with the changing consumer tastes is a point in Conagra's favor.

The company is also working to improve its balance sheet. Conagra has taken on a lot of debt in recent years to fund acquisitions, but has lowered its net debt by almost $2 billion over the last five quarters. The company ended the first quarter with a net leverage ratio of 3.7, which was down from 4.0 at the end of the previous quarter. The company has a net leverage ratio target of 3.5 to 3.6 by the third quarter of this fiscal year.

Lastly, Conagra's ability to take advantage of the eat at home trend paved the way for results. According to information from the company, an additional 6.9 billion meals were eaten at home in the quarter than the year before. The number of occurrences of dinner and lunch at home greatly increased. These meals are often more expensive and offer better margins. The sheer number of additional meals eaten at home during the first quarter helped Conagra grow at a faster rate than competitors in 72% of the product categories that the company has a presence.

Total return potential

With all these positives, it is not surprising that Conagra raised its dividend, something the company hasn't done since the third quarter of 2017. What was surprising was the sheer size of the raise. The dividend payment scheduled for Dec. 2 will be 29.4% higher than the dividend that was distributed in early September.

The new annualized dividend of $1.10 gives the stock a 3.1% dividend yield based off of Thursday's closing price of $35.87. Were the stock to average this yield for an entire year, it would be the highest average yield since 2014.

Based off of EPS expectations for this fiscal year and the current share price, shares of Conagra have a forward price-earnings ratio of 15. Conagra had an average price-earnings ratio of 16.2 over the last decade.

Due to recent results, multiple growth levers currently being pulled and the dividend increase, I believe that a price-earnings ratio target that is at least equal to the historical average is achievable.

Applying expected EPS to this target results in a share price of $38.72. This would be an 8% gain from the most recent closing price. Added to this return would be the stock's dividend yield, which at this price would be 2.8%.

Finally, leadership guided towards a midpoint of $2.70 of adjusted EPS next fiscal year. This would represent 13% growth from fiscal year 2021 estimates. Added up, shareholders of Conagra could see a total return of 23.8%.

Final thoughts

Conagra surpassed raised expectations and delivered a very strong quarter. All three of its retail segments had double-digit volume growth. Its foodservice business was weak, but that was to be expected given the trends related to Covid-19.

The company also has multiple ways to grow beyond just taking advantage of a pandemic that required consumers to eat more at home. This allowed the company to make its first dividend raise in several years, one that should make shareholders very happy.

This all adds up to a potential total return of almost 24% when combing multiple expansion, dividend yield and projected earnings growth. Investors looking for a consumer-packaged food company with tremendous upside should consider adding Conagra to their portfolio.

Author disclosure: the author has no position in any stocks mentioned in this article.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.