Concentrix Corp (CNXC) Reports Robust Revenue Growth Amidst Earnings Challenges

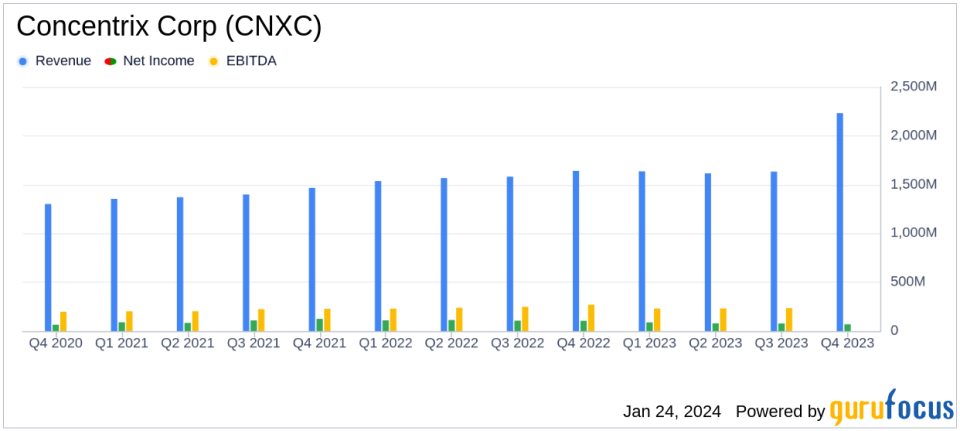

Revenue Growth: Q4 revenue surged by 36.0% year-over-year, and annual revenue grew by 12.5%.

Operating Income: Q4 operating income saw a slight increase of 1.3%, while annual operating income rose by 3.3%.

Net Income Decline: Q4 net income decreased by 33.7%, with an annual drop of 27.9%.

Earnings Per Share (EPS): Diluted EPS fell by 45.8% for Q4 and 31.2% for the full year.

Non-GAAP Measures: Non-GAAP operating income and adjusted EBITDA showed strong growth in Q4 and the full year.

Dividends and Share Repurchases: Concentrix paid and declared quarterly dividends and repurchased shares under its program.

On January 24, 2024, Concentrix Corp (NASDAQ:CNXC), a global leader in customer experience (CX) solutions and technology, released its 8-K filing, detailing the financial outcomes for the fiscal fourth quarter and the full year ended November 30, 2023. The company, known for its comprehensive customer engagement and management solutions, reported significant revenue growth, although net income and EPS faced declines.

Financial Performance Overview

Concentrix Corp (NASDAQ:CNXC) experienced a robust increase in revenue, with Q4 revenue rising to $2,230.8 million, a 36.0% increase from the previous year's quarter. The full year's revenue also saw an uptick, reaching $7,114.7 million, marking a 12.5% growth. This growth reflects the company's strong market position and the successful integration of Webhelp, which has contributed to both revenue and profit.

Operating income for Q4 was $180.4 million, a marginal increase from the $178.0 million reported in the same quarter of the previous year. The full year's operating income rose to $661.3 million, up 3.3% from the prior year. Non-GAAP operating income, which excludes certain expenses, stood at $340.8 million for Q4 and $1,010.0 million for the full year, indicating substantial growth of 37.4% and 14.2%, respectively.

Despite the revenue and operating income growth, net income for Q4 fell to $69.5 million, a 33.7% decrease year-over-year, and the full year net income also declined by 27.9% to $313.8 million. Diluted EPS followed suit, dropping by 45.8% for Q4 and 31.2% for the full year. However, non-GAAP net income and non-GAAP diluted EPS, which adjust for certain non-operational items, showed an increase, highlighting the company's underlying operational strength.

Balance Sheet and Cash Flow

Concentrix Corp (NASDAQ:CNXC) reported a strong balance sheet with total assets of $12,491.8 million as of November 30, 2023, compared to $6,669.8 million the previous year. The increase in assets is primarily due to the acquisition of Webhelp, which expanded the company's goodwill and intangible assets. Liabilities also increased, with long-term debt rising to $4,939.7 million, reflecting the financing of the acquisition.

Cash flow from operations remained robust at $678.0 million for the fiscal year, and free cash flow was reported at $497.5 million. These cash flow measures are inclusive of integration costs and are indicative of the company's ability to generate cash and maintain liquidity.

Dividends, Share Repurchases, and Outlook

Concentrix Corp (NASDAQ:CNXC) continues to return value to shareholders through dividends and share repurchases. The company paid a quarterly dividend of $0.3025 per share on November 7, 2023, and declared another dividend payable on February 15, 2024. Additionally, the company repurchased 0.3 million shares at an average cost of $79.29 per share under its share repurchase program.

Looking ahead, Concentrix Corp (NASDAQ:CNXC) provided its outlook for the first quarter and full year of fiscal 2024, expecting continued revenue growth and operational performance. The company's focus on integrating Webhelp and leveraging its global platform positions it for sustained growth and shareholder value creation.

Concentrix Corp (NASDAQ:CNXC) remains committed to delivering value to shareholders and is poised for success in 2024 with a strengthened foundation and sustained growth trajectory.

For a detailed analysis and more information on Concentrix Corp (NASDAQ:CNXC)'s financial results, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Concentrix Corp for further details.

This article first appeared on GuruFocus.