Concrete Pumping Holdings Inc (BBCP) Reports Solid Growth in Q4 and Fiscal Year 2023

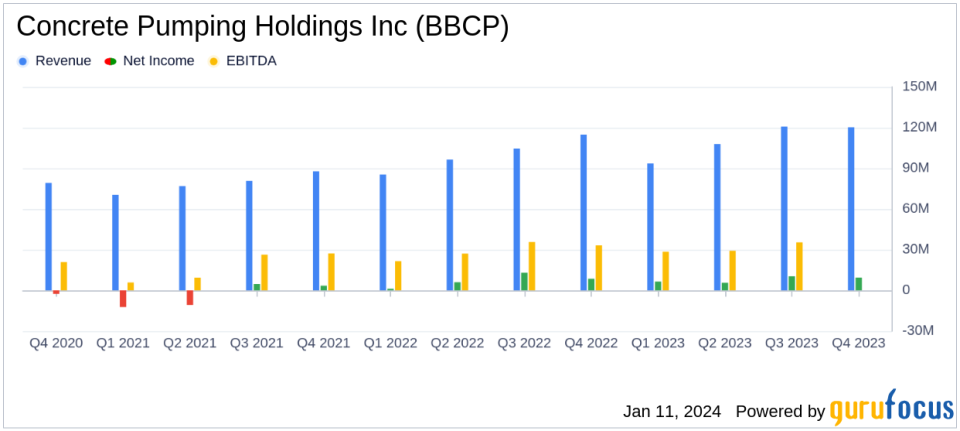

Revenue: Increased by 5% in Q4 and 10% for the fiscal year.

Net Income: Grew by 10% in Q4 and 12% for the fiscal year.

Diluted Earnings Per Share: Rose by 14% in Q4 and 15% for the fiscal year.

Adjusted EBITDA: Slightly increased in Q4; up 7% for the fiscal year.

Leverage Ratio: Achieved target of 3.0x at fiscal year-end.

Free Cash Flow: Expected to be at least $75.0 million in fiscal year 2024.

On January 11, 2024, Concrete Pumping Holdings Inc (NASDAQ:BBCP) released its 8-K filing, detailing the financial outcomes for the fourth quarter and the full fiscal year ended October 31, 2023. The company, a leading provider of concrete pumping services and concrete waste management services in the U.S. and U.K., demonstrated resilience and growth despite economic headwinds.

Financial Performance Overview

For the fourth quarter, BBCP reported a revenue increase of 5% to $120.2 million, up from $114.9 million in the same quarter of the previous year. The fiscal year saw a more substantial revenue increase of 10% to $442.2 million. This growth was attributed to organic growth across the company's segments, with notable contributions from the U.S. Concrete Pumping and U.S. Concrete Waste Management Services segments.

Gross profit saw a modest increase in Q4, while the fiscal year gross profit rose by 9% to $178.3 million. Income from operations and net income also showed healthy growth, with net income attributable to common shareholders increasing by 11% in Q4 and 12% for the fiscal year. Diluted earnings per share followed suit, rising by 14% in Q4 and 15% for the fiscal year.

Challenges and Achievements

Despite facing persistent cost inflation, BBCP managed to increase its net income and maintain a strong Adjusted EBITDA margin. The company's CEO, Bruce Young, highlighted the record-setting revenue and Adjusted EBITDA year, driven by the strength and diversification of their business. Young pointed out the company's success in reducing leverage, achieving a 3.0x leverage ratio target by the end of the fiscal year.

"Our outstanding 2023 results, despite persistent cost inflation, underscore the resilience of our business and the diversity of our chosen geographies. We are encouraged by our ability to adapt to the challenges inherent in the current volatile macroeconomic environment and looking ahead, we believe our end market diversity and mission-critical service in the construction industry positions us well for continued growth," said CEO Bruce Young.

The company's leverage ratio, a key metric for financial stability, stood at 3.0x at the end of the quarter, reflecting a strong balance sheet. Total available liquidity at the end of the quarter was $216.7 million, with net debt of $378.1 million.

Looking Forward

For fiscal year 2024, BBCP anticipates revenue to range between $465.0 million to $490.0 million, with Adjusted EBITDA expected to be between $127.0 million to $137.0 million. The company also projects a free cash flow of at least $75.0 million, signaling a positive outlook for the upcoming year.

Concrete Pumping Holdings Inc's performance in fiscal year 2023, despite economic uncertainties, reflects the company's robust business model and strategic positioning in the construction industry. With a solid financial foundation and a clear strategy for growth, BBCP is well-positioned to continue its upward trajectory in the coming year.

For a more detailed analysis of Concrete Pumping Holdings Inc's financial results and future outlook, investors and interested parties are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Concrete Pumping Holdings Inc for further details.

This article first appeared on GuruFocus.