Concrete Pumping Holdings, Inc.'s (NASDAQ:BBCP) Earnings Haven't Escaped The Attention Of Investors

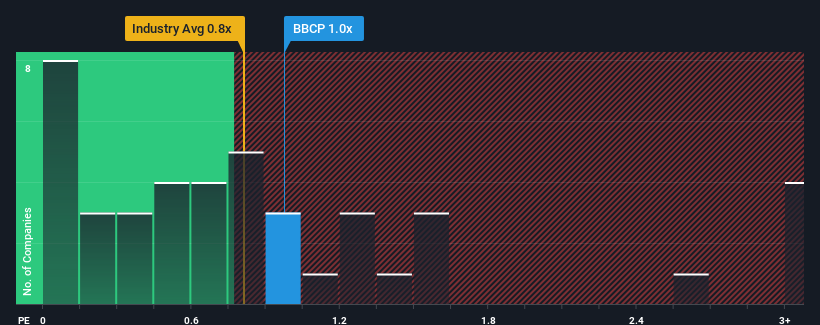

It's not a stretch to say that Concrete Pumping Holdings, Inc.'s (NASDAQ:BBCP) price-to-sales (or "P/S") ratio of 1x right now seems quite "middle-of-the-road" for companies in the Construction industry in the United States, where the median P/S ratio is around 0.8x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Concrete Pumping Holdings

What Does Concrete Pumping Holdings' P/S Mean For Shareholders?

Recent times have been advantageous for Concrete Pumping Holdings as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Concrete Pumping Holdings.

Is There Some Revenue Growth Forecasted For Concrete Pumping Holdings?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Concrete Pumping Holdings' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 24% gain to the company's top line. The latest three year period has also seen an excellent 37% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 7.7% over the next year. That's shaping up to be similar to the 8.7% growth forecast for the broader industry.

With this information, we can see why Concrete Pumping Holdings is trading at a fairly similar P/S to the industry. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Bottom Line On Concrete Pumping Holdings' P/S

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look at Concrete Pumping Holdings' revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

You always need to take note of risks, for example - Concrete Pumping Holdings has 1 warning sign we think you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here