Conduent Inc (CNDT) Reports Mixed Financial Outcomes Amid Strategic Shifts

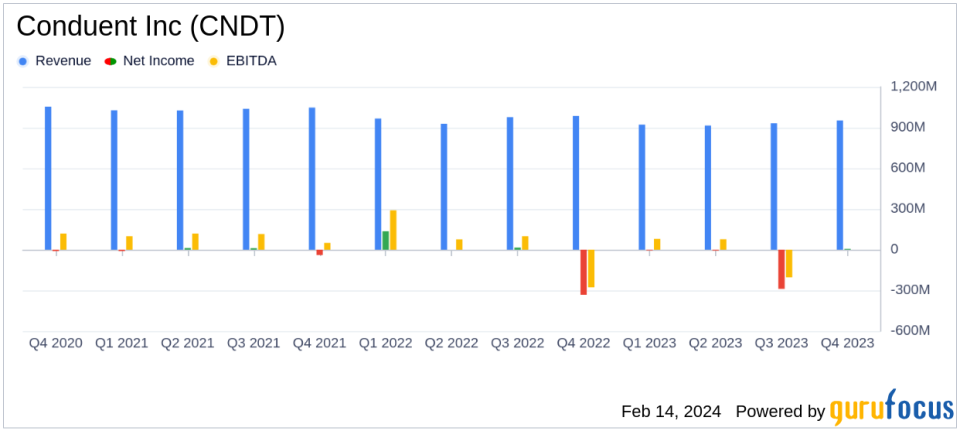

Revenue: Q4 $953M, FY $3,722M, marking a year-over-year decline.

Net Income: Q4 $6M, a significant improvement from a loss of $333M in Q4 2022.

Adjusted EBITDA Margin: Increased to 10.8% in Q4, up from 9.6% in the same quarter last year.

Adjusted Free Cash Flow: Q4 $93M, showcasing a substantial increase from $24M in Q4 2022.

New Business Signings: Annual Contract Value (ACV) in Q4 reached $152M, contributing to a strong new business pipeline.

Liquidity Position: Remains robust with $1.1 billion total, supporting ongoing share repurchase program.

Outlook for FY 2024: Adjusted Revenue projected between $3,600M and $3,700M with Adjusted EBITDA Margin of 8% - 9%.

On February 14, 2024, Conduent Inc (NASDAQ:CNDT), a leader in business process services, released its 8-K filing, detailing the fourth quarter and full year financial results for 2023. The company, known for its transaction-intensive processing, analytics, and automation services, operates across Commercial Industries, Government Services, and Transportation segments, primarily in the United States.

Conduent's Q4 revenue reached $953 million, contributing to the full year's $3,722 million, both slightly down from the previous year. However, the company saw a remarkable turnaround in net income, posting a $6 million profit in Q4 compared to a $333 million loss in the same period last year. Adjusted EBITDA margin improved by 120 basis points to 10.8% in Q4, reflecting operational efficiency gains.

Adjusted free cash flow for Q4 was reported at $93 million, a significant increase from $24 million in the prior year's quarter. This financial achievement underscores Conduent's focus on cash flow generation and operational improvements. The company's new business signings, with an ACV of $152 million in Q4, indicate a robust pipeline and potential for future growth.

Conduent's liquidity position remains strong, with a total of $1.1 billion, supporting its share repurchase program which saw approximately 6.6 million shares bought back in Q4. The company's strategic divestitures, including the anticipated sale of its Curbside Management and Public Safety Solutions businesses, are expected to close in the first half of 2024, further streamlining its operations.

Despite the positive turnaround in net income and cash flow, Conduent faced challenges, including a goodwill impairment related to the BenefitWallet divestiture. The company's full year pre-tax income reported a loss of $332 million, largely due to this impairment. However, the expected gain from this transaction, approximately $425 million, will be recorded upon closing in the first half of 2024.

Looking ahead, Conduent provided an FY 2024 outlook with adjusted revenue expected to be between $3,600 million and $3,700 million and an adjusted EBITDA margin ranging from 8% to 9%. The adjusted free cash flow is projected to be between 5% and 10% of adjusted EBITDA.

Conduent's President and CEO, Cliff Skelton, commented on the results and outlook, stating:

"Our Q4 results contributed to a strong finish to 2023, with Adjusted Revenue, Adjusted EBITDA and Adjusted EBITDA Margin exceeding our previously described Outlook for 2023. While we experienced some macroeconomic headwinds in our Commercial sales efforts, our Total Contract Value sales were up 20% year over yearthe highest in company historyand our new business pipeline remains quite strong, up 10% year on year."

In conclusion, Conduent's financial results for Q4 and FY 2023 reflect a company in transition, focusing on strategic divestitures and operational efficiency to position itself for future growth. While revenue has seen a slight decline, improvements in net income, adjusted EBITDA margin, and free cash flow highlight the company's resilience and potential for value creation.

Explore the complete 8-K earnings release (here) from Conduent Inc for further details.

This article first appeared on GuruFocus.