Confluent Inc CEO Edward Kreps Sells 232,500 Shares: An Insider Sell Analysis

Edward Kreps, the CEO of Confluent Inc (NASDAQ:CFLT), has recently made a significant change to his holdings in the company. On December 14, 2023, the insider sold a substantial block of 232,500 shares. This transaction has caught the attention of investors and market analysts, as insider activity, particularly from high-ranking executives, can provide valuable insights into a company's financial health and future prospects.

Who is Edward Kreps of Confluent Inc?

Edward Kreps serves as the Chief Executive Officer of Confluent Inc, a position that places him at the helm of the company's strategic direction and operational execution. His role is critical in steering the company through the competitive landscape of data infrastructure and real-time data streaming services. Kreps's insider status provides him with a deep understanding of the company's challenges and opportunities, making his trading activities particularly noteworthy to investors.

Confluent Inc's Business Description

Confluent Inc is a pioneering enterprise that specializes in real-time data streaming platforms. The company's flagship product, Confluent Platform, is built on Apache Kafka and provides a scalable and reliable framework for companies to move data from isolated systems into a real-time data pipeline. This enables businesses to react and make decisions based on fresh data, a critical capability in today's fast-paced digital economy. Confluent's innovative approach to data infrastructure has positioned it as a key player in the industry, catering to a wide range of sectors including finance, retail, logistics, and more.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

Insider transactions are often scrutinized for the signals they may send about a company's financial health. A sell-off by a CEO can be interpreted in various ways. It may indicate that the insider believes the stock is fully valued and that there are better investment opportunities elsewhere. Alternatively, it could be part of a pre-planned selling program or for personal financial management, such as diversification or liquidity needs.

When analyzing Edward Kreps's recent sell, it's important to consider the broader context of his trading history. Over the past year, Kreps has sold a total of 1,627,500 shares and has not made any purchases. This pattern of selling without corresponding buys could suggest a lack of confidence in the company's short-term growth prospects or simply a decision to realize gains from his equity compensation.

The relationship between insider selling and stock price can be complex. While extensive selling by insiders can sometimes precede a decline in stock price, this is not a rule. Market conditions, company performance, and broader economic factors also play significant roles in determining stock price movements.

On the day of Kreps's recent sell, Confluent Inc's shares were trading at $25.24, valuing the company at a market cap of $7.675 billion. This valuation reflects the market's current assessment of the company's worth, taking into account its financial performance, growth potential, and competitive position.

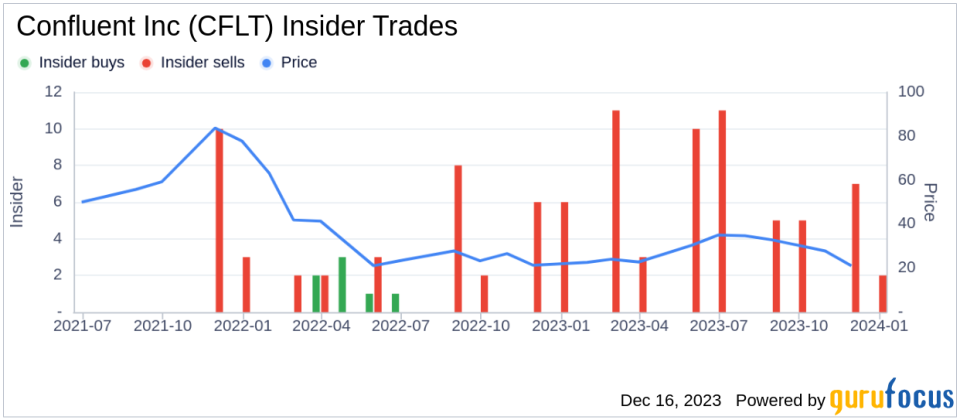

It's also crucial to look at the overall insider trend at Confluent Inc. Over the past year, there have been no insider buys, contrasted with 57 insider sells. This one-sided activity could be a red flag for potential investors, as it may indicate that those with the most intimate knowledge of the company's workings are choosing to reduce their stake.

The insider trend image above provides a visual representation of this selling activity. The absence of buying transactions may lead to questions about the long-term value of the stock and whether insiders are collectively anticipating a downturn or simply cashing in on the company's current market position.

Conclusion

Edward Kreps's recent sale of 232,500 shares of Confluent Inc is a significant event that warrants attention from investors and market analysts. While the reasons behind the sale may not be immediately clear, the ongoing pattern of insider selling at the company could be a signal worth considering in the context of investment decisions. As always, it is essential for investors to conduct their own due diligence and consider a multitude of factors before making any financial commitments.

Insider activity is just one piece of the puzzle when evaluating a stock's potential. Confluent Inc's position in the real-time data streaming market, its financial performance, competitive advantages, and future growth prospects should all be weighed alongside insider trends to form a comprehensive view of the company's investment profile.

As the market continues to evolve and Confluent Inc strives to maintain its position in the industry, investors will be watching closely to see how insider activity aligns with the company's performance and stock price movements in the future.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.