Confluent Inc (CFLT) Reports Strong Revenue Growth Amidst Path to Profitability

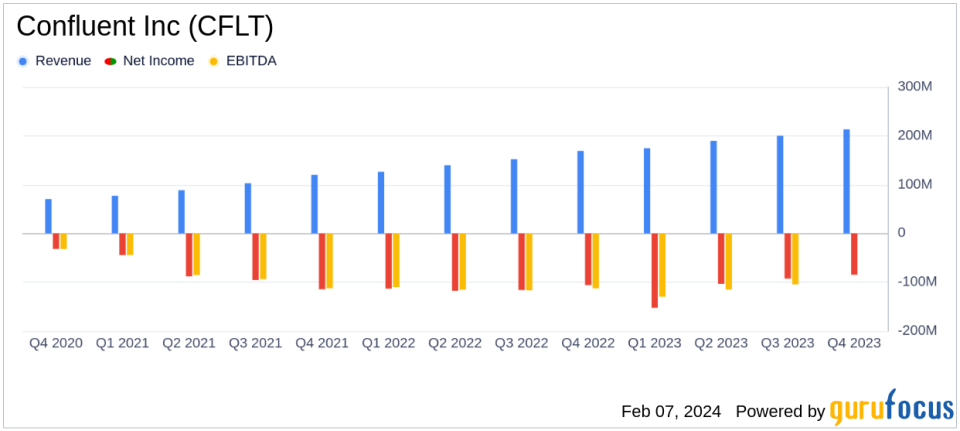

Total Revenue: $213 million in Q4, a 26% increase year over year; $777 million for FY 2023, up 33%.

Subscription Revenue: $203 million in Q4, up 31% year over year; $729 million for FY 2023, a 36% rise.

Confluent Cloud Revenue: $100 million in Q4, a 46% surge year over year; $349 million for FY 2023, up 65%.

Customer Growth: 1,229 customers with $100,000 or greater in ARR, marking a 21% increase year over year.

Non-GAAP Operating Margin: Achieved first positive non-GAAP operating margin in Q4.

Free Cash Flow: Improved to $6.8 million in Q4 from a negative $30.9 million in the prior year.

On February 7, 2024, Confluent Inc (NASDAQ:CFLT), a leader in data streaming platforms, announced its financial results for the fourth quarter and fiscal year 2023, showcasing robust growth and a strategic path towards profitability. The company's 8-K filing reveals significant year-over-year revenue increases, particularly in its Confluent Cloud and subscription services.

Confluent Inc is at the forefront of a new category of data infrastructure, connecting applications, systems, and data layers into a real-time central nervous system. Its product suite, including the Confluent Platform and ksqlDB, is primarily monetized through subscriptions and services, with the United States being its largest market. Confluent serves various sectors, including Financial Services, Insurance, Retail, and Government.

Financial Performance and Future Outlook

Confluent's Q4 2023 total revenue reached $213 million, a 26% increase from Q4 2022, while the fiscal year 2023 total revenue soared to $777 million, up 33% from the previous year. Subscription revenue, a critical metric for software companies, grew by 31% in Q4 and 36% for the full year, indicating strong customer commitment and product adoption.

The company's cloud offering, Confluent Cloud, experienced a remarkable 46% growth in Q4 and a 65% increase for the full year, reflecting the accelerating demand for cloud-based data solutions. The number of customers contributing over $100,000 in annual recurring revenue (ARR) grew by 21%, underscoring Confluent's expanding market presence.

Confluent achieved a significant milestone by reporting its first positive non-GAAP operating margin in Q4, a testament to its improved operational efficiency and cost management. The company also turned around its free cash flow, reporting $6.8 million in Q4 compared to a negative $30.9 million in the same quarter of the previous year.

Challenges and Achievements

Despite its strong performance, Confluent faces challenges common to the software industry, including competition, market saturation, and the need to continuously innovate. However, the company's focus on cloud services and subscription revenue aligns with current industry trends, positioning it well for future growth.

Confluent's financial achievements, particularly in cloud revenue and subscription growth, are crucial as they reflect the company's ability to scale and meet the growing demand for real-time data streaming services. These metrics are important indicators of the company's health and potential for long-term success.

Key Financial Details

Confluent reported a GAAP operating loss of $84.7 million in Q4, which is an improvement from the $115.0 million loss in Q4 2022. The non-GAAP operating income was $11.2 million in Q4, a significant improvement from a $36.3 million loss in the prior year. The GAAP net loss per share decreased to $0.30 from $0.37 year over year, while non-GAAP net income per diluted share was $0.09, compared to a loss of $0.09 in Q4 2022.

For the fiscal year 2023, Confluent's GAAP operating loss was $478.8 million, slightly worse than the $462.7 million loss in 2022. However, the non-GAAP operating loss improved dramatically to $57.3 million from $176.9 million. The GAAP net loss per share improved to $1.47 from $1.62, and the company achieved a non-GAAP net income per diluted share of $0.04, a significant turnaround from a $0.58 loss in 2022.

Confluent's financial outlook for Q1 2024 anticipates total revenue between $211 million and $212 million, with subscription revenue between $199 million and $200 million. The company expects a non-GAAP operating margin of approximately negative 4% and a non-GAAP net income per diluted share between $0.00 to $0.02. For the fiscal year 2024, Confluent projects total revenue of approximately $950 million, a non-GAAP operating margin of approximately 0%, and a non-GAAP net income per diluted share of approximately $0.17.

Management Commentary

Confluent closed fiscal year 2023 on a high note, delivering our first $100 million quarter in Confluent Cloud revenue, representing growth of 46% year over year, and growing subscription revenue by 31% year over year, said Jay Kreps, co-founder and CEO, Confluent. Our momentum is driven by our leadership of the data streaming platform category, which has become a requirement to deliver business critical use cases like connected customer experiences, cloud migrations and now real time generative AI.

We accomplished our stated goals of driving high revenue growth for fiscal year 2023 while accelerating our path to achieving our first positive non-GAAP operating margin in Q4, said Rohan Sivaram, CFO, Confluent. Given our solid Q4 performance, we feel confident in achieving our revenue guidance for 2024 and our first breakeven year for both non-GAAP operating margin and free cash

Explore the complete 8-K earnings release (here) from Confluent Inc for further details.

This article first appeared on GuruFocus.