Confluent Inc's CTO Chad Verbowski Sells 8,859 Shares: An Insider Sell Analysis

In a recent transaction on November 21, 2023, Chad Verbowski, the Chief Technology Officer of Confluent Inc (NASDAQ:CFLT), sold 8,859 shares of the company. This sale has caught the attention of investors and market analysts, as insider transactions can often provide valuable insights into a company's financial health and future prospects. In this article, we will delve into who Chad Verbowski is, provide a description of Confluent Inc's business, and analyze the implications of this insider sell activity in relation to the stock price.

Who is Chad Verbowski?

Chad Verbowski serves as the Chief Technology Officer at Confluent Inc. In his role, Verbowski is responsible for leading the company's technological advancements and ensuring that Confluent's product offerings remain innovative and competitive in the market. With a background in software engineering and a track record of success in technology leadership positions, Verbowski's actions and decisions are closely watched by investors and industry professionals alike.

Confluent Inc's Business Description

Confluent Inc is a company that specializes in real-time data streaming. It provides a platform that enables organizations to access, store, and manage data as continuous, real-time streams. This technology is crucial for businesses that require immediate insights and actions based on live data, such as financial services, retail, and IoT (Internet of Things) applications. Confluent's platform is built on Apache Kafka, an open-source stream-processing software platform developed by the company's founders. The company's mission is to set data in motion, empowering organizations to access data as real-time streams.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

Insider transactions are often considered a signal of a company's internal perspective on its financial health and future performance. A sell transaction, such as the one executed by Chad Verbowski, can be interpreted in various ways. It could indicate that the insider believes the stock is currently overvalued or that they foresee potential challenges ahead that could affect the stock price. However, it is also important to consider that insiders may sell shares for personal reasons that have no bearing on their outlook for the company.

Over the past year, Chad Verbowski has sold a total of 62,476 shares and has not made any purchases. This pattern of selling without corresponding buys could suggest a lack of confidence in the company's short-term growth potential or simply a desire to diversify personal assets. The broader insider transaction history for Confluent Inc shows a similar trend, with 55 insider sells and no insider buys over the past year. This one-sided activity could be a red flag for potential investors, as it may imply that those with the most intimate knowledge of the company's workings are choosing to reduce their holdings.

On the day of Verbowski's recent sale, shares of Confluent Inc were trading at $18.73, giving the company a market cap of $5.908 billion. The stock price and market cap provide context for the scale of the transaction and can help investors gauge the potential impact of the insider's actions. It is worth noting that insider sells can sometimes lead to a decrease in stock price if the market perceives the sell as a lack of confidence in the company's future. However, the effect of a single insider's transactions on the stock price can vary and is influenced by many factors, including overall market conditions and investor sentiment.

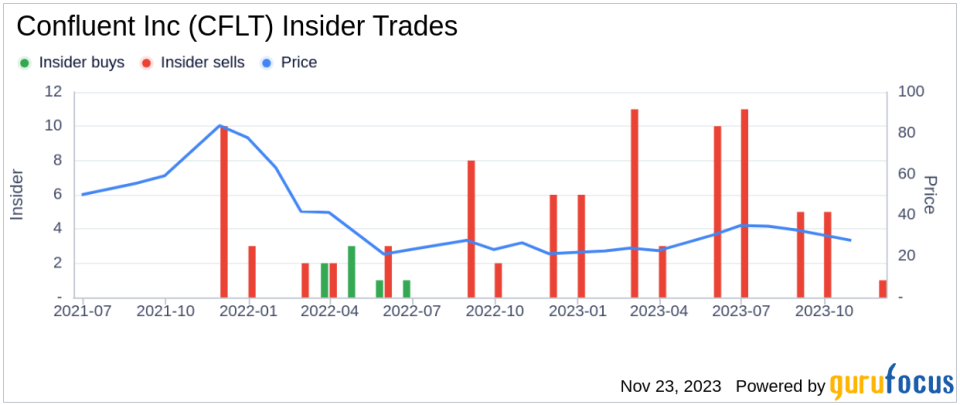

To better understand the potential impact of insider transactions on Confluent Inc's stock price, it is helpful to look at historical data and trends. The following insider trend image illustrates the pattern of insider transactions over the past year:

The image shows a clear trend of insider selling, which could be interpreted as a cautious or bearish signal by market observers. However, without additional context, such as the company's financial performance, growth prospects, and industry conditions, it is difficult to draw definitive conclusions from insider selling alone.

Conclusion

In conclusion, the recent sale of 8,859 shares by Confluent Inc's CTO Chad Verbowski is a transaction that warrants attention from investors and analysts. While the pattern of insider selling at Confluent Inc over the past year may raise questions about the insiders' confidence in the company's stock, it is essential to consider a range of factors before making investment decisions. Investors should evaluate the company's financial health, growth strategy, competitive position, and the broader market environment when interpreting insider transactions. As always, insider sells are just one piece of the puzzle, and a comprehensive analysis should include a variety of data points and market indicators.

It is also important for investors to remember that insider transactions are not always indicative of future stock performance and should not be the sole basis for investment decisions. Instead, they should be viewed as part of a broader investment strategy that takes into account an individual's financial goals, risk tolerance, and investment horizon.

As we continue to monitor insider activity at Confluent Inc and other companies, we will provide updates and insights that can help investors make informed decisions. For the latest insider trading data, market analysis, and investment news, stay tuned to gurufocus.com.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.