Confluent (NASDAQ:CFLT) Posts Better-Than-Expected Sales In Q4, Stock Jumps 13.7% On Positive Cash Flow And Strong Guidance

Data infrastructure software company, Confluent (NASDAQ:CFLT) reported Q4 FY2023 results topping analysts' expectations , with revenue up 26.4% year on year to $213.2 million. The company expects next quarter's revenue to be around $211.5 million, in line with analysts' estimates. It made a non-GAAP profit of $0.09 per share, improving from its loss of $0.09 per share in the same quarter last year.

Is now the time to buy Confluent? Find out by accessing our full research report, it's free.

Confluent (CFLT) Q4 FY2023 Highlights:

Revenue: $213.2 million vs analyst estimates of $205.3 million (3.8% beat)

EPS (non-GAAP): $0.09 vs analyst estimates of $0.05 ($0.04 beat)

Revenue Guidance for Q1 2024 is $211.5 million at the midpoint, roughly in line with what analysts were expecting

Management's revenue guidance for the upcoming financial year 2024 is $950 million at the midpoint, beating analyst estimates by 1.6% and implying 22.3% growth (vs 33.1% in FY2023)

Free Cash Flow of $6.82 million is up from -$13.08 million in the previous quarter

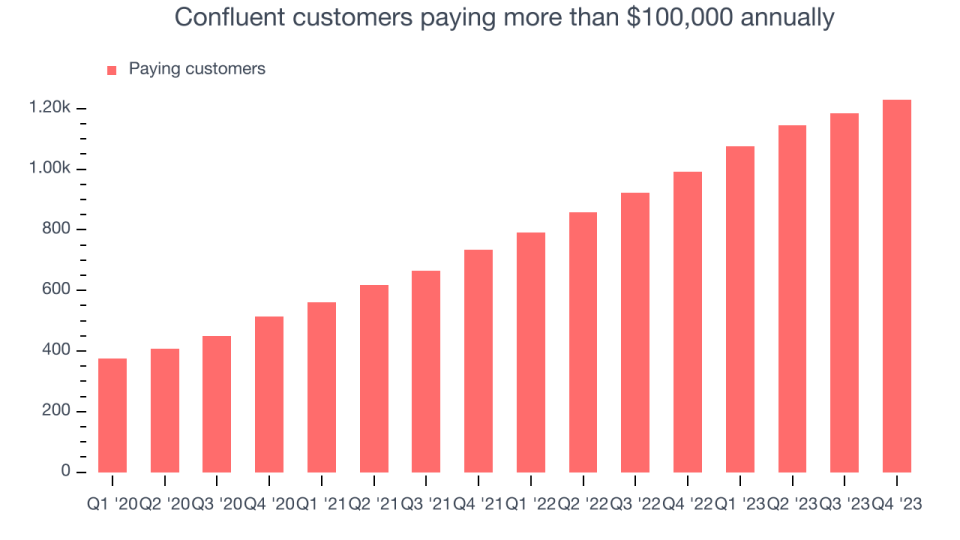

Customers: 1,229 customers paying more than $100,000 annually

Gross Margin (GAAP): 73.2%, up from 68.3% in the same quarter last year

Market Capitalization: $7.23 billion

“Confluent closed fiscal year 2023 on a high note, delivering our first $100 million quarter in Confluent Cloud revenue, representing growth of 46% year over year, and growing subscription revenue by 31% year over year,” said Jay Kreps, co-founder and CEO, Confluent.

Started in 2014 by the team of engineers at LinkedIn who originally built it as an internal tool, Confluent (NASDAQ:CFLT) provides infrastructure software for organizations that makes it easy and fast to collect and move large amounts of data between different systems.

Data Infrastructure

Generating insights from system level data is an increasing priority for most businesses, but to do so requires connecting and analyzing piles of data stored and siloed in separate databases. This is the demand driver for cloud based data infrastructure software providers, who can more readily integrate, distribute and process information vs. legacy on-premise software providers.

Sales Growth

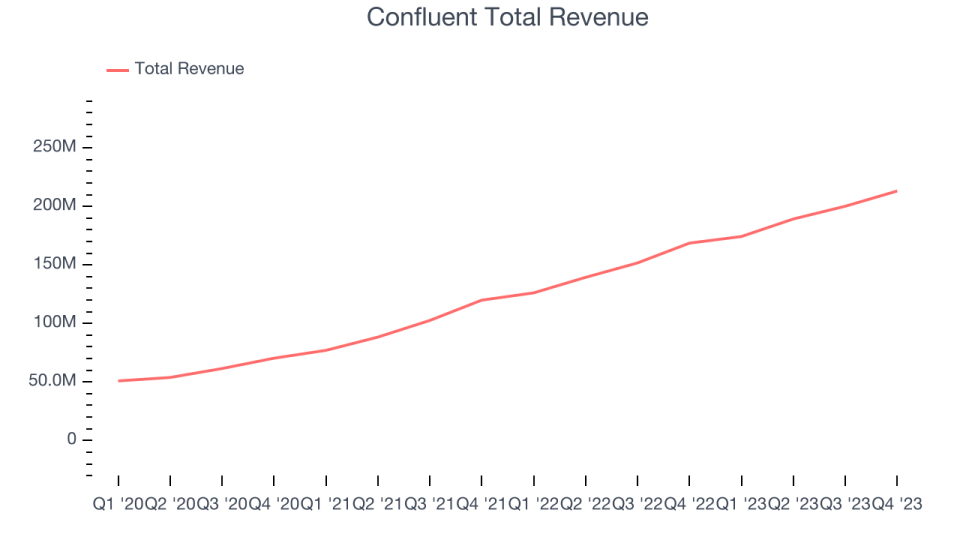

As you can see below, Confluent's revenue growth has been impressive over the last two years, growing from $119.9 million in Q4 FY2021 to $213.2 million this quarter.

This quarter, Confluent's quarterly revenue was once again up a very solid 26.4% year on year. On top of that, its revenue increased $13 million quarter on quarter, a solid improvement from the $10.9 million increase in Q3 2023. Thankfully, that's a slight acceleration of growth.

Next quarter's guidance suggests that Confluent is expecting revenue to grow 21.3% year on year to $211.5 million, slowing down from the 38.2% year-on-year increase it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $950 million at the midpoint, growing 22.3% year on year compared to the 32.6% increase in FY2023.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Large Customers Growth

This quarter, Confluent reported 1,229 enterprise customers paying more than $100,000 annually, an increase of 44 from the previous quarter. That's in line with the number of contracts wins in the last quarter but quite a bit below what we've typically observed over the last year, suggesting that the sales slowdown we observed in the last quarter could continue.

Key Takeaways from Confluent's Q4 Results

It was good to see Confluent beat analysts' revenue expectations this quarter and turn free cash flow positive for the first time. We were also glad its full-year revenue guidance came in higher than Wall Street's estimates. Revenue guidance for next year suggests a slowdown in growth but that was mostly expected. Zooming out, we think this was still a very good quarter, showing that the company is staying on track. The stock is up 13.7% after reporting and currently trades at $27.65 per share.

So should you invest in Confluent right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.