CONMED (CNMD) Beats on Q2 Earnings, Ups '23 EPS View

CONMED Corporation CNMD delivered second-quarter 2023 adjusted earnings per share (EPS) of 83 cents, which beat the Zacks Consensus Estimate of 79 cents by 5.1%. The bottom line improved 9.2% from the year-ago quarter’s level.

GAAP EPS for the quarter was 43 cents against a reported loss of $5.65 per share in the year-ago period. The significantly higher loss in the year-ago period was due to the presence of $112 million debt-related expenses, primarily due to conversion premium on the repurchase and extinguishment of certain convertible debts.

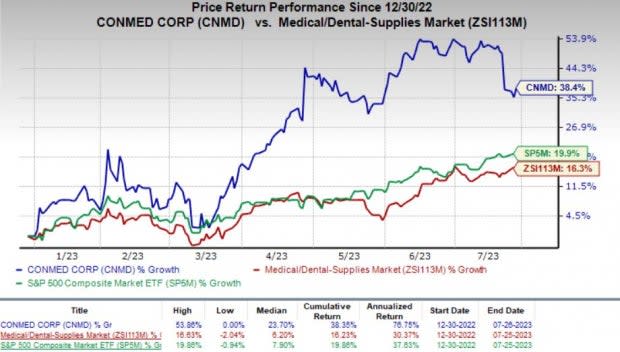

The company’s shares have risen 38.4% year to date compared with the industry’s growth of 16.3%. The broader S&P 500 Index has increased 6.6% in the same time frame.

Image Source: Zacks Investment Research

Revenues in Detail

CONMED’s revenues totaled $317.7 million, up 14.6% year over year. The top line beat the Zacks Consensus Estimate by 3.9%. At constant exchange rate (CER), revenues increased 16.6%. Additional sales from newly-acquired businesses contributed approximately 400 basis points of growth.

The first-quarter sales were adversely impacted due to the implementation of a warehouse management software system during the fourth quarter of 2022. However, during the second quarter, the company’s top line is likely to have recovered from the disruption. We expect revenue growth to be steady in the second half of 2023.

Segmental Details

Revenues in the Orthopedic Surgery segment totaled $140.8 million, up 17.1% from the year-ago quarter’s level on a reported basis. At CER, revenues increased 19.8%.

The top line improved 29.4% on a reported basis on the domestic front. It also increased 11% (up 14.8% at CER) from the prior-year quarter’s level on the international front.

Revenues in the General Surgery segment amounted to $176.9 million, up 12.6% year over year on a reported basis and 14.1% at CER. Domestically, the figure increased 12.5% year over year. International sales gained 12.9% on a reported basis (up 17.9% at CER).

Sales by Geography

Sales in the United States totaled $174.7 million, up 17.1% year over year. International sales were $143 million, up 11.7% year over year on a reported basis and 16% at CER.

Margins

CONMED’s gross profit improved 12.5% to $170.7 million. However, the gross margin declined 110 basis points to 53.7%.

Selling & administrative expenses increased 12% to $129.7 million. Research and development expenses rose 18.1% year over year to $13.6 million.

The company recorded an operating income of $27.4 million compared with $24.6 million in the prior-year quarter.

2023 Guidance

Based on strong second-quarter results, CONMED announced updated guidance for earnings and revenues in 2023. The company now expects revenues between $1.23 billion and $1.26 billion for full-year 2023, implying growth of 21.8-24.8% over 2022.

Previously, it expected revenues between $1.205 billion and $1.250 billion. The Zacks Consensus Estimate for the same is currently pegged at $1.23 billion.

Adjusted EPS is now expected in the range of $3.40-$3.55, up from the previous projection of $3.30-$3.50. The Zacks Consensus Estimate for the same is currently pegged at $3.41. The current EPS guidance indicates an improvement of 5.9-10.6% year over year.

CNMD continues to expect foreign exchange to have an unfavorable impact on its top-line growthby 150-200 basis points in 2023. Currency rates are expected to negatively impact EPS by 20-25 cents.

Our Take

CONMED exited the second quarter on a strong note, wherein both earnings and revenues beat their respective consensus mark. The company’s revenues recovered from the shipping delays. It had reduced the backlog due to the aforementioned disruption, to normal operating levels during the first quarter 2023. Moreover, a strong order book is likely to drive revenue growth for the rest of the year.

However, rising cost of goods and higher operating expenses completely offset strong top-line growth, which led to a decline in earnings. Although CONMED raised its bottom-line guidance, the metric is still expected to be under pressure going forward.

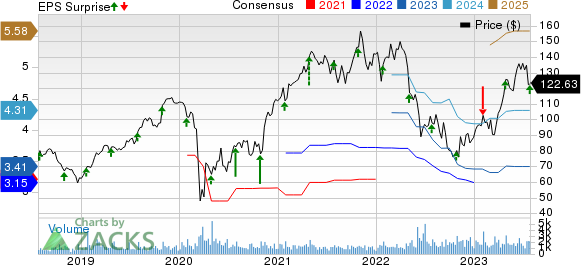

CONMED Corporation Price, Consensus and EPS Surprise

CONMED Corporation price-consensus-eps-surprise-chart | CONMED Corporation Quote

Zacks Rank and Stocks to Consider

Currently, CNMD carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space that have announced quarterly results are Abbott Laboratories ABT, Elevance Health, Inc. ELV and Intuitive Surgical, Inc. ISRG.

Abbott, carrying a Zacks Rank of 2 (Buy) at present, reported second-quarter 2023 adjusted EPS of $1.08, which beat the Zacks Consensus Estimate by 3.8%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Revenues of $9.98 billion outpaced the consensus mark by 2.9%.

Abbott has a long-term estimated growth rate of 5.1%. ABT’s earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 12.4%.

Elevance Health reported second-quarter 2023 adjusted EPS of $9.04, which beat the Zacks Consensus Estimate by 2.5%. Revenues of $43.38 billion surpassed the Zacks Consensus Estimate by 4.5%. The company currently carries a Zacks Rank #2.

ELV has a long-term estimated growth rate of 12.1%. Its earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 2.8%.

Intuitive Surgical reported second-quarter 2023 adjusted EPS of $1.42, which beat the Zacks Consensus Estimate by 7.6%. Revenues of $1.76 billion surpassed the Zacks Consensus Estimate by 1.4%. It currently carries a Zacks Rank #2.

ISRG has a long-term estimated growth rate of 14.5%. Its earnings surpassed estimates in three of the trailing four quarters and missed once, delivering an average surprise of 4.2%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abbott Laboratories (ABT) : Free Stock Analysis Report

CONMED Corporation (CNMD) : Free Stock Analysis Report

Intuitive Surgical, Inc. (ISRG) : Free Stock Analysis Report

Elevance Health, Inc. (ELV) : Free Stock Analysis Report