CONMED (CNMD) Beats on Q3 Earnings, Ups '23 EPS View

CONMED Corporation CNMD delivered adjusted earnings per share (EPS) of 90 cents in third-quarter 2023, which beat the Zacks Consensus Estimate of 83 cents by 8.4%. The bottom line also improved 16.9% from the year-ago quarter’s level.

GAAP EPS for the quarter was 50 cents against a reported loss of $1.48 per share in the year-ago period.

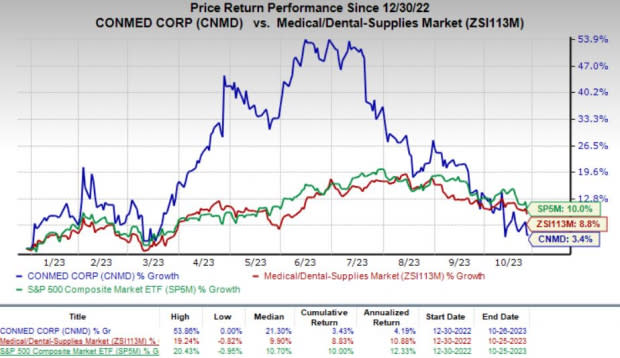

The company’s shares have risen 3.4% year to date compared with the industry’s growth of 8.8%. The broader S&P 500 Index has gained 10% in the same time frame.

Image Source: Zacks Investment Research

Revenues in Detail

CONMED’s revenues totaled $304.6 million, up 10.7% year over year. The top line beat the Zacks Consensus Estimate by 3.9%. At constant exchange rate (CER), revenues increased 11.9%. Additional sales from the newly acquired businesses contributed approximately 40 basis points of growth.

CNMD’s third-quarter sales were driven by strong growth in the U.S. as well as international markets. The company’s two products, In2Bones and Biorez, were the key drivers during the reported quarter. However, its legacy orthopedic business was hurt by supply constraints.

Segmental Details

Revenues in the Orthopedic Surgery segment totaled $124.7 million, up 5.1% from the year-ago quarter’s level on a reported basis. At CER, revenues increased 6.4%.

The top line improved 1.3% on a reported basis on the domestic front. It also increased 7.5% (9.7% at CER) from the prior-year quarter’s level on the international front.

Revenues in the General Surgery segment amounted to $179.9 million, up 15% year over year on a reported basis and 16% at CER. Domestically, the figure increased 12.9% year over year. International sales improved 12.3% on a reported basis (15.1% at CER).

Sales by Geography

Sales in the United States totaled $170.5 million, up 9.5% year over year. International sales amounted to $134.1 million, up 12.3% year over year on a reported basis and 15.1% at CER.

Margins

CONMED’s gross profit improved 12.5% to $170.3 million. The gross margin improved 80 basis points to 55.9%.

Selling & administrative expenses increased 9.3% to $125.3 million. Research and development expenses rose 2.4% year over year to $12.5 million.

The company recorded an operating income of $30.3 million compared with $24.2 million in the prior-year quarter.

2023 Guidance

Based on strong third-quarter results, CONMED raised the lower-end of its previous guidance for 2023 earnings and revenues. The company now expects revenues between $1.24 billion and $1.26 billion for full-year 2023, implying growth of 18.1-20% over 2022.

Previously, it expected revenues between $1.23 billion and $1.26 billion. The Zacks Consensus Estimate for the same is currently pegged at $1.25 billion.

Adjusted EPS is now expected in the range of $3.45-$3.55, up from the previous projection of $3.40-$3.55. The Zacks Consensus Estimate for the same is currently pegged at $3.48. The current EPS guidance indicates an improvement of 30.2-34% year over year.

CNMD continues to expect foreign exchange to have an unfavorable impact on its top-line growthby 150-200 basis points in 2023. Currency rates are expected to negatively impact EPS by 20-25 cents.

CONMED Corporation Price, Consensus and EPS Surprise

CONMED Corporation price-consensus-eps-surprise-chart | CONMED Corporation Quote

Our Take

CONMED exited the third quarter on a strong note, wherein both earnings and revenues beat their respective consensus mark. However, the supply-chain disruption continues to pose a headwind for the company during the quarter. CNMD expects supply-chain issues to improve from first-quarter 2024.

Although the supply-chain issue lingers, the company’s gross margin continues to improve. CONMED expects to reach a gross margin of 60% by 2025.

Zacks Rank and Stocks to Consider

Currently, CNMD carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space that have announced quarterly results are Abbott Laboratories ABT, Elevance Health, Inc. ELV and Edwards Lifesciences EW.

Abbott, carrying a Zacks Rank of 2 (Buy) at present, reported third-quarter 2023 adjusted EPS of $1.14, which beat the Zacks Consensus Estimate by 3.6%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Revenues of $10.14 billion outpaced the consensus mark by 3.6%.

Abbott has a long-term estimated growth rate of 5.1%. ABT’s earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 6.76%.

Elevance Health reported third-quarter 2023 adjusted EPS of $8.99, which beat the Zacks Consensus Estimate by 6.4%. Revenues of $42.5 billion were in line with the Zacks Consensus Estimate. The company currently carries a Zacks Rank #2.

ELV has a long-term estimated growth rate of 12.1%. Its earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 2.91%.

Edwards Lifesciences reported third-quarter 2023 adjusted EPS of 59 cents and revenues of $1.48 billion, both in line with the Zacks Consensus Estimate. It currently carries a Zacks Rank #2.

EW has a long-term estimated growth rate of 8%. Its earnings surpassed estimates in three of the trailing four quarters and missed once, delivering an average surprise of 1.62%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abbott Laboratories (ABT) : Free Stock Analysis Report

CONMED Corporation (CNMD) : Free Stock Analysis Report

Edwards Lifesciences Corporation (EW) : Free Stock Analysis Report

Elevance Health, Inc. (ELV) : Free Stock Analysis Report