CONMED (CNMD) Stock Hits 52-Week High: Will It Continue?

CONMED Corporation CNMD is well poised for growth in the coming quarters, courtesy of its broad product spectrum. The optimism, led by the solid first-quarter 2023 performance and a potential General Surgery, is expected to contribute further. However, headwinds from regulatory requirements and data security threats persist.

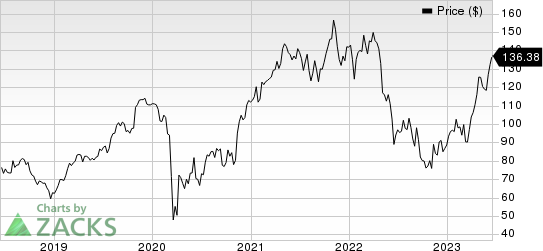

In the past year, this Zacks Rank #2 (Buy) company has gained 53.5% compared with the industry’s 19.6% growth. The S&P 500 Index rose 19% during the same time frame.

CONMED, a renowned global medical products manufacturer specializing in surgical instruments and devices, has a market capitalization of $3.17 billion. The company projects 18% growth over the next five years and expects to maintain its strong performance going forward.

Image Source: Zacks Investment Research

Its earnings surpassed estimates in two of the trailing four quarters, missed once and met in another, delivering a negative average surprise of 10.54%.

Despite mixed performance in the last four quarters, CNMD’s shares have risen more than 50% in the past year. A potential rise in demand for surgeries and a broad spectrum of products are likely to drive its share prices higher.

The company reached a new 52-week high in the past few trading session. This, along with a favorable Zacks Rank, makes CONMED a good bet for investors.

Let’s delve deeper.

Potential in General Surgery: The segment consists of a complete line of endo-mechanical instrumentation for minimally invasive laparoscopic and gastrointestinal procedures, a line of cardiac monitoring products as well as electrosurgical generators and related instruments.

CONMED’s unique products and solutions within this segment have been providing a competitive edge in the MedTech space. One of these products, the Anchor Tissue Retrieval bag, deserves a special mention. It is one of the major platforms in the company’s specimen bag portfolio.

Broad Product Spectrum: CONMED offers a broad line of surgical products, which includes several new devices in the Orthopedic, Laparoscopic, Robotic, Open Surgery, Gastroenterology, Pulmonary and Cardiology sections.

Products like Hi-Fi Tape and Hi-Fi suture interface are a critical component of repair security in the rotator cuff repair space.

Other notable offerings include the MicroFree platform in Orthopedics, the TruShot, the Y-Knot Pro and the CRYSTALVIEW Pump. The Anchor Tissue Retrieval bag is a unique product under the General Surgery arm.

Solid Recurring Revenue Base: Approximately 80% of CONMED’s revenues are recurring and derived from the sale of disposable single-use products. The remaining 20% comes from sales of capital equipment such as powered drills and saws for surgery, electrosurgical generators, video-imaging cameras, fluid control systems and surgical hand-pieces, thereby creating demand for complementary single-use items.

Hospitals and clinics are expanding the use of single-use, disposable products. This endeavor is aimed at reducing expenses related to sterilizing surgical instruments and products following surgery.

CONMED’s revenues totaled $295.5 million in first-quarter 2023, up 21.9% year over year. Additional sales from newly-acquired businesses contributed approximately 570 basis points of growth.

Using one-time disposable products also lowers the risk of patient infection and reduces post-operative care cost, which is no longer covered by Medicare.

Downsides

Regulatory Requirements: Substantially, all CONMED products are classified as class II medical devices, subject to regulations of numerous agencies and legislative bodies worldwide. As a manufacturer of medical devices, the company’s manufacturing processes and facilities are subject to on-site inspection and constant review by the FDA for compliance with the Quality System Regulations.

Dismal margins: Although CONMED recorded strong growth across all segments in the first quarter, inflationary pressures continued hurting margins. Gross margin declined 350 basis points to 52.6%. During the reported quarter, the company recorded a year-over-year decline of 43.3% in operating income. Higher costs and expenses are likely to continue for the rest of 2023.

CONMED Corporation Price

CONMED Corporation price | CONMED Corporation Quote

Estimate Trend

CONMED is witnessing a positive estimate revision trend for 2023. In the past 60 days, the Zacks Consensus Estimate for earnings has improved 3% to $3.31 per share.

The consensus mark for the company’s second-quarter revenues is pegged at $305.9 million, indicating a 10.4% improvement from the year-ago quarter’s reported number.

Other Stocks to Consider

Some other top-ranked stocks in the broader medical space are West Pharmaceutical Services WST, Merit Medical Systems MMSI and Dentsply Sirona XRAY, each carrying a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

West Pharmaceutical Services has an estimated long-term growth rate of 6.3%. The company’s earnings surpassed estimates in three of the trailing four quarters and missed the same once, delivering an average surprise of 13.61%.

WST’s shares haverisen 27.2% in the past year compared with the industry’s 19.6% growth.

Merit Medical Systems has an estimated long-term growth rate of 11%. Its earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 20.22%.

The company’s shares have risen 58.2% in the past year compared with the industry’s 19.6% growth.

Dentsply Sirona has an estimated long-term growth rate of 9.1%. XRAY delivered a trailing four-quarter average earnings surprise of 10.47%.

The company’s shares have risen 8.6% in the past year compared with the industry’s 19.6% growth.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CONMED Corporation (CNMD) : Free Stock Analysis Report

DENTSPLY SIRONA Inc. (XRAY) : Free Stock Analysis Report

Merit Medical Systems, Inc. (MMSI) : Free Stock Analysis Report

West Pharmaceutical Services, Inc. (WST) : Free Stock Analysis Report