ConnectOne Bancorp Inc Reports Mixed Results Amid Industry Challenges

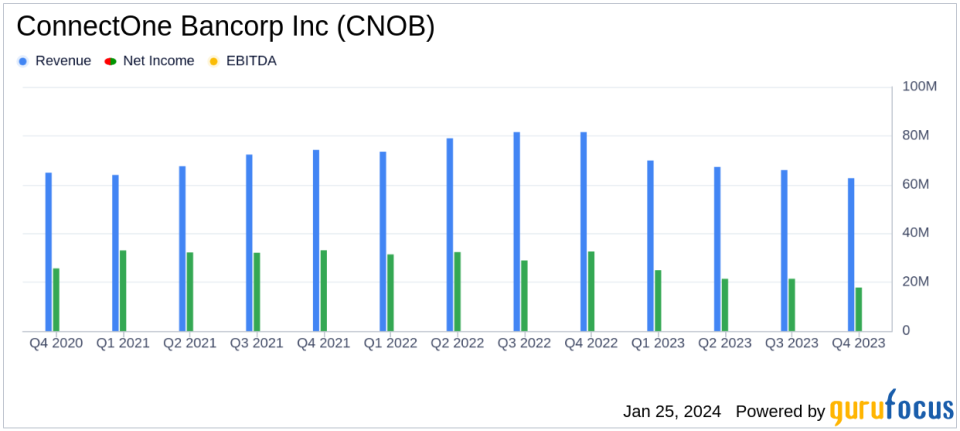

Net Income: Q4 net income available to common stockholders was $17.8 million, a decrease from $19.9 million in Q3 2023 and $31.0 million in Q4 2022.

Diluted Earnings Per Share (EPS): Q4 diluted EPS stood at $0.46, down from $0.51 in Q3 2023 and $0.79 in Q4 2022.

Net Interest Income: Experienced a decrease to $62.6 million in Q4 2023, compared to the previous year.

Dividends: Declared a quarterly cash dividend on common stock of $0.17 and a preferred stock dividend of $0.328125 per depositary share.

Asset Quality: Nonperforming assets as a percentage of total assets were 0.53% as of December 31, 2023.

Balance Sheet Growth: Total assets increased to $9.856 billion as of December 31, 2023, up from $9.644 billion the previous year.

Stock Repurchase: Repurchased 102,200 shares of common stock at an average price of $21.17 during Q4 2023.

On January 25, 2024, ConnectOne Bancorp Inc (NASDAQ:CNOB) released its 8-K filing, detailing the financial results for the fourth quarter and full year of 2023. ConnectOne, a community bank holding company providing a range of banking services to commercial, industrial, and governmental customers, faced a challenging year marked by the Federal Reserve's tightening policy which impacted net interest margins and overall earnings.

Financial Performance and Challenges

ConnectOne's net income available to common stockholders for Q4 2023 was $17.8 million, a decrease from both the previous quarter and the same quarter in the prior year. This decline was attributed to a special FDIC assessment, an increase in the provision for credit losses, and a decrease in net interest income. Despite these challenges, the bank managed to increase its tangible book value per share by over 6% in 2023, demonstrating resilience in a tough economic environment.

Strategic Focus and Outlook

Chairman and CEO Frank Sorrentino highlighted the company's strategic focus on relationship-based lending and disciplined credit and spread management, which led to solid commercial and industrial (C&I) loan growth. Sorrentino expressed confidence in the bank's financial strength and ability to capitalize on opportunities in 2024, anticipating gradual growth and a potential widening of the net interest margin as the Fed eases interest rates.

"While 2023 was marked by significant challenges in the banking industry, Im proud to report that with the strength of our balance sheet, our culture and the commitment to our clients, we were able to stay the course and continue on the path that has made ConnectOne a success since our inception nearly twenty years ago." - Frank Sorrentino, Chairman and CEO

Financial Highlights

ConnectOne's net interest income for Q4 2023 was $62.6 million, a decrease from both the previous quarter and the same quarter last year, primarily due to a contraction in net interest margin. Noninterest income saw a slight increase, while noninterest expenses rose, including a $2.1 million FDIC special assessment. The bank's efficiency ratio, despite being impacted by compressing margins, remained in the top tier among banks.

The bank's asset quality remained solid, with nonperforming assets at 0.53% of total assets as of December 31, 2023. The provision for credit losses increased to $2.7 million for Q4 2023, reflecting loan growth and charge-offs of previously-reserved-for taxi medallion loans.

ConnectOne's balance sheet grew over the year, with total assets increasing to $9.856 billion as of December 31, 2023. The bank's total stockholders' equity also increased, primarily due to retained earnings growth.

Dividend Declarations and Share Repurchase Program

The company declared a quarterly cash dividend on its common stock of $0.17 per share and a preferred stock dividend of $0.328125 per depositary share. Additionally, ConnectOne repurchased shares of common stock and has authorization for further repurchases, which may occur in the open market or through privately negotiated transactions.

ConnectOne's earnings report reflects a company navigating a challenging economic landscape while maintaining a focus on strategic growth and shareholder returns. Investors and stakeholders will be watching closely to see how the bank's focus on relationship-based lending and disciplined financial management will fare in the coming year.

For a detailed analysis of ConnectOne Bancorp Inc's financial results and management's commentary, investors are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from ConnectOne Bancorp Inc for further details.

This article first appeared on GuruFocus.