ConocoPhillips (COP) Posts $3.0 Billion Q4 Earnings; Announces $9 Billion Capital Return Plan

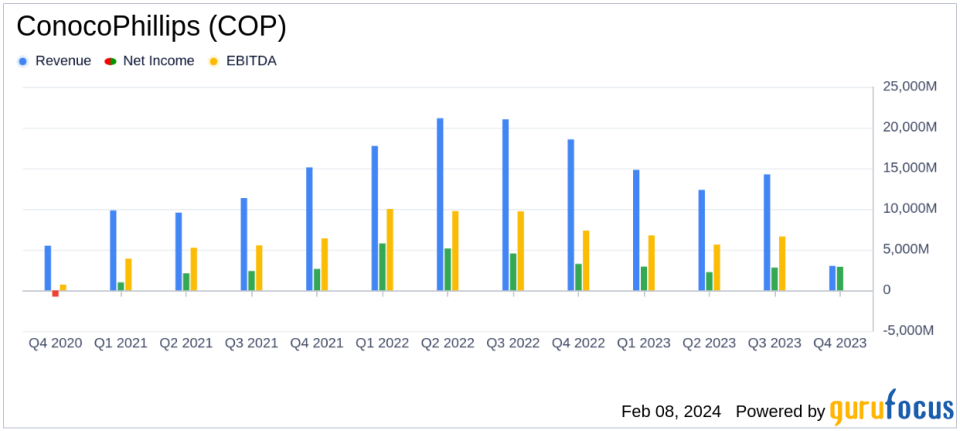

Q4 Earnings: Reported $3.0 billion, or $2.52 per share, a slight decrease from $3.2 billion, or $2.61 per share in Q4 2022.

Full-Year Earnings: $11.0 billion, or $9.06 per share, down from $18.7 billion, or $14.57 per share in 2022.

Adjusted Earnings: Q4 adjusted earnings were $2.9 billion, or $2.40 per share; full-year adjusted earnings were $10.6 billion, or $8.77 per share.

Production: Achieved record production with 1,826 MBOED for the full year.

Capital Return: Distributed $11.0 billion to shareholders and announced a planned return of capital of $9 billion for 2024.

Reserve Replacement Ratio: Reported a preliminary reserve replacement ratio of 123% for 2023.

Future Outlook: 2024 production guidance set at 1.91 to 1.95 MMBOED with capital expenditure guidance of $11.0 to $11.5 billion.

On February 8, 2024, ConocoPhillips (NYSE:COP), a leading independent exploration and production company, released its 8-K filing, detailing its financial performance for the fourth quarter and full year of 2023. The company, which operates globally with a focus on Alaska, the Lower 48 in the United States, Norway, and several countries in Asia-Pacific and the Middle East, reported a slight decrease in earnings for the fourth quarter compared to the same period in the previous year. Despite this, ConocoPhillips achieved record production levels and maintained a strong capital return program.

ConocoPhillips (NYSE:COP) reported fourth-quarter earnings of $3.0 billion, or $2.52 per share, compared with $3.2 billion, or $2.61 per share, in the fourth quarter of 2022. Full-year earnings for 2023 were $11.0 billion, or $9.06 per share, a decrease from the $18.7 billion, or $14.57 per share, reported in 2022. Adjusted for special items, the fourth-quarter earnings were $2.9 billion, or $2.40 per share, and full-year adjusted earnings were $10.6 billion, or $8.77 per share.

ConocoPhillips (NYSE:COP) achieved a 123% preliminary reserve replacement ratio, signaling robust resource management and future production potential. The company's production for the fourth quarter of 2023 was 1,902 MBOED, marking a 144 MBOED increase from the previous year. This production growth was attributed to strategic acquisitions and operational milestones, including the acquisition of the remaining 50% interest in Surmont and the final investment decision on the Willow project in Alaska.

Despite the challenges posed by lower commodity prices, which saw an 18% decrease in the company's average realized price per BOE compared to the fourth quarter of 2022, ConocoPhillips (NYSE:COP) demonstrated financial resilience. The company generated $20.0 billion in cash from operating activities and $21.3 billion in CFO for the full year. It also distributed $11.0 billion to shareholders through dividends and share repurchases, underscoring its commitment to returning value to investors.

Looking ahead, ConocoPhillips (NYSE:COP) has set a capital expenditure guidance of $11.0 to $11.5 billion for 2024, with production expected to range between 1.91 to 1.95 MMBOED. The company's focus remains on delivering competitive returns on capital, advancing its net-zero operational emissions ambition, and meeting the demands of the energy transition pathway.

ConocoPhillips (NYSE:COP) is positioned to continue its trajectory of financial and operational success, with a deep and diversified portfolio that supports robust cash flow generation. The company's strategic investments and operational efficiencies have laid a strong foundation for sustainable growth and shareholder returns in the years to come.

Investors and stakeholders can expect ConocoPhillips (NYSE:COP) to maintain its disciplined approach to capital management, as evidenced by its planned $9 billion return of capital in 2024, which includes an ordinary dividend of $0.58 per share and a variable return of cash (VROC) of $0.20 per share.

For more detailed information on ConocoPhillips (NYSE:COP)'s financial performance and strategic outlook, interested parties are encouraged to review the full 8-K filing and listen to the company's conference call, which can be accessed through ConocoPhillips' investor relations website.

Explore the complete 8-K earnings release (here) from ConocoPhillips for further details.

This article first appeared on GuruFocus.