Consensus Cloud Solutions Inc (CCSI) Reports Mixed Financial Results for Q4 and Full Year 2023

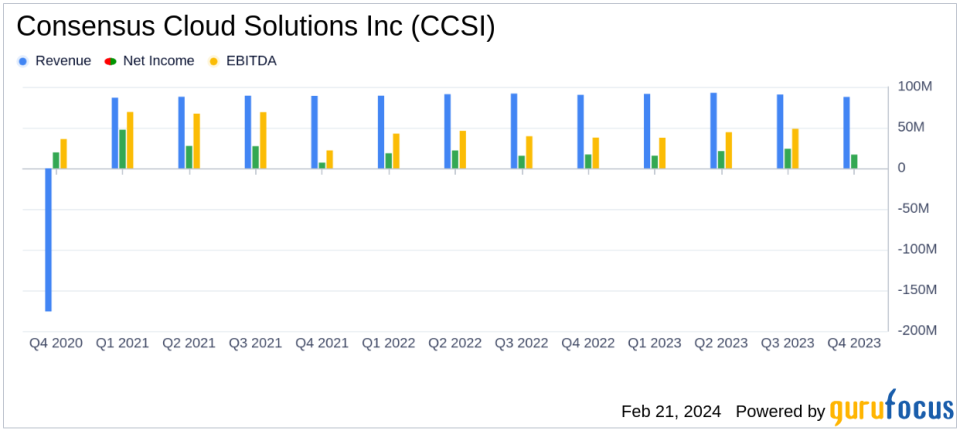

Revenue: Q4 2023 revenue decreased by 2.7% year-over-year, while full-year revenue remained consistent.

GAAP Net Income: Q4 GAAP net income remained stable, with a slight increase in GAAP net income per diluted share.

Adjusted EBITDA: Q4 and full-year Adjusted EBITDA declined compared to the previous year, with margins within forecasted range.

Free Cash Flow: Strong free cash flow generation in Q4 and full-year 2023, with significant debt repayment and stock repurchases.

2024 Outlook: The company provided guidance for 2024, expecting lower revenue but maintaining Adjusted EBITDA and non-GAAP earnings per diluted share.

On February 21, 2024, Consensus Cloud Solutions Inc (NASDAQ:CCSI) released its 8-K filing, detailing its financial performance for the fourth quarter and full year of 2023. As a leading provider of secure information delivery services and a scalable Software-as-a-Service (SaaS) platform, CCSI has faced revenue growth challenges but has managed to maintain a strong free cash flow and a stable GAAP net income.

For Q4 2023, CCSI reported a revenue decrease of 2.7% to $87.8 million compared to $90.2 million for Q4 2022. The decline was primarily due to a decrease in Small office home office (SoHo) revenues, partially offset by an increase in Corporate business. Despite the revenue dip, GAAP net income for the quarter remained consistent at $16.8 million, with GAAP net income per diluted share increasing by 2.4% to $0.87. Adjusted EBITDA for Q4 2023 was $47.2 million, a decline from $49.0 million in Q4 2022, with an Adjusted EBITDA margin of 53.8%, aligning with the company's forecasted range.

Full Year 2023 Performance

For the full year 2023, CCSI's revenues were stable at $362.6 million, with an increase in Corporate business offsetting a decline in SoHo revenues. GAAP net income for the year rose to $77.3 million, up 6.3% from $72.7 million in 2022. This increase was attributed to a reduction in non-income related sales taxes, a gain on debt extinguishment, and interest income from money market investments, despite higher personnel-related expenses. Adjusted non-GAAP net income and Adjusted non-GAAP earnings per diluted share for the year experienced a decrease due to the same personnel-related expenses.

Consensus ended the year with a strong cash position of $88.7 million, after significant cash outlays for debt repurchases, capital expenditures, and repurchases of common stock. The company's focus on cost containment and judicious capital investments has been effective in generating free cash flow, which CEO Scott Turicchi emphasized as a key achievement in the face of revenue growth challenges.

I am pleased with the free cash flow generation in Q4 and full fiscal year 2023. While there have been challenges in growing the revenue, the focus on cost containment, cash generation and debt paydown are bearing fruit. As we look to 2024, we are eliminating inefficient marketing spend and being judicious with our capital investments to continue to generate strong free cash flows that can be deployed for debt retirement, stock repurchases and acquisitions," said Scott Turicchi, CEO of Consensus.

Looking Ahead: 2024 Guidance

For 2024, CCSI provided guidance anticipating a decrease in revenue to a range of $338 million to $353 million. However, the company expects to maintain its Adjusted EBITDA between $182 million and $194 million and Adjusted non-GAAP earnings per diluted share between $5.08 and $5.31. The Q1 2024 guidance also forecasts revenue between $85 million and $89 million, with Adjusted EBITDA and Adjusted non-GAAP earnings per diluted share expected to remain robust.

The company's performance reflects its resilience in a challenging market, with a focus on maintaining profitability and shareholder value through strategic financial management. As Consensus Cloud Solutions continues to navigate the evolving landscape of digital information delivery, its ability to generate strong free cash flow and maintain stable net income will be critical for long-term success.

For more detailed financial information and to view the full earnings report, please visit the 8-K filing.

Explore the complete 8-K earnings release (here) from Consensus Cloud Solutions Inc for further details.

This article first appeared on GuruFocus.