Consider Camden National (CAC) Stock for 6% Dividend Yield

In this current backdrop, when the banking industry is facing uncertain macroeconomic conditions, investors should watch solid dividend-yielding stocks. Today, we are discussing one such stock, Camden National Corporation CAC.

This Camden, ME-based company provides various commercial and consumer banking products and services. CAC has been paying dividends on a regular basis and raising the same too. The last hike of 5% to 42 cents per share was announced in September 2022.

In the past five years, it increased dividends four times, with an annualized dividend growth rate of 8.8%.

Considering last day’s closing price of $28.05 per share, Camden National’s dividend yield currently stands at 5.99%. This is impressive compared with the industry’s average of 3.22%, attracting investors as it represents a steady income stream.

Camden National Corporation Dividend Yield (TTM)

Camden National Corporation dividend-yield-ttm | Camden National Corporation Quote

Is the Camden National stock worth a look to earn a high dividend yield? Let’s check the company's financials to understand the risks and rewards.

Apart from regular quarterly dividend payouts, CAC has a share buyback program in place. In January 2023, the company’s board authorized the repurchase of 0.75 million shares. It replaced the prior buyback program that was announced in January 2022. As of Jun 30, 2023, almost 0.68 million shares remained available. The plan is set to expire on Jan 3, 2024.

CAC has been witnessing consistent organic growth. The company’s net revenues witnessed a compound annual growth rate (CAGR) of 4.1% over the last five years (2017-2022). The rise was mainly driven by solid loan and deposit balances. In the same time frame, net loans witnessed a CAGR of 5.8% and deposits saw a CAGR of 6.9%.

Supported by steady loan demand and high rates, along with the efforts to strengthen fee income. Camden National’s top-line growth is expected to continue in the near term. The company expects fee income to be roughly $10 million in the third quarter of 2023, in line with the second-quarter level.

With the Federal Reserve expected to keep interest rates high, CAC’s net interest margin (NIM) is likely to keep rising, though the pace of growth will slow down on higher funding costs. Management expects NIM in the third quarter to be relatively flat sequentially at 2.40%.

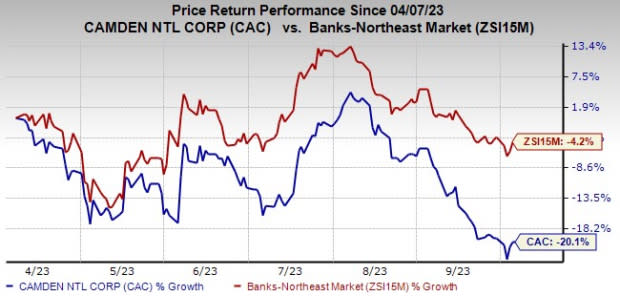

Despite near-term headwinds that include elevated expenses and a tough operating environment, the CAC stock is fundamentally solid. In the past six months, shares of this Zacks Rank #2 (Buy) company have lost 20.1% compared with the industry's fall of 4.2%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Image Source: Zacks Investment Research

Therefore, income investors should keep this stock on their radar as this will help generate robust returns over time.

Other Bank Stocks With Solid Dividends

Banking stocks like Financial Institutions, Inc. FISI and Washington Trust Bancorp, Inc. WASH are worth a look as these, too, have robust dividend yields.

Considering the last day’s closing price, Financial Institutions’ dividend yield currently stands at 7.22%. In the past three months, shares of FISI have rallied 6.9%.

Based on the last day’s closing price, Washington Trust Bancorp’s dividend yield currently stands at 8.75%. In the past three months, shares of WASH have lost 1.2%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Financial Institutions, Inc. (FISI) : Free Stock Analysis Report

Camden National Corporation (CAC) : Free Stock Analysis Report

Washington Trust Bancorp, Inc. (WASH) : Free Stock Analysis Report