Should You Consider Huntington (HBAN) for Its Dividend Yield?

Huntington Bancshares HBAN is one solid dividend-yielding stock that investors prefer to hold in their portfolios amid hovering recession fears in the near term.

Headquartered in Columbus, OH, this multi-state diversified regional bank, through its banking subsidiary, The Huntington National Bank, provides a comprehensive suite of banking, payments, wealth management, and risk management products and services.

HBAN has been paying its quarterly dividends on a regular basis, along with occasional raises. The last hike of 3.3% to 15.5 cents per share was announced in October 2021. Over the past five years, it increased dividends thrice, with an annualized dividend growth rate of 2.25%.

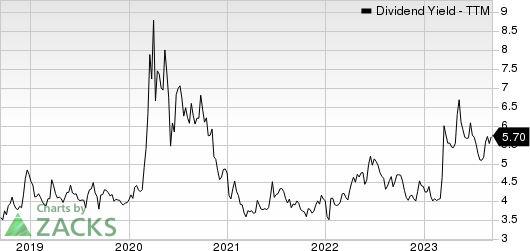

Considering last day’s closing price of $10.87 per share, the company’s current dividend yield is 5.7%. This is impressive compared with the industry’s average of 3.53% and attracts investors as it represents a steady income stream.

Huntington Bancshares Incorporated Dividend Yield (TTM)

Huntington Bancshares Incorporated dividend-yield-ttm | Huntington Bancshares Incorporated Quote

HBAN also has a steady share repurchase program in place. In January 2023, the company’s board authorized the repurchase of common shares worth $1 billion till Dec 31, 2024.

However, it did not repurchase shares under the current authorization in the first half of 2023. Also, management does not expect to utilize this program in the current year as part of its 2023 plan to improve its capital position.

As of Jun 30, 2023, Huntington had cash and due from banks, and interest-bearing deposits at Federal Reserve Bank of $11.08 billion and total debt (comprising of long-term debt and short-term borrowings) of $16.39 billion. The company’s largest source of liquidity is core deposits, a source of stable funding. Core deposits were $142.9 billion at June 2023-end and comprised 97% of the total deposits. Given its decent liquidity, dividend payments seem sustainable.

Huntington, one of the top 30 bank holding companies in the United States, remains focused on acquiring the industry's best deposit franchise. The company’s total deposits saw a four-year compounded annual growth rate (CAGR) of 21.6% in 2022. The rising trend continued in the first half of 2023.

The company’s loan balance rose in 2022, seeing a four-year CAGR of 16.6%. The uptrend continued in the first half of 2023. Given the strength in loans and deposits, the balance sheet is poised to grow. Management expects average loans to grow 5-6% in 2023, while average deposits are expected to increase 1-3%.

With expectations of the Federal Reserve keeping interest rates high in the near term, Huntington’s net interest income (NII) and the yield on interest-earning assets are expected to witness decent growth. The company projects 2023 NII (excluding Paycheck Protection Program or PPP and Purchase Accounting Accretion) to grow 3-5%, aided by higher earning assets.

On the flipside, weak mortgage business due to higher rates is expected to ail fee income in the near term. Further, rising costs may hinder bottom-line growth. Also, loan concentration, comprising 56% of commercial loans in the total loan portfolio, is concerning.

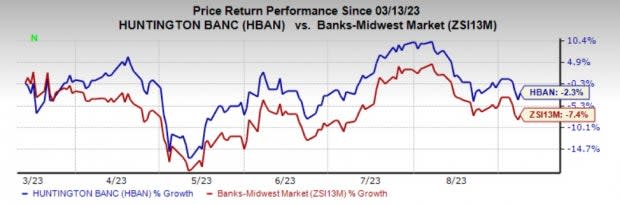

Over the past six months, shares of HBAN have lost 2.3% compared with the industry’s fall of 7.4%.

Image Source: Zacks Investment Research

HBAN currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Bank Stocks With Attractive Dividend Yields

Banking stocks like The PNC Financial Services Group, Inc. PNC and Citigroup C are worth a look as these, too, have robust dividend yields.

Considering the last day’s closing price, PNC’s dividend yield is pegged at 5.30%. In the past three months, shares of PNC have declined 8.2%.

Based on the last day’s closing price, Citigroup’s dividend yield is pinned at 5.22%. In the past three months, shares of C have declined 16.2%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Citigroup Inc. (C) : Free Stock Analysis Report

The PNC Financial Services Group, Inc (PNC) : Free Stock Analysis Report

Huntington Bancshares Incorporated (HBAN) : Free Stock Analysis Report