CONSOL Energy Inc. (CEIX) Reports Strong Earnings Amidst Export Market Shift

Net Income: $655.9 million for the full year, with Q4 contributing $157.1 million.

Earnings Per Share: GAAP dilutive earnings per share of $19.79 for the full year and $5.05 for Q4.

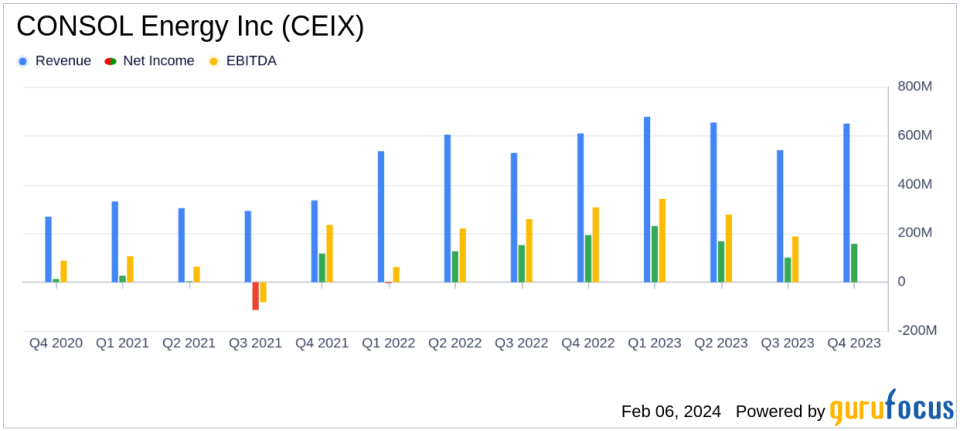

Revenue: Total revenue and other income reached $2,568.9 million in 2023, with Q4 accounting for $649.4 million.

Free Cash Flow: A record $686.9 million for the full year, with $165.0 million generated in Q4.

Debt Reduction: Reduced total debt outstanding by $189.0 million, fully retiring Second Lien Notes and Term Loan B.

Share Repurchases: Repurchased 5.2 million shares at a weighted average price of $75.69 per share.

Coal Sales: PAMC sales volume increased by 8% to 26.0 million tons, the highest level in the post-COVID era.

On February 6, 2024, CONSOL Energy Inc (NYSE:CEIX) released its 8-K filing, detailing its financial and operating results for the fourth quarter and full year of 2023. The company, a leading producer and exporter of high-BTU bituminous thermal coal, operates longwall mining operations and export terminals on the Eastern seaboard. CONSOL Energy's primary business involves the mining, preparation, and marketing of thermal coal, primarily to power generators, with its PAMC segment being the major revenue generator.

Financial and Operational Performance

CONSOL Energy's financial achievements in 2023 are significant, particularly in the context of the energy sector's ongoing transformation. The company's strategic pivot towards the export market has resulted in record annual throughput volume and revenue at its CONSOL Marine Terminal (CMT), with 70% of its total recurring revenues and other income derived from export sales. This shift has not only diversified the company's revenue streams but also reduced its reliance on domestic power generation markets, which are subject to regulatory and market pressures as the global energy mix evolves.

The company's robust free cash flow, which amounted to $686.9 million for the full year, underscores its operational efficiency and ability to generate significant cash from its core operations. This financial strength has enabled CONSOL Energy to return value to shareholders through aggressive stock repurchases and dividends, as well as to reduce its debt burden, thereby improving its balance sheet and financial flexibility.

Key Financial Metrics

CONSOL Energy's performance in 2023 was marked by several key financial metrics that reflect the company's strong position in the industry:

Financial Metric | Q4 2023 | Full Year 2023 |

|---|---|---|

GAAP Net Income | $157.1 million | $655.9 million |

Adjusted EBITDA | $239.9 million | $1,047.7 million |

Net Cash Provided by Operating Activities | $219.1 million | $858.0 million |

Free Cash Flow | $165.0 million | $686.9 million |

Total Revenue and Other Income | $649.4 million | $2,568.9 million |

These metrics are crucial as they demonstrate the company's profitability (net income), operational efficiency (adjusted EBITDA), liquidity (net cash provided by operating activities), and the ability to generate cash beyond its capital expenditure needs (free cash flow). The total revenue and other income reflect the company's top-line growth and ability to capitalize on market opportunities.

Management Commentary and Outlook

CEO Jimmy Brock highlighted the company's operational excellence and financial discipline, stating,

During the fourth quarter of 2023, we delivered a strong operational performance to close out our third consecutive year of production and sales volume growth for CONSOL Energy."

Brock also emphasized the strategic shift towards the export market and the expectation of improving contributions from the Itmann Mining Complex.

Looking ahead, CONSOL Energy provides guidance for 2024, projecting PAMC coal sales volume of 25.0-27.0 million tons and an average realized coal revenue per ton sold of $62.50-$66.50. The company also anticipates an average cash cost of coal sold per ton of $36.50-$38.50, reflecting ongoing cost management efforts.

CONSOL Energy's performance in 2023, coupled with its strategic positioning and financial prudence, positions the company well for continued success in the evolving energy landscape. Investors and stakeholders can look forward to a company that is not only weathering the challenges of the industry but also capitalizing on opportunities to create value.

For more detailed financial information and operational insights, interested parties are encouraged to review the full 8-K filing and the upcoming Form 10-K, which will be filed with the SEC on February 9, 2024.

Explore the complete 8-K earnings release (here) from CONSOL Energy Inc for further details.

This article first appeared on GuruFocus.