Constellation Brands (NYSE:STZ) Misses Q3 Sales Targets

Beer, wine, and spirits company Constellation Brands (NYSE:STZ) missed analysts' expectations in Q3 FY2024, with revenue up 1.4% year on year to $2.47 billion. It made a non-GAAP profit of $3.19 per share, improving from its profit of $2.83 per share in the same quarter last year.

Key Takeaways from Constellation Brands's Q3 Results

It was encouraging to see Constellation Brands slightly top analysts' EPS expectations this quarter based on better operating profit. It was also good to see its gross margin narrowly outperformed Wall Street's estimates. However, revenue missed due to underperformance in the 'Wines & Spirits' segment. Additionally, full-year earnings guidance missed analysts' expectations. Overall, this was a mixed quarter for Constellation Brands. The stock is flat after reporting and currently trades at $243.99 per share.

Is now the time to buy Constellation Brands? Find out by accessing our full research report, it's free.

Constellation Brands (STZ) Q3 FY2024 Highlights:

Market Capitalization: $44.51 billion

Revenue: $2.47 billion vs analyst estimates of $2.54 billion (2.6% miss)

EPS (non-GAAP): $3.19 vs analyst estimates of $3.00 (6.5% beat)

Free Cash Flow of $394.9 million, down 39.4% from the previous quarter

Gross Margin (GAAP): 51.4%, up from 50.5% in the same quarter last year

Organic Revenue was up 2% year on year

With a presence in more than 100 countries, Constellation Brands (NYSE:STZ) is a globally renowned producer and marketer of beer, wine, and spirits.

Beverages and Alcohol

The beverages and alcohol category encompasses companies engaged in the production, distribution, and sale of refreshments like beer, wine, and spirits, along with soft drinks, juices, and bottled water. These companies' performance is influenced by brand strength, marketing strategies, and shifts in consumer preferences. Changing consumption patterns are particularly relevant and can be seen in the explosion of alcoholic craft beer drinks or the steady decline of non-alcoholic sugary sodas. The industry is highly competitive, with a diverse range of products from large multinational corporations, niche brands, and startups vying for market share. It's also subject to varying degrees of government regulation and taxation, especially for alcoholic beverages.

Sales Growth

Constellation Brands is one of the larger consumer staples companies and benefits from a well-known brand, giving it customer mindshare and influence over purchasing decisions.

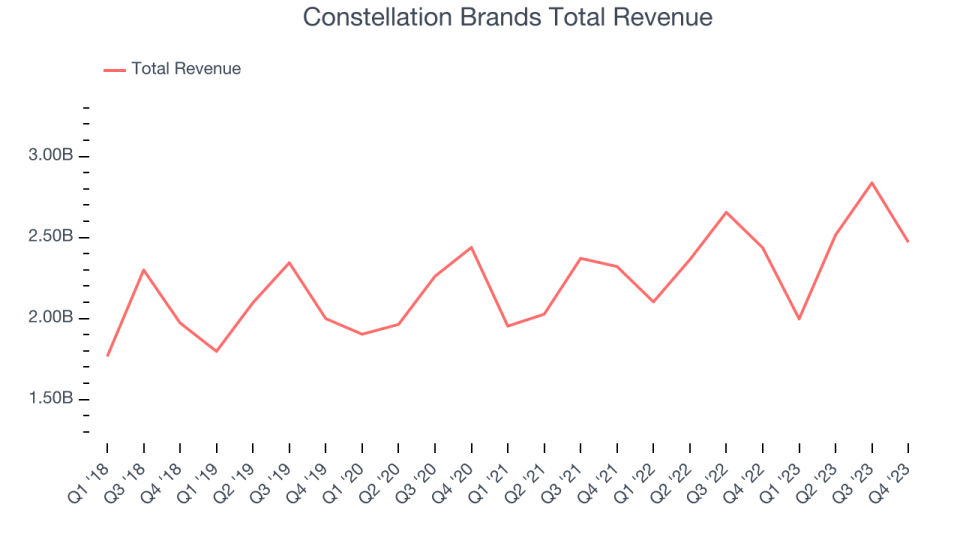

As you can see below, the company's annualized revenue growth rate of 4.7% over the last three years was mediocre for a consumer staples business.

This quarter, Constellation Brands's revenue grew 1.4% year on year to $2.47 billion, falling short of Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 7.9% over the next 12 months, an acceleration from this quarter.

Our recent pick has been a big winner, and the stock is up more than 2,000% since the IPO a decade ago. If you didn’t buy then, you have another chance today. The business is much less risky now than it was in the years after going public. The company is a clear market leader in a huge, growing $200 billion market. Its $7 billion of revenue only scratches the surface. Its products are mission critical. Virtually no customers ever left the company. You can find it on our platform for free.

Organic Revenue Growth

When analyzing revenue growth, we care most about organic revenue growth. This metric captures a business's performance excluding the impacts of foreign currency fluctuations and one-time events such as mergers, acquisitions, and divestitures.

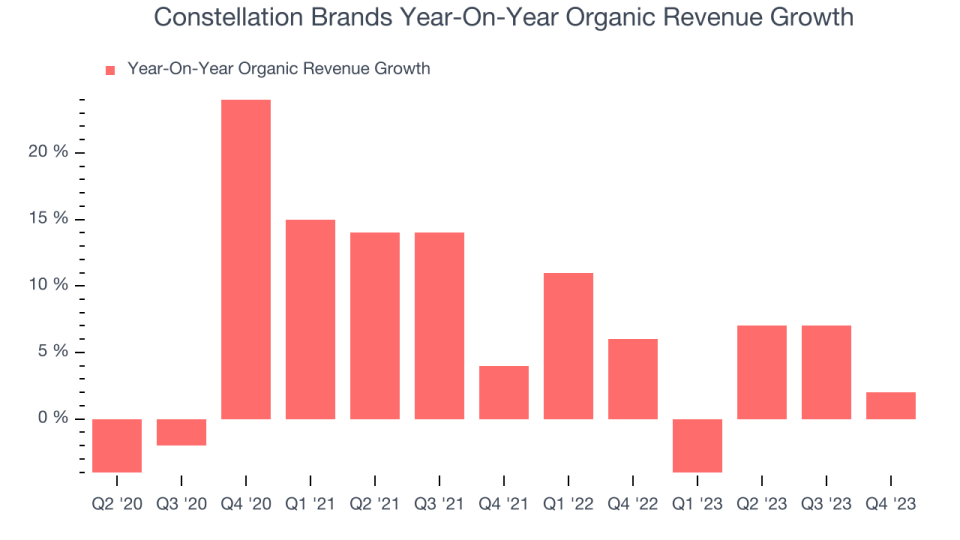

The demand for Constellation Brands's products has generally risen over the last two years but lagged behind the broader sector. On average, the company's organic sales have grown by 4.8% year on year.

In the latest quarter, Constellation Brands's organic sales rose 2% year on year. By the company's standards, this growth was a meaningful deceleration from the 6% year-on-year increase it posted 12 months ago. We'll be watching Constellation Brands closely to see if it can reaccelerate growth.

Constellation Brands may not have had the best quarter, but does that create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.