Constellation Brands (STZ) Beats on Q3 Earnings, Raises View

Constellation Brands, Inc. STZ has reported third-quarter fiscal 2024 results, wherein the bottom line beat the Zacks Consensus Estimate, while sales missed. The company’s sales and earnings improved year over year. Results have primarily gained from the continued strong performance of the beer business. Management has raised its guidance for fiscal 2024.

Comparable earnings of $3.19 per share for the fiscal third quarter grew 13% year over year and surpassed the Zacks Consensus Estimate of $3.03. On a reported basis, the company has recorded earnings of $2.76, up 10% from the year-ago quarter. Excluding the impacts of Canopy Growth, the company has posted comparable earnings of $3.24 per share, up 8% from the year-ago period.

Net sales rose 1% year over year to $2,471 million but missed the Zacks Consensus Estimate of $2,551 million. Sales growth was driven by continued strength in the beer business on high-single-digit depletion growth and the continued sales momentum in the Modelo brand family.

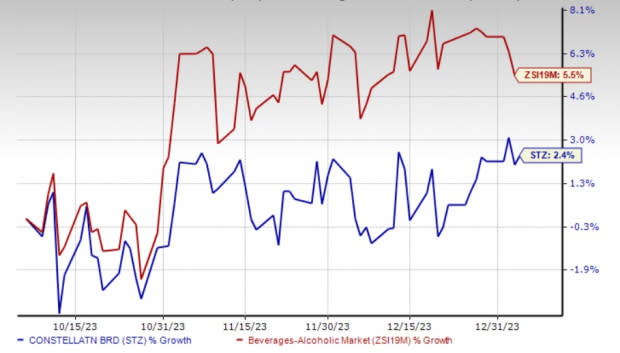

Shares of the Zacks Rank #3 (Hold) company have risen 2.4% in the past three months compared with the industry’s growth of 5.5%.

Image Source: Zacks Investment Research

Q3 Details

The company’s sales for the beer business advanced 4% year over year to $1,968.5 million, driven by a 3.4% increase in shipment volumes and 8.2% depletion growth. Depletion volume benefited from the continued strong demand for its high-end brand portfolio, including Modelo Especial, Corona Extra, Pacifico and Modelo Chelada brands.

The depletion volume increased 12% for Modelo Especial and 22% for Modelo Chelada. Additionally, depletions improved 1% for Corona Extra and 19% for Pacifico.

Sales in the wine and spirits segment declined 8% to $502.4 million in the fiscal third quarter. Sales were affected by lower shipments and depletions for the segment. The shipment volume in the wine and spirits business declined 11.6% year over year, whereas depletions dropped 10%. Organic sales for the segment declined 7%, including a 10.3% fall in organic shipments.

Constellation Brands Inc Price, Consensus and EPS Surprise

Constellation Brands Inc price-consensus-eps-surprise-chart | Constellation Brands Inc Quote

Margins

Constellation Brands' comparable operating income was $819.8 million, up 7% from the prior-year quarter’s $769.7 million.

Operating income for the beer segment improved 7% year over year to $757.3 million. The operating margin for the beer segment expanded 100 bps to 38.5% due to sales growth, pricing actions, lower marketing spend and cost efficiencies. This was partly negated by higher raw material costs due to the ongoing inflationary pressures, increased depreciation and operating costs from brewery capacity expansions.

Operating income for the wine and spirits segment declined 5% year over year to $127.6 million. The segment’s operating margin contracted 60 bps to 25.4%, mainly on lower shipment volume, which partly offset the gains from lower freight, warehousing and material costs, and planned efficiencies in marketing expenses.

Financial Position

As of Nov 30, 2023, Constellation Brands’ cash and cash equivalents were $78.7 million, long-term debt (excluding current maturities) was $10,282.3 million and total shareholders’ equity (excluding non-controlling interest) was $9,471 million. The company generated an operating cash flow of $2,346.8 million and an adjusted free cash flow of $1,434.9 million as of Nov 30.

On Jan 4, 2024, the company announced a quarterly dividend of 89 cents per share for Class A stock. The dividend is payable on Feb 24 to its shareholders of record as of Feb 8.

Outlook

Constellation Brands has raised its outlook for fiscal 2024, backed by the continued strong performance of its beer portfolio. The company is confident of delivering strong operating income for its beer business in fiscal 2024. Management also expects higher enterprise operating cash flow and free cash flow in fiscal 2024.

The company has reaffirmed its comparable earnings guidance of $12.00-$12.20 per share (excluding canopy growth impacts) for fiscal 2024. Notably, it reported comparable earnings of $10.65 per share and $11.40 (excluding canopy growth impacts) for fiscal 2023. Comparable earnings per share are anticipated to be $11.77-$11.97 for fiscal 2024.

Constellation Brands anticipates earnings of $9.15-$9.35 per share on a reported basis compared with $9.60-$9.80 stated earlier. On a reported basis, STZ has posted a loss of 11 cents for fiscal 2023.

Net sales are likely to increase 8-9% for the beer segment, with the operating income rising 7-8% (6-7% growth expected earlier). The company expects organic net sales for the wine and spirits business to decline 7-9% in fiscal 2024. The operating income for the wine and spirits segment is envisioned to dip 6-8% compared with 2-4% growth stated earlier.

The company predicts interest expenses of $450 million for fiscal 2024, while corporate expenses are expected to be $260-$270 million. It anticipates a comparable tax rate of 19%, excluding the impacts of Canopy equity earnings. On a reported basis, STZ estimates a tax rate of 20% for fiscal 2024. The company expects weighted average diluted shares outstanding of 184 million at the end of fiscal 2024.

Constellation Brands forecasts an operating cash flow of $2.6-$2.8 billion for fiscal 2024 compared with $2.4-$2.6 billion mentioned earlier. The company expects a free cash flow of $1.4-$1.5 billion versus $1.2-$1.3 billion stated earlier. STZ plans to incur a capital expenditure of $1.2-$1.3 billion in fiscal 2024.

Stocks to Consider

We highlighted some better-ranked stocks from the broader Consumer Staples space, namely Dutch Bros BROS, Fomento Economico Mexicano FMX and Molson Coors TAP.

Dutch Bros currently sports a Zacks Rank #1 (Strong Buy). BROS has a trailing four-quarter earnings surprise of 57.1%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Dutch Bros’ current financial-year sales and earnings suggests growth of 30.6% and 81.3%, respectively, from the prior-year reported levels. The consensus mark for BROS’ earnings per share has been unchanged in the past 30 days.

Fomento Economico Mexicano, alias FEMSA, currently flaunts a Zacks Rank #1. FMX has a trailing four-quarter earnings surprise of 23.2%, on average.

The Zacks Consensus Estimate for FEMSA’s current financial-year sales and earnings indicates increases of 32.3% and 60.3%, respectively, from the year-ago reported numbers. The consensus mark for FMX’s earnings per share has been unchanged in the past 30 days.

Molson Coors currently carries a Zacks Rank #2 (Buy). TAP has a trailing four-quarter earnings surprise of 41.3%, on average.

The Zacks Consensus Estimate for Molson Coors’ current financial year’s sales and earnings implies an improvement of 9.1% and 28.8%, respectively, from the year-ago reported number. The consensus mark for TAP’s earnings per share has been unchanged in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fomento Economico Mexicano S.A.B. de C.V. (FMX) : Free Stock Analysis Report

Molson Coors Beverage Company (TAP) : Free Stock Analysis Report

Constellation Brands Inc (STZ) : Free Stock Analysis Report

Dutch Bros Inc. (BROS) : Free Stock Analysis Report