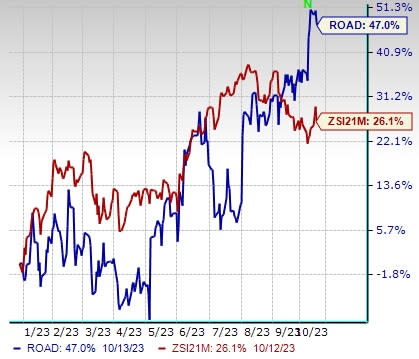

Construction Partners (ROAD) Gains 47% YTD: What's Aiding It?

Construction Partners, Inc. ROAD is benefiting from accretive acquisitions, solid backlog level and strategic business initiatives.

Shares of this vertically integrated civil infrastructure company have gained 47% in this year so far, outperforming the Zacks Building Products - Miscellaneous industry’s 26.1% growth.

Earnings estimates for fiscal 2024 have increased to $1.28 per share from $1.16 per share over the past 30 days, portraying 47.1% year-over-year growth.

Image Source: Zacks Investment Research

Furthermore, this Zacks Rank #1 (Strong Buy) company solidifies the growth prospect with a VGM Score of A, backed by a Growth Score of A and a Value Score of B. The positive trend signifies bullish analysts’ sentiments, robust fundamentals and the continuation of an outperformance in the near term.

Here’s What Makes the Stock a Desirable Pick

Accretive Buyouts: Construction Partners follows a profitable buyout strategy, which enhances as well as expands its product offerings and geographical reach. On Oct 2, 2023, the company strengthened its presence in the dynamic Upstate region of South Carolina with the acquisition of Hubbard Paving & Grading, Inc. This added a hot-mix asphalt plant and construction operations to its subsidiary company King Asphalt, Inc.

Furthermore, on Aug 1, the company acquired a hot-mix asphalt plant in Myrtle Beach, SC from C.R. Jackson, Inc. and established a new greenfield hot-mix asphalt plant and market in Waycross, GA. Also, on May 1, it acquired the Huntsville, AL, operations of Southern Site Contractors, LLC.

The company is optimistic that the availability of its credit facility and cash-generation potential will continue to provide it flexibility and capacity for its potential near-term acquisitions and high-value growth opportunities.

Solid Backlog: Increased infrastructure spending accompanied by growing relative market share in its local markets and other organic growth opportunities have resulted in impressive backlog growth for Construction Partners. Furthermore, the Infrastructure Investment and Jobs Act’s investment in public infrastructure, which is now in effect throughout the US, creates opportunities for road widening and resurfacing, bridge replacements, airport taxiways, and many other types of good opportunities for the company.

The company’s efficient business strategies and service offerings have aided it in achieving the growth trend. In the fiscal third quarter of 2023, the company reported a record backlog of $1.59 billion, reflecting continued strong demand momentum.

Strategic Initiatives: Construction Partners follows profitable business strategies, which help it to maintain its growth momentum despite the uncertain economic conditions.

The company’s local market dynamic approach is helping it gain market share. Through this approach, the company has strategically positioned itself to win routine and maintenance-related projects, thus enabling its growth trend. Also, its focus on short-duration and low-risk projects has increased its profit band and helped it to maintain the upward momentum.

Moreover, its ROAD-Map 2027 margin expansion strategy bodes well. Through this strategy, the company intends to achieve 13-14% adjusted EBITDA margin by 2027.

Other Key Picks

Some other top-ranked stocks from the Construction sector are EMCOR Group, Inc. EME, Fluor Corporation FLR and Toll Brothers, Inc. TOL.

EMCOR currently sports a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

EME delivered a trailing four-quarter earnings surprise of 17.2%, on average. Shares of the company have risen 70.1% in the past year. The Zacks Consensus Estimate for EME’s 2023 sales and earnings per share (EPS) indicates growth of 11.3% and 35.4%, respectively, from the previous year’s reported levels.

Fluor currently flaunts a Zacks Rank of 1. FLR delivered a trailing four-quarter negative earnings surprise of 5.3%, on average. Shares of the company have gained 43.3% in the past year.

The Zacks Consensus Estimate for FLR’s 2023 sales and EPS indicates growth of 12.6% and 159.8%, respectively, from the previous year’s reported levels.

Toll Brothers currently sports a Zacks Rank of 1. TOL delivered a trailing four-quarter earnings surprise of 31.4%, on average. Shares of the company have surged 73.4% in the past year.

The Zacks Consensus Estimate for TOL’s fiscal 2024 sales and EPS indicates growth of 4% and 1.5%, respectively, from the previous year’s reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fluor Corporation (FLR) : Free Stock Analysis Report

Toll Brothers Inc. (TOL) : Free Stock Analysis Report

EMCOR Group, Inc. (EME) : Free Stock Analysis Report

Construction Partners, Inc. (ROAD) : Free Stock Analysis Report