Construction Stock Earnings Due on Apr 27: MAS, MLM, WY & More

The Zacks Construction sector has generated impressive results so far this earnings season. Although numbers were down year over year due to difficult comparison, most firms’ results surpassed the Zacks Consensus Estimate for the top and the bottom line. The sector has been banking on improving demand for housing and remodelling activities and solid growth in the infrastructural and public construction spending.

The rising demand for non-residential and infrastructural activities for public project work are expected to have supported growth. Other factors like favorable weather, prudent cost-saving efforts, a disciplined approach to bidding, project management, strength in funding programs across the states and rapid fiber deployments are added positives. These above-mentioned tailwinds are expected to have contributed to the quarterly performances of Masco Corporation MAS, Martin Marietta Materials, Inc. MLM, Weyerhaeuser Company WY, Meritage Homes Corporation MTH and Eagle Materials Inc. EXP, due on Jul 27.

Yet, supply-chain woes, material and labor constraints and project delays are a concern.

Per the latest Earnings Outlook, construction sector earnings are expected to decline 24.4% year over year in the to-be-reported quarter, compared with 19.1% fall registered in first-quarter 2023. Revenues are projected to slip 0.4% year over year, versus a rise of 2.8% registered in the last reported quarter.

A Handful of Construction Stocks to Watch

A handful of companies from the construction space are likely to release their respective quarterly results on Jul 27. Let’s take a quick glance at how these stocks are poised ahead of their respective earnings release.

According to the Zacks model, the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Masco is slated to report second-quarter results before the opening bell. The chances of MAS delivering an earnings beat are low this time around as it has an Earnings ESP of -1.86% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

For the quarter to be reported, the Zacks Consensus Estimate for earnings per share has moved up to 96 cents from 95 cents in the past seven days. The estimated figure indicates a 15.8% decline from the year-ago quarter’s level. For net sales, the consensus mark is pegged at $2.1 billion, suggesting a decline of 10.9% from the year-ago quarter’s reported figure.

Masco Corporation Price and EPS Surprise

Masco Corporation price-eps-surprise | Masco Corporation Quote

Masco is likely to have witnessed lower net sales on a year-over-year basis in second-quarter 2023. Restricted consumer spending and increased interest rates, reflecting soft housing demand, are expected to have dented Masco’s revenue performance. (Read more: Soft Consumer Spending to Hurt Masco's Q2 Earnings Y/Y)

Martin Marietta is scheduled to report second-quarter 2023 results before the opening bell. MLM is likely to beat earnings this time as it has a Zacks Rank #2 and an Earnings ESP of +0.41%.

The Zacks Consensus Estimate for Martin Marietta’s second-quarter earnings is pegged at $4.83 per share, suggesting a rise of 22% from the year-ago quarter’s reported figure of $3.96. The consensus estimate for net sales is pegged at $1.82 billion, indicating a 19.7% increase from the prior-year quarter’s reported figure of $1.52 billion.

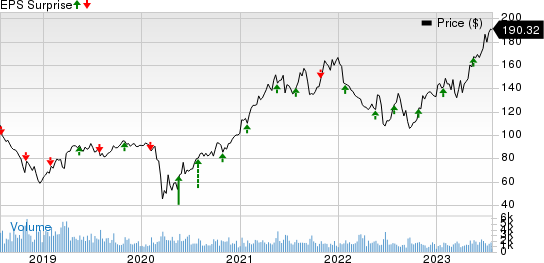

Martin Marietta Materials, Inc. Price and EPS Surprise

Martin Marietta Materials, Inc. price-eps-surprise | Martin Marietta Materials, Inc. Quote

Martin Marietta’s second-quarter results are expected to have improved on the back of strong pricing gains in aggregates, strength in public construction and accretive acquisitions. (Read more: Product Demand, Pricing to Aid Martin Marietta Q2 Earnings)

Weyerhaeuser is slated to report second-quarter 2023 results after the closing bell. WY has an Earnings ESP of -0.49% and sports a Zacks Rank #1, which does not conclusively predicts an earnings beat this time around.

The Zacks Consensus Estimate for the to-be-reported quarter’s earnings has remained unchanged at 21 cents per share in the past 60 days. The estimated figure indicates a plunge of 80.2% from the year-ago level. The consensus mark for revenues is $2.03 billion, suggesting a 31.8% year-over-year decline.

Weyerhaeuser Company Price and EPS Surprise

Weyerhaeuser Company price-eps-surprise | Weyerhaeuser Company Quote

Slow construction activities are expected to have weighed on Weyerhaeuser’s second-quarter 2023 results on a year-over-year basis. Precisely, a slow housing market and weakness in the Wood Products segment are likely to have affected the company’s quarterly performance on a year-over-year basis. (Read more: Factors Setting the Tone for Weyerhaeuser's Q2 Earnings)

Meritage Homes is slated to report second quarter results after market close. The chances of MTH delivering an earnings beat are high this time around as it has an Earnings ESP of +0.98% and a Zacks Rank #2.

The Zacks Consensus Estimate for second-quarter 2023 earnings per share has increased to $3.49 from $3.47 in the past 30 days. The estimated figure indicates a 48.5% decline from the year-ago quarter’s reported value. For Homebuilding revenues, the consensus mark is pegged at $1.31 billion, suggesting a decline of 7.2% from the year-ago quarter’s reported figure.

Meritage Homes Corporation Price and EPS Surprise

Meritage Homes Corporation price-eps-surprise | Meritage Homes Corporation Quote

Low housing demand owing to high mortgage rates, ongoing inflationary pressure, increased fuel and equipment costs, high labor expenses and insurance costs are likely to have hurt second-quarter numbers. (Read more: Here's What to Expect From Meritage Homes' Q2 Earnings)

Eagle Materials is scheduled to report first-quarter fiscal 2024 results, before the opening bell. EXP is not likely to deliver earnings beat this time as it has an Earnings ESP of -6.73% and carries a Zacks Rank #3.

The Zacks Consensus Estimate for the to-be-reported quarter’s earnings has declined to $3.54 per share from $3.57 in the past 30 days. The estimated figure indicates an increase of 25.5% from the year-ago quarter’s level. The consensus mark for revenues is $605.2 million, suggesting a 7.8% year-over-year growth.

Eagle Materials Inc Price and EPS Surprise

Eagle Materials Inc price-eps-surprise | Eagle Materials Inc Quote

Improved demand trends and good pricing momentum are expected to have contributed to Eagle Materials’ fiscal first-quarter revenue growth. (Read more: Here's What to Expect From Eagle Materials' Q1 Earnings)

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Weyerhaeuser Company (WY) : Free Stock Analysis Report

Masco Corporation (MAS) : Free Stock Analysis Report

Meritage Homes Corporation (MTH) : Free Stock Analysis Report

Martin Marietta Materials, Inc. (MLM) : Free Stock Analysis Report

Eagle Materials Inc (EXP) : Free Stock Analysis Report