Consumer Emergency Expenses Rise 16% Year-Over-Year to $1,700, Far Exceeding The $400 Benchmark

LendingClub and PYMNTS Research Shows Young and Affluent Are Hit More Frequently by Unexpected Expenditures

SAN FRANCISCO, June 26, 2023 /PRNewswire/ -- LendingClub Corporation (NYSE: LC), the parent company of LendingClub Bank, America's leading digital marketplace bank, today released findings from the 23rd edition of the Reality Check: Paycheck-To-Paycheck research series, conducted in partnership with PYMNTS. The Emergency Spending Deep Dive Edition examines the impact of financial stressors, such as emergency spending, on consumers' ability to manage expenses and put aside savings as well as the rising trend in unexpected expenditures among young and affluent consumers. The series draws on insights from a survey of 3,620 U.S. consumers conducted from May 3 to May 18, as well as analysis of other economic data.

In May 2023, the Federal Reserve released the "Economic Well-Being of U.S. Households in 2022," the latest edition of an annual report often used in measurements of financial well-being.1 Since 2013, these annual reports have tracked consumers' stated ability to afford a theoretical $400 emergency expense — a number that seems outdated in today's economic environment.

LendingClub and PYMNTS have examined this topic since 2022 and have found that the $400 benchmark does not accurately reflect today's consumer experience. In fact, two-thirds of the unexpected expenses* consumers experienced cost more than the benchmark of $400, with 41% spending double that amount or more. Furthermore, the average emergency expense was approximately $1,700, reflecting a year-over-year growth of 16%.

"It's very clear that the $400 emergency expense benchmark is no longer an accurate figure to use when assessing a consumer's overall financial well-being as it doesn't factor in inflation over the last decade or address the macroeconomic volatility we've seen since the beginning of the pandemic," said Alia Dudum, LendingClub's Money Expert. "Despite their best efforts to live within their means, consumers face unexpected expenses regularly that stress their budgets and impact their ability to meet their financial obligations causing the financial health of many to remain fragile."

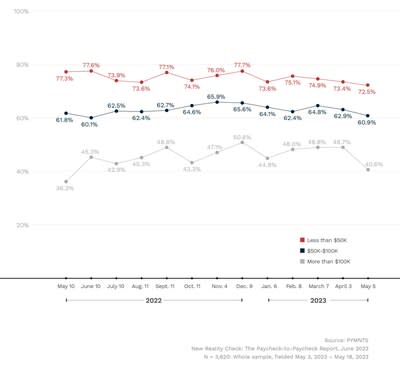

Today's Paycheck-to-Paycheck Landscape

In May 2023, 57% of consumers lived paycheck to paycheck, with fewer struggling to pay bills compared to May 2022. This can be explained by fluctuations in financial lifestyle among high-income consumers. For instance, in May 2023, 41% of consumers earning more than $100,000 annually reported living paycheck to paycheck, an 8 percentage point drop from April 2023. The recent shifts in financial lifestyle indicate that consumers are finding ways to mitigate ongoing inflationary pressures by managing their spending and living within their means. However, unexpected emergencies are happening more frequently, and the costs of those events are increasing which has a fundamental impact on consumers' overall financial well-being.

The True Cost of an Unexpected Emergency

In the three months prior to May 2023, nearly half (46%) of U.S. consumers stated they faced an unexpected emergency, with millennials and high-income consumers facing them at even higher rates. In this same timeframe, consumers earning more than $100,000 annually were 34% more likely to have faced emergency expenses than their low-income counterparts.

While the share of consumers who have faced an emergency expense is virtually unchanged from July 2022, the average cost to consumers of these expenses continues to inflate, growing 16% over last year — from $1,400 to $1,700. For example, car repairs and health-related expenses, the most common unexpected events, cost an average of $1,300 and $1,500, respectively. Furthermore, unexpected health-related expenses increased 7% year over year. With rising inflation and the increased cost of emergency expenses, the Federal Reserve's indicator of financial distress for over a decade is losing relevance.

Consumers' Ability to Pay for the Unexpected

How consumers pay for emergency expenses correlates with their financial situations and the cost of the expense. For example, most consumers use available funds to cope with unexpected expenses, unless they face financial hardships or the cost was equal to most of, or all of, their savings.

According to the data, 51% of all consumers reported paying for unexpected expenses with cash or money from their savings accounts in the three months before May 2023, while 33% used financing or alternative sources to pay for unexpected expenses. In fact, 28% of consumers used credit cards to pay for the expense and settled the amount in full, while 18% revolved the balance or used installment payments. The data also shows that 54% of consumers who used financing said emergency expenses represented 60% or more of their savings — an indication that consumers turn to financing when the cost of the emergency expense cuts too much into their available savings.

While consumer financial lifestyles dictate how they choose to finance an unexpected emergency, two-thirds of consumers overall were able to face unexpected expenses without reducing everyday spend. However, the size of the expense in relation to a consumer's savings impacts whether they need to make cutbacks: 58% of consumers facing expenses that were 60% or more of their current savings or who had no savings to speak of cut back on spending, with 28% making extreme cutbacks. Fifty-one percent of those using financing to pay for an emergency expense cut back on everyday spend, which suggests weak financial grounding of those who used credit. Postponing large payments is another alternative considered by those surveyed when faced with unexpected expenses, with nonessential housing and vehicle expenses ranking at the top.

"We're seeing a false sense of security where consumers feel they have enough savings and/or available cash to cover unexpected expenses," continued Dudum. "The reality is, as unexpected emergencies become more frequent and the cost for those expenses continues to rise, have consumers really prepared enough and will the same saving levels from previous years be enough to help them navigate the future?"

To view the full report, visit: https://www.pymnts.com/study/reality-check-paycheck-to-paycheck-emergency-expenses-savings-financing/

*Unexpected or emergency expenses are defined as certain types of unanticipated expenses of at least $100 or more that consumers were forced to pay for in the last three months. These may include surprise medical expenses, tax bills, and urgent home or car repairs, but do not include spending on travel, electronics, clothing or other equipment.

Methodology

New Reality Check: The Paycheck-to-Paycheck Report — The Emergency Spending Deep Dive Edition is based on a census-balanced survey of 3,620 U.S. consumers conducted from May 3 to May 18, as well as analysis of other economic data. The data in this report is not intended to represent LendingClub's core member base. The Paycheck-to-Paycheck series expands on existing data published by government agencies, such as the Federal Reserve System and the Bureau of Labor Statistics, to provide a deep look into the core elements of American consumers' financial wellness: income, savings, debt and spending choices. The survey sample for this report was balanced to match the U.S. adult population in a set of key demographic variables: 51% of respondents identified as female, 33% were college-educated and 38% declared incomes of more than $100,000 per year.

About LendingClub

LendingClub Corporation (NYSE: LC) is the parent company of LendingClub Bank, National Association, Member FDIC. LendingClub Bank is the leading digital marketplace bank in the U.S., where members can access a broad range of financial products and services designed to help them pay less when borrowing and earn more when saving. Based on more than 150 billion cells of data and over $85 billion in loans, our advanced credit decisioning and machine-learning models are used across the customer lifecycle to expand seamless access to credit for our members while generating compelling risk-adjusted returns for our loan investors. Since 2007, more than 4.7 million members have joined the Club to help reach their financial goals. For more information about LendingClub, visit https://www.lendingclub.com.

CONTACT:

For Investors: IR@lendingclub.com

Media Contact: Press@lendingclub.com

PYMNTS Contact: information@PYMNTS.com

1 Report on the Economic Well-Being of U.S. Households in 2022 - May 2023. Board of Governors of the Federal Reserve System. 2023. https://www.federalreserve.gov/publications/2023-economic-well-being-of-us-households-in-2022-executive-summary.htm. Accessed June 2023.

View original content to download multimedia:https://www.prnewswire.com/news-releases/consumer-emergency-expenses-rise-16-year-over-year-to-1-700--far-exceeding-the-400-benchmark-301861393.html

SOURCE LendingClub Corporation